Alexa Belonick

Alexa is a Public Offerings/Public Companies partner in our San Francisco office.

Alexa is a corporate and securities lawyer who focuses on public companies representation, governance and capital markets transactions. She works with clients preparing to go public and through the full scope of post-IPO matters, including public and private debt and equity financings and ongoing public reporting and compliance. She works with leading technology and life sciences clients across industries including software, healthtech, fintech, medical devices, agtech, and consumer products.

She has led at-the-market equity offerings, Rule 144A convertible debt offerings, secondary offerings, registered and privately placed equity and warrant offerings, and putting up shelf and resale registration statements. She also assists clients with an array of securities law structures for strategic transactions and mergers and acquisitions, including representing public companies being sold or acquiring other public companies in transactions that have a total deal value of over $18.5 billion.

Alexa also advises companies including their management teams and boards of directors throughout the year on a range of securities regulation and corporate governance topics. She works with companies on compliance with NYSE and Nasdaq listing standards, Sarbanes Oxley, Dodd Frank, and U.S. federal securities laws. She also regularly works with companies on ’34 Act disclosure questions, responding to SEC comment letters, ESG initiatives, fine-tuning corporate governance policies and procedures, and Section 16 topics.

Webinar

What GCs Should Expect Before and After the IPO Part I

In this webinar, Of Counsel Brett Pletcher along with partners Alexa Belonick and Andy Thorpe will delve into the S-1 process, responsibilities typically delegated to the legal team, and strategies for readiness as an IPO draws near.

Webinar

IPO Readiness: Setting the Stage for a Successful IPO

The key to a successful IPO is early preparation. For most companies considering an IPO, this preparation starts 18 months to two years before the IPO launches. Late-stage private companies that begin working towards IPO readiness early will be well-positioned to execute an IPO and to thrive as a public company.

Webinar

The Late-Stage Transition to IPO – Governance

Gunderson Dettmer partners Alexa Belonick and Andrew Thorpe discuss governance considerations for late-stage companies, including board effectiveness, risk management, and ESG trends, to continue a company’s journey both as a maturing private company and preparing for an IPO.

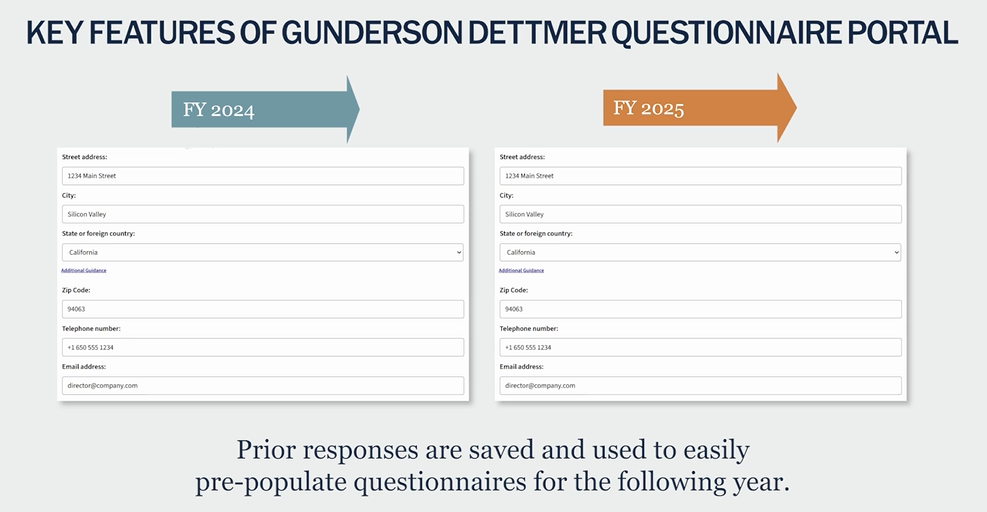

D&O Questionnaire Online Portal

Gunderson’s D&O Questionnaire Portal provides a modern, user-friendly interface for directors and officers to complete D&O questionnaires that can be used by our clients during the go-public process and after.

The D&O Questionnaire Portal is a web-based, tech-forward tool designed to simplify and streamline the process of completing the Director and Officer (D&O) questionnaires used by companies when going public and after as public companies.