Initial Public Offerings (IPOs) & Direct Listings

Since 2014, Gunderson Dettmer has been consistently recognized for closing more venture and growth equity financing transactions than any other law firm in the world, and we leverage this experience when taking our clients public.

We are proud of the fact that every one of the more than 350 public offerings we’ve closed has been for a venture-backed company. We know your unique needs and built a team for them. Venture-backed companies look to us for legal guidance on the strategy, timing and execution of their public offerings and rely on our IPO lawyers, working hand-in-glove with their existing client teams, to ensure an efficient and seamless transition into the public markets.

Learn More

Initial Public Offerings (IPOs) & Direct Listings

Since 2014, Gunderson Dettmer has been consistently recognized for closing more venture and growth equity financing transactions than any other law firm in the world, and we leverage this experience when taking our clients public.

We are proud of the fact that every one of the more than 350 public offerings we’ve closed has been for a venture-backed company. We know your unique needs and built a team for them. Venture-backed companies look to us for legal guidance on the strategy, timing and execution of their public offerings and rely on our IPO lawyers, working hand-in-glove with their existing client teams, to ensure an efficient and seamless transition into the public markets.

Our IPO focus: Tech and Life Sciences

We are uniquely qualified to support emerging and maturing technology and life sciences companies when they go public — having advised thousands of them in the last 30 years and completed hundreds of public offerings.

All venture, all the time. Because our IPO team works exclusively on technology and life sciences transactions, we are at the cutting edge of the market dynamics and trends most relevant to our clients seeking an IPO.

A 360° view. The IPO expertise we bring to our venture-backed company clients is further enhanced by the fact that, in addition to representing companies, we also represent VC investors, funds, and firms. This gives us a 360° perspective on capital raising transactions in this space, which is immensely valuable to companies preparing for an IPO.

Experienced counsel. Always. While the lead partners at other firms may supervise the deal team’s work, our client-team partners are deeply involved in every public offering we handle.

The IPO: A Practical Guide For Companies

D&O Questionnaire Online Portal

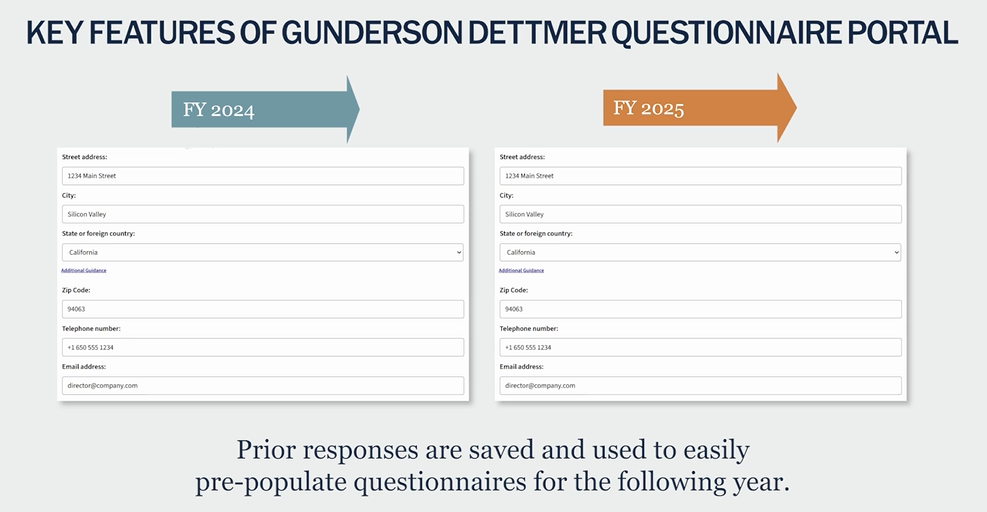

Gunderson’s D&O Questionnaire Portal provides a modern, user-friendly interface for directors and officers to complete D&O questionnaires that can be used by our clients during the go-public process and after.

The D&O Questionnaire Portal is a web-based, tech-forward tool designed to simplify and streamline the process of completing the Director and Officer (D&O) questionnaires used by companies when going public and after as public companies.

Related Webinars

Related News & Insights

Related News & Insights

Client News