Public Companies/Public Offerings

Public companies, boards of directors and management teams turn to Gunderson Dettmer for best-in-class advice for the day-to-day operational, strategic, regulatory, disclosure and governance issues they face as reporting companies.

From advising on corporate governance matters to assisting with regulatory filings and compliance, our team provides strategic counsel that empowers public companies to make informed decisions and seize opportunities. We work closely with boards of directors and management teams to develop effective strategies that enhance transparency, protect shareholder interests, and foster long-term value creation.

Learn More

Public Companies/Public Offerings

Public companies, boards of directors and management teams turn to Gunderson Dettmer for best-in-class advice for the day-to-day operational, strategic, regulatory, disclosure and governance issues they face as reporting companies.

From advising on corporate governance matters to assisting with regulatory filings and compliance, our team provides strategic counsel that empowers public companies to make informed decisions and seize opportunities. We work closely with boards of directors and management teams to develop effective strategies that enhance transparency, protect shareholder interests, and foster long-term value creation.

Advising Public Companies in the Innovation Economy

We are strategic advisors to our clients on market dynamics and execution risks and opportunities, and we keep our finger on the pulse of the latest developments in corporate law affecting public companies and the latest terms and trends for securities offerings.

Seeing around corners. We help our clients anticipate roadblocks and prevent surprises by highlighting regulatory developments and evolving trends, and provide real-time insights on the changing priorities of the SEC, stock exchanges, proxy advisors, institutional and strategic investors, and other key market participants.

Ongoing relationships. Many firms bifurcate their public company clients onto teams of regulatory and compliance lawyers after an IPO. We take a different approach. We continue to add resources to the same core Corporate and IPO team that helped guide the business through the IPO while integrating other legal services as your needs evolve. We know your IPO isn’t an endpoint; it is the beginning of your organization's life as a public company. We design our staffing to seamlessly support you in this next stage.

Unparalleled technology and life sciences insight. We bring our decades of experience working in these industries to assist our clients with the next stage of their development – in public offerings and as they evolve and grow as public companies.

Public Ventures serves as your trusted source for timely updates and expert perspectives on the issues that matter most to public companies in the venture ecosystem. The blog delivers curated content relevant for public companies, venture funds and private companies looking to launch their own public ventures.

D&O Questionnaire Online Portal

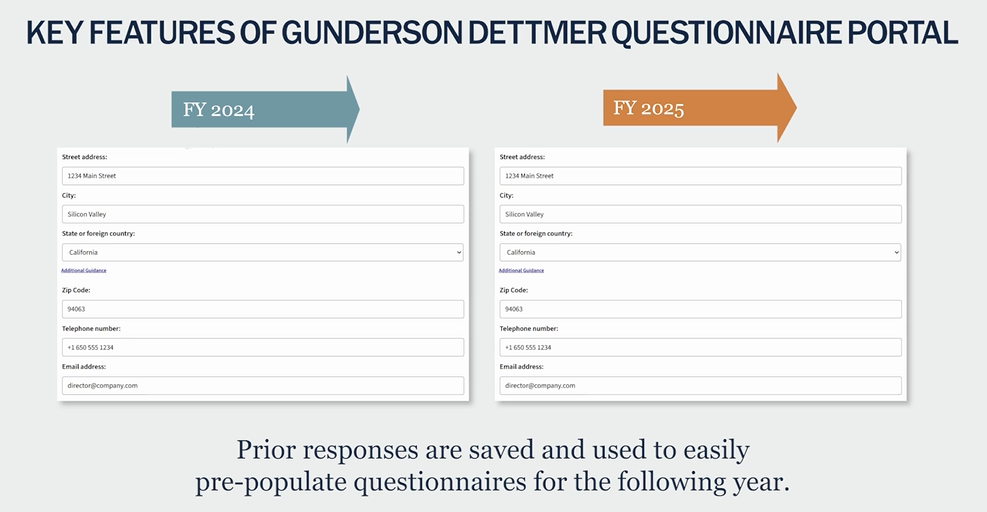

Gunderson’s D&O Questionnaire Portal provides a modern, user-friendly interface for directors and officers to complete D&O questionnaires that can be used by our clients during the go-public process and after.

The D&O Questionnaire Portal is a web-based, tech-forward tool designed to simplify and streamline the process of completing the Director and Officer (D&O) questionnaires used by companies when going public and after as public companies.

Related News & Insights

Related News & Insights

Client News

Related Webinars

Webinar

Post-IPO Summit Webinar Series: Everything You Need To Know About Dual-Class Stock.

In this webinar, partner Jeff Vetter and Of Counsel Brett Pletcher discuss the critical issues companies will need to consider when assessing the desirability and viability of a dual-class structure, how such structures are implemented, how those structures are viewed by public investors and the impact of such structures on corporate governance going forward.

Webinar

What GCs Should Expect Before and After the IPO Part I

In this webinar, Of Counsel Brett Pletcher along with partners Alexa Belonick and Andy Thorpe will delve into the S-1 process, responsibilities typically delegated to the legal team, and strategies for readiness as an IPO draws near.

Webinar

The Late-Stage Transition to IPO – Governance

Gunderson Dettmer partners Alexa Belonick and Andrew Thorpe discuss governance considerations for late-stage companies, including board effectiveness, risk management, and ESG trends, to continue a company’s journey both as a maturing private company and preparing for an IPO.