Client Insight: “Click to Cancel” Amendments to the FTC Negative Option Rule and California’s Automatic Renewal Law

These revised federal and state regulations impact both B2B and B2C companies offering automatically renewing subscriptions and negative option plans. However, implementation of the federal rules remains subject to potential legal, legislative, and administrative actions.

Key Takeaways

-

- The Federal Trade Commission’s (“FTC”) new “Click to Cancel” amendments to its Negative Option Rule (“FTC Rule”), along with California’s amended Automatic Renewal Law (“CARL”), impose new requirements on companies that offer goods and services on a “negative option” subscription plan in any format, including phone, print, and in-person.

- The amended FTC Rule broadens the scope of application beyond business-to-consumer (“B2C”) companies to include business-to-business (“B2B”) transactions for goods and services offered as negative option plans. The FTC Rule also require companies to provide a simple, easy-to-use, and timely cancellation method, such as a “click to cancel” button in user account settings.

- Meanwhile, CARL continues to be one of the most comprehensive and stringent state automatic renewal regulations. The amended CARL imposes new requirements on companies to provide annual reminders to subscribers (regardless of subscription period), and introduces requirements on companies presenting retention, “win back,” or “save” offers during the cancellation process.

- Companies offering subscription-based goods or services online must comply with both the FTC Rule and CARL, or else they may face steep statutory penalties for non-compliance. This includes evaluating current processes with respect to disclosure of negative option offer terms, obtaining subscriber consent, content of purchase acknowledgments, content and timing of renewal notices, and provision of cancellation methods (including any authentication requirements).

Table of Contents

Scope of Application

Companies must comply with federal regulations promulgated by the FTC, as well as state-specific automatic renewal laws that impose additional requirements on negative option plans.

What Is a Negative Option Plan?

What Other Types of Offers Can Be Combined With a Negative Option Plan?

Summary of Key Regulatory Updates

What Are the New “Click to Cancel” Amendments to the FTC Rule?

What Are the New Changes to CARL?

What Actions Should Companies Take Now?

Notably, the broadened scope of the FTC Rule now applies to both B2C agreements, and B2B agreements with small businesses on standard clickthrough terms, with negative option features. Companies offering goods or services with such negative option terms should revisit their exposure under federal and state law. This includes evaluating current processes with respect to disclosure of negative option offer terms, content of purchase acknowledgments, content and timing of renewal notices, and provision of cancellation methods (including any authentication requirements).

Below are key compliance takeaways and best practices:

Before Sale

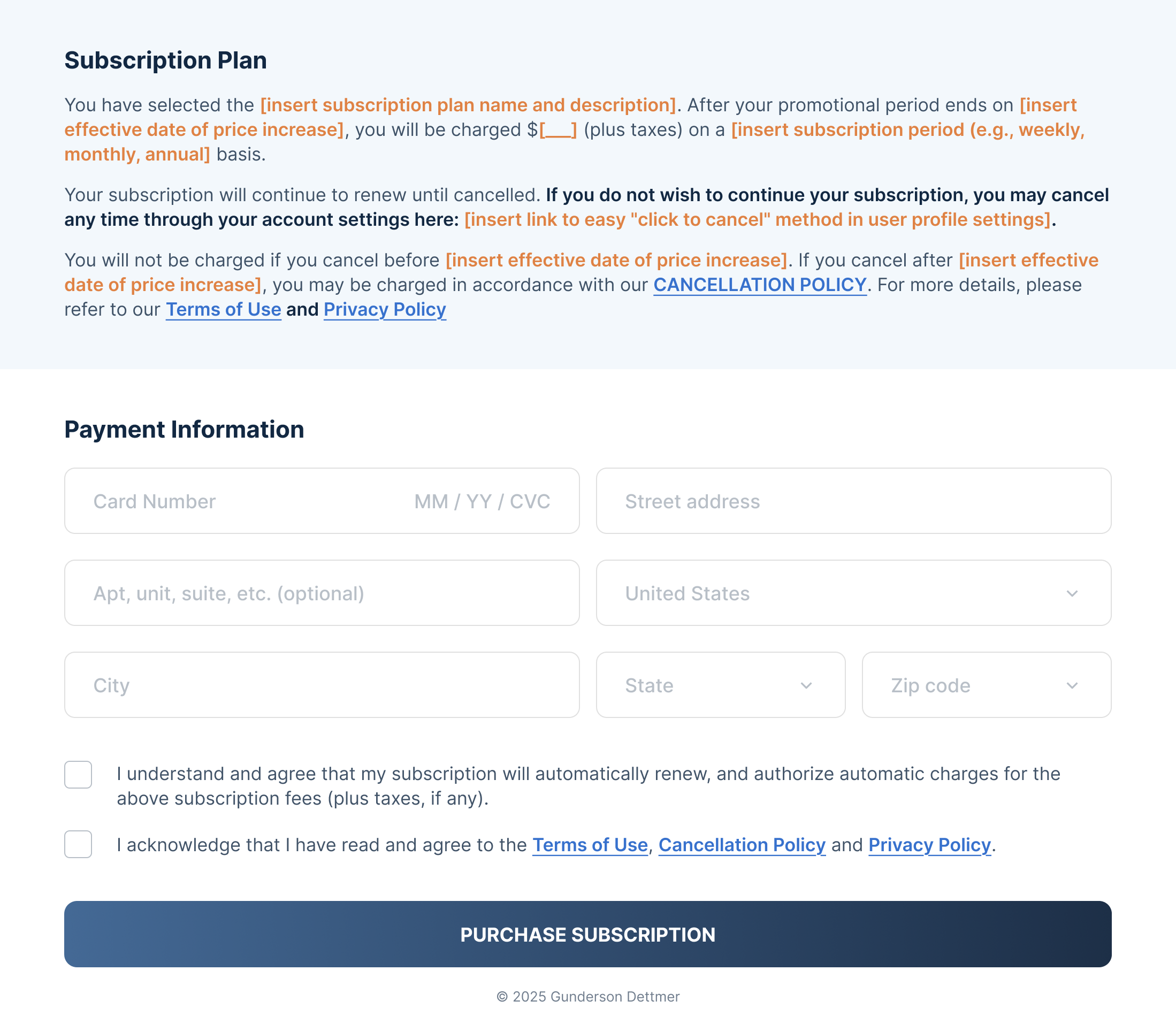

1. Clear and Conspicuous Notices: Companies must provide clear, conspicuous and simultaneous visual and audible disclosures of subscription-related terms prior to obtaining a consumer’s express, affirmative consent. Notices must include:

-

-

-

- Applicable product or service subject to negative option terms;

- Business contact information;

- Frequency and amount of charges associated with the subscription;

- Renewal term or period;

- Cancellation method; and

- Deadline for cancellation and any other information necessary for cancellation (e.g., process, policies, and methods). This includes notifying consumers that they will incur recurring charges unless they cancel.

-

-

The FTC has stated that disclosures cannot be buried and must be “unavoidable.” While the FTC has stated that hyperlinks are acceptable, it is best to implement a “scroll through” requirement for customers to review disclosures in full prior to presenting the adjacent consent mechanism (see more below).

2. No Misrepresentations: Companies will be liable for any false, unsubstantiated, deceptive, or misleading statements that are likely to affect a customer’s choice to purchase goods or services. This includes subscription terms (e.g., deadlines to prevent a charge, cancellation policies and processes, etc.) as well as product or service advertising claims (e.g., purpose, efficacy, health, or safety disclosures, qualifications of service providers, influencer sponsorship disclosures, etc.).

3. Obtain Express Affirmative Consent to Negative Option Terms Separately: Companies must obtain “unambiguously affirmative consent” to negative option terms, and the terms must be immediately adjacent to the consent mechanism without any additional information that may undermine the customer’s ability to understand the disclosures. The consent must be obtained separately from any other portion of the transaction, so any information that is not directly related to the negative option feature must be disclosed prior to the consent mechanism.

-

-

-

- For written offers (e.g., online), companies can obtain consent through an un-filled checkbox, signature, or substantially similar method that allows the customer to affirmatively provide acceptance.

- For verbal offers (e.g., phone), companies must clearly provide disclosures prior to requesting customer consent, and offer alternative methods to allow a customer to read, hear, see, or otherwise understand the disclosures.

-

-

Companies must disclose negative option terms and provide details of applicable cancellation methods before confirming the consumer’s billing information (i.e. prior to the final checkout page), and send the same information in a written purchase acknowledgement (e.g., email) after completing the transaction.

After Sale

4. Maintain Consent Records: Companies must maintain a record of customer consent for a minimum of 3 years or at least 1 year after the contract is terminated, whichever period is longer. Companies may be exempted from this consent record retention requirement only if the company can demonstrate that it is technologically impossible to complete the negative option transaction without first obtaining such consent.

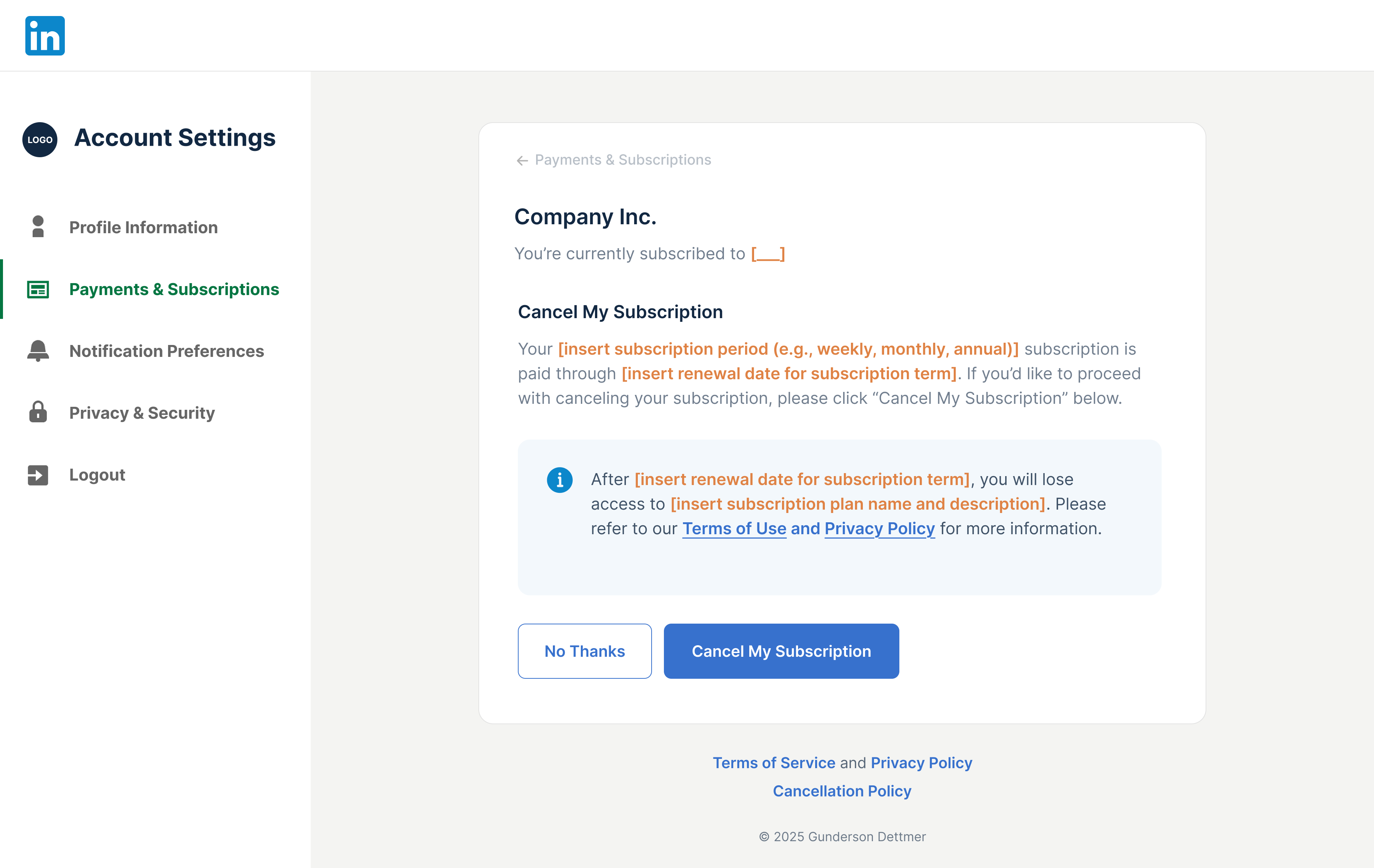

5. Simple Cancellation Method: The FTC’s new rule introduces a “click to cancel” feature, ensuring consumers can cancel subscriptions easily and without unnecessary hurdles. Businesses must provide a simple, cost-effective and timely cancellation process in the same medium used to initially enroll the customer in the subscription plan, such as:

-

-

-

- For online cancellations, the cancellation mechanism must be the same method used initially to enroll (or an equivalent, similarly easy-to-use method). Companies cannot require customers to interact with a live or virtual agent (e.g., chatbot) if the customer did not have to interact with one to initially consent to the negative option terms. Similarly, email or phone cancellation methods are insufficient for web- or app-based subscription transactions. For example, companies offering negative option plans online can provide an online cancellation method like: (1) a prominently located link or button in the customer account or profile (or within the device or user settings), or (2) allowing the customer to send an accessible pre-formatted cancellation email that will terminate the subscription without requiring any additional information.

- For phone cancellations, each company must prominently display the phone number on its website (or otherwise provide the telephone number that is easily retained by the customer), promptly acknowledge the cancellation request during normal business hours without obstruction or delay, respond to voicemail cancellation requests within 1 business day, and cannot make the cancellation phone call more costly than the call required to obtain initial consent to enroll (e.g., cannot impose any unreasonable or unnecessary additional costs).

- For in-person cancellations, companies must offer a similar in-person cancellation method and an alternative cancellation method by phone or online that is simple, accessible and easy to use.

-

-

6. Retention or “save” offers: The FTC Rule remains silent on whether companies can present any “save” attempts, but it is best practice for companies to obtain a customer’s express, affirmative consent to receiving such retention offers before presenting them. Under CARL, and in a stark break from the FTC Rule, subscription-based companies operating in California are allowed to present a “discounted offer, retention benefit, or information regarding the effects of cancellation” to consumers during the cancellation process, provided that:

-

-

-

- For online cancellations, the company simultaneously displays a prominent method to cancel (e.g., “click to cancel” button) adjacent to any such retention offer.

- For cancellations by phone, the company first informs the customer that they may complete the cancellation process at any time by stating their intent to cancel.

-

-

7. Additional Acknowledgements, Reminders, and Notices: In addition to the clear and conspicuous disclosure of negative option terms, companies should also provide the following notices:

-

-

-

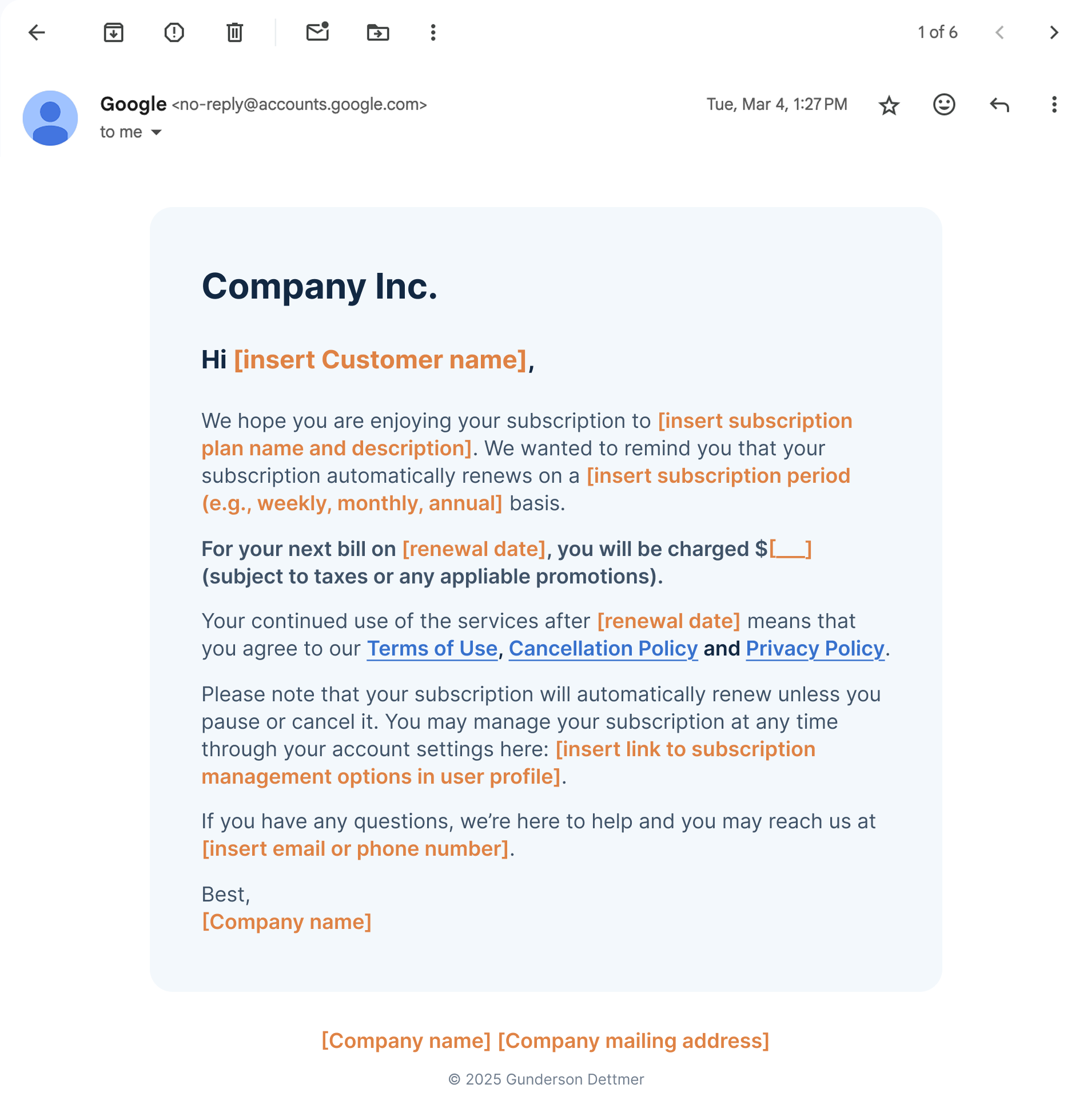

- Purchase acknowledgment “after completion” of the transaction or initial order that is sent to the consumer in a format that can be readily retained (e.g., email).

- Annual reminder of any negative option terms. This applies to all automatically renewing subscriptions or continuous service plans, even if the subscription term is less than one year (e.g., month-to-month). The annual reminder must be sent by email if the original purchase acknowledgement was initially sent via e-mail.

- Notice of renewal terms prior to the date of renewal or conversion to a paid subscription (or a plan with higher fees). Specifically: (1) within 15 to 45 days before the renewal date for subscription terms of 1 year or longer, and (2) within 2 to 21 days before the expiration of a promotional or discount period for subscriptions that automatically convert to a paid (or higher fee) plan after such applicable trial period.

- Notice of changes to subscription terms (e.g., pricing) between 7 to 30 days before the change goes into effect.

-

-

These notices must comply with disclosure requirements (e.g., negative option terms must be clear, and conspicuously presented separate from other transactional information), and should include all relevant information associated with the negative option terms (e.g., applicable product or service, frequency and amount of charges, renewal period, cancellation method, etc.)

Examples

Below please find mockups of online subscription sign-up, acknowledgement, and cancellation flows that comply with the latest requirements of the FTC Rule and CARL. In addition to preexisting requirements for companies to present clear disclosures about applicable terms and obtain explicit consumer consent, companies must also provide straightforward cancellation options before and after purchase.

What Are the Penalties for Failure to Comply?

Failure to adhere to these regulations may result in substantial legal and financial consequences, including consumer class actions, regulatory fines, and reputational harm (e.g., consumer trust and brand reputation).

-

- Under the FTC Rule, violations are punishable by injunctive or monetary relief (e.g., consumer redress, refunds, disgorgement or profits, recission of contract) under the FTC Act. Companies may also be subject to statutory penalties of $53,088 per incident, and the FTC asserts that a single transaction could result in multiple violations.

- Under CARL, companies bear the burden of showing good faith efforts to satisfy CARL requirements. Failure to comply could mean that any goods or services that a seller sends to a customer may be deemed an “unconditional gift” that requires full refunds for all sales made in violation of CARL requirements. In addition to injunctive or monetary relief granted through private actions, the California Automatic Renewal Taskforce can impose statutory penalties of up to $2,500 per violation.

While there is no private right of action under both the FTC Rule and CARL, companies remain exposed to private and class actions under “unfair and deceptive practices” state laws for any violation of recurring subscription requirements that result in consumer economic harm. For example, in California, plaintiffs can allege violations of CARL under California’s Unfair Competition Law, which provides the right for plaintiffs to seek restitution, injunctive relief, and attorneys’ fees. See Cal. Bus. & Prof. Code § 17200 et seq. Under New York’s consumer protection statutes, the New York Attorney General can impose civil penalties of $100 to $500 per violation from a single act, or up to $500 to $1,000 per knowing violations, as well restitution and injunctive relief. See N.Y. Gen. Bus. Law § 349 et seq.

When Does Enforcement Begin?

CARL

For companies operating in California that offer goods or services on a negative option basis, the new CARL requirements go into effect on July 1, 2025. Note that the new requirements only apply to contracts “entered into, amended, or extended” on or after July 1, 2025.

FTC Rule

The amended FTC Rule was initially published in the Federal Register in January, with the bulk of compliance requirements slated to go into effect on May 14. However, on May 9, 2025, the FTC deferred the enforcement of the FTC Rule to July 14, 2025. For the time being, companies should be aware of the following effective dates:

-

- As of January 19, 2025, the FTC Rule’s prohibition on material misrepresentations relating to the promotion, offer, or sale of any good or service with a negative option feature are in effect.

- Effective July 14, 2025, companies operating anywhere in the U.S. must comply with the remaining FTC Rule’s amendments, including updated requirements regarding the disclosure of material subscription terms, obtaining consumer consent, sending purchase and reminder notices, and providing an easy “click to cancel” or equivalent cancellation method.

Note that the final implementation and enforcement of the revised FTC Rule, which was promulgated under President Biden’s administration, remains vulnerable to potential judicial challenges and further FTC actions, such as:

-

- Federal Court Challenges: The revised FTC Rule has been challenged in federal courts by a consortium of companies, industry groups, and trade associations. These challenges allege that the FTC rulemaking was arbitrary and capricious (e.g., “overbroad,” “unfair,” and “unsupported by substantial evidence”), exceeds the FTC’s agency authority, and is an abuse of discretion under the federal Administrative Procedure Act. The multidistrict litigation was consolidated and transferred to the Eighth Circuit Court of Appeals, and oral arguments were recently held on June 10. See Custom Communications, Inc., et al. v. FTC, No. 24-03469 (8th Cir. Dec 04, 2024). While it seems unlikely that the Eighth Circuit will issue a stay before July 14, but the court’s eventual ruling may impact the final implementation of the FTC Rule amendments.

- FTC Response and Enforcement Focus: The current FTC, led by President Trump’s appointee Andrew Ferguson, is actively defending the FTC Rule in the Eighth Circuit action. On May 15, 2025, Chairman Ferguson testified before Congress and noted that the FTC will prioritize consumer protection enforcement actions, including targeting “deceptive billing and cancellation practices,” as part of its 2026 initiatives. Further, the FTC has expressed its willingness to issue additional amendments to the FTC Rule if needed in the future. In its May 9 deferral statement, the FTC has noted that “if that enforcement experience exposes problems with the [FTC Rule], the [FTC] is open to amending the [FTC Rule] to address any such problems.” That said, any new amendments must go through the mandated public notice and comment period, rendering any immediate changes to the FTC Rule unlikely.

Companies should assume that comprehensive enforcement of the revised FTC Rule will begin on July 14, 2025. To get ahead of this compliance deadline, companies should conduct thorough analyses of current sign-up and consent flows, cadence of purchase and renewal notice distributions, consumer request and verification practices, and cancellation methods and record retention practices to ensure maximal compliance with the as-published regulations.

How Can GD Help?

Stay updated with Gunderson as we continue monitoring the latest regulatory developments. Compliance with the revised FTC Rule and CARL requires a nuanced analysis of the current measures put in place by your business and our specialists in our Strategic Transactions & Licensing and Data Privacy practice groups are happy to help. If you have any questions regarding this client alert or need assistance understanding your obligations under relevant CARL regulations, please do not hesitate to reach out to your Gunderson Dettmer attorney.