SEC Proposes New SPAC Regulatory Regime

Proposed Extension of Traditional IPO Investor Protections to SPAC Transactions Would Significantly Increase Costs, Complexity and Potential Liability for Market Participants Throughout the SPAC Lifecycle

KEY TAKEAWAYS

- The Securities and Exchange Commission (“SEC” or “Commission”) recently proposed a wide-ranging set of reforms designed to regulate special purpose acquisition companies (“SPACs”), which in recent years have become a key feature of the capital markets and M&A landscape as a means for private companies to go public through business combinations.

- The proposed new rules and amendments to existing rules (“proposed rules”) seek to extend traditional initial public offering (“IPO”) disclosure and liability-related investor protections to SPAC IPOs and to subsequent business combination transactions between SPACs and private operating companies (“de-SPAC transactions”) through which such companies become public reporting companies.

- If adopted in the form proposed, the new rules would significantly increase costs, complexity and potential federal securities law liability for market participants throughout the SPAC lifecycle, and would likely reshape current market practices in fundamental ways. As a result, some private companies could consider the traditional IPO or direct listing channels a more viable alternative to accessing the public markets, or could choose to forgo going public at all.

- The public comment period will remain open through at least May 31, after which the SEC will review and analyze the feedback received before voting on a final version of the rules, possibly before the end of the year.

- In light of the far-reaching changes in the SEC’s treatment of SPACs looming on the horizon—and the prospect of increased investor and regulatory scrutiny, enforcement and litigation risks—parties currently involved in or planning a SPAC IPO or de-SPAC transaction should review the proposed rules carefully and assess with counsel their implications for pending or contemplated deals. Please engage with Gunderson Dettmer’s public companies and M&A teams to discuss actions you may wish to consider taking now in anticipation of final SEC rules.

Background and Overview

On March 30, 2022, a divided SEC proposed, in a 372-page release, a wide-ranging set of reforms designed to regulate SPACs. In recent years, SPACs have become a key feature of the capital markets and M&A landscape as a means for private companies to go public through business combinations. The SEC’s proposal seeks to extend traditional IPO disclosure and liability-related investor protections to SPAC IPOs and de-SPAC transactions.

The proposed rules affect all stages of the SPAC lifecycle and, if adopted in the form proposed, would significantly increase costs, complexity and potential federal securities law liability for SPAC participants, and would likely reshape current market practices in fundamental ways. As a result, some private companies could consider the traditional IPO or direct listing channels a more viable alternative to accessing the U.S. public capital markets, or could choose to forgo going public at all.

SPACs have been in existence since the 1990s, and their prevalence has varied over time. In 2020 and 2021, the U.S. securities markets experienced an unprecedented surge in the number of SPAC IPOs, aided by low interest rates and pandemic-related stimulus, with more than $80 billion raised in 2020 and more than $160 billion raised in 2021. By contrast, SPAC IPOs raised a total of $13.6 billion in 2019 and a total of $10.8 billion in 2018. In 2020 and 2021, more than half of all IPOs were SPAC IPOs, compared to less than 30% in each of the prior four years. In addition, approximately 200 companies went public via de-SPAC transactions in 2021, which is slightly more than a sevenfold increase since 2019 and a twentyfold increase since 2015.

Although SPAC activity has receded substantially in 2022 as investor interest has declined and regulatory and judicial scrutiny have grown, the recent exponential growth in the number and value of SPAC IPOs and rapidly increasing use of de-SPAC transactions as a mechanism for private operating companies to access the public markets have caused the SEC and market observers to raise concerns about various aspects of the SPAC structure, including about whether the SPAC’s organizers/founders (referred to as “sponsors”) and target companies may be engaging in “regulatory arbitrage” by using de-SPAC transactions (rather than the conventional IPO process) as a path to the public markets to avoid the disclosure, liability and other investor safeguards afforded by registration under the Securities Act of 1933 (“Securities Act”).

While the SEC staff has issued guidance relating to SPACs on multiple occasions since late 2020, and the Commission has since been engaged in significant enforcement activity involving SPAC transactions, the proposed rules mark the Commission’s first broad regulatory effort to comprehensively address these concerns. The SEC’s stated intention is “to help the SPAC market function more efficiently by improving the relevance, completeness, clarity and comparability of the disclosures provided by SPACs at the initial public offering and de-SPAC transaction stages, and by providing important investor protections to strengthen investor confidence in this market.”

In furtherance of these objectives, the proposed rules would impose significant new burdens on market participants throughout the SPAC lifecycle, including by:

- Requiring extensive specialized disclosures in connection with SPAC IPOs and de-SPAC transactions, including enhanced disclosures about sponsors, sponsor compensation, potential conflicts of interest and dilution, as well as certain disclosures on the prospectus cover page and in the prospectus summary section of registration statements (including resale registration statements);

- Mandating additional disclosures with respect to de-SPAC transactions, including on the background, material terms and effects of such transactions, and a fairness determination pursuant to which the SPAC would be required to state (1) whether it reasonably believes that the de-SPAC transaction and any related financing transaction (such as a so-called “PIPE,” or private investment in public equity, transaction) are fair or unfair to investors and (2) whether it has received any outside report, opinion or appraisal relating to the fairness of the transaction. These proposed disclosure requirements could lead SPACs to seek fairness opinions in connection with de-SPAC transactions more often (though a fairness opinion would not be required);

- Deeming a target company to be a co-registrant when a SPAC files a registration statement in connection with a de-SPAC transaction, such that the target company and its control persons would be subject to liability under Section 11 of the Securities Act (“Section 11 liability”) as signatories to the registration statement for any material misstatements or omissions therein (subject to a due diligence defense for all parties other than the SPAC and the target company);

- Deeming a SPAC IPO underwriter that takes steps to facilitate a subsequent de-SPAC transaction, or any related PIPE or other financing transaction, or otherwise participates (directly or indirectly) in the de-SPAC transaction, to be engaged in a distribution and to be an underwriter in the de-SPAC transaction, and thus subject to Section 11 liability for any material misstatements or omissions in the de-SPAC transaction registration statement (subject to a due diligence defense);

- Amending the definition of “blank check company” for purposes of the Private Securities Litigation Reform Act of 1995 (“PSLRA”), such that the safe harbor under the PSLRA for forward-looking statements would not be available to SPACs, including with respect to financial projections of target companies disclosed in connection with de-SPAC transactions, which would raise the potential liability associated with their use;

- Requiring a post-business combination company to re-determine its smaller reporting company (“SRC”) status before its first SEC filing after the filing of the Form 8-K with Form 10 information (“Super 8-K”), with public float measured as of a date within four days after the completion of the de-SPAC transaction, which would result in more such companies losing their SRC status (and thus having to provide more-expansive disclosures) sooner following a de-SPAC transaction than under existing rules;

- Mandating that disclosure documents in de-SPAC transactions generally be disseminated to investors at least 20 calendar days in advance of a shareholder meeting or the earliest date of action by consent;

- Prescribing additional non-financial statement disclosures about the target company in disclosure documents for de-SPAC transactions to align more closely with those required in a traditional IPO;

- Deeming a de-SPAC transaction to constitute a “sale” of securities within the meaning of the Securities Act to the existing SPAC public shareholders, requiring the filing of a registration statement and triggering potential Section 11 liability for signatories, underwriters, auditors and other experts for any material misstatements or omissions therein (subject to a due diligence defense for all parties other than the SPAC and the target company);

- Aligning more closely the financial statement reporting requirements in de-SPAC transactions with the analogous requirements in traditional IPOs;

- Expanding and updating existing Commission guidance to enhance the reliability of projections of future economic performance disclosed in SEC filings generally, and imposing additional disclosure requirements applicable to financial projections used in de-SPAC transactions; and

- Establishing a new non-exclusive safe harbor from “investment company” status under the Investment Company Act of 1940 (“Investment Company Act”) for SPACs that satisfy certain conditions that limit their asset composition, activities, business purpose and duration.

In a statement accompanying the announcement of the rule proposal, SEC Chair Gary Gensler urged a leveling of the regulatory playing field between SPACs and traditional IPOs, invoking Aristotle’s maxim that “like cases should be treated alike.” “Ultimately, I think it’s important to consider the economic drivers of SPACs,” he wrote. “Functionally, the SPAC target IPO is being used as an alternative means to conduct an IPO. Thus, investors deserve the protections they receive from traditional IPOs, with respect to information asymmetries, fraud and conflicts, and when it comes to disclosure, marketing practices, gatekeepers and issuers.”

In a strongly worded dissent, the lone Republican commissioner asserted that the rule proposal “seems designed to stop SPACs in their tracks,” arguing that it “does more than mandate disclosures that would enhance investor understanding. It imposes a set of substantive burdens that seems designed to damn, diminish and discourage SPACs because we do not like them, rather than elucidate them so that investors can decide whether they like them. The typical SPAC would not meet the proposal’s parameters without significant changes to its operations, economics and timeline.”

Companies, investors and other interested stakeholders will have through at least May 31 to provide comments on the proposed rules, which the SEC will consider before voting on a final version of the rules, possibly before the end of the year. While it is currently unclear whether, or to what extent, the final rules will differ from the proposals, the final rules can be expected to reflect the SEC’s intense ongoing focus on strengthening disclosure and liability protections for investors in SPAC transactions.

Notably, the proposing release does not address whether the final rules will be effective immediately upon adoption or be subject to a transition period for compliance, or how transactions then pending might be affected. Market participants will likely request that the SEC clarify the timing of application of the proposals during the comment process. In addition, the final rules may face legal challenges that could delay, or even bar, their implementation.

Notwithstanding these uncertainties, regulatory action could move quickly, and the Commission has signaled a continued emphasis on aggressive enforcement action relating to SPACs. In light of the fundamental and far-reaching changes in the SEC’s treatment of SPACs looming on the horizon—and the prospect of increased investor and regulatory scrutiny, enforcement and litigation risks—parties currently involved in or planning a SPAC IPO or de-SPAC transaction should review the proposed rules carefully and assess with counsel their implications for pending or contemplated deals. Please engage with Gunderson Dettmer’s public companies and M&A teams to discuss actions you may wish to consider taking now in anticipation of final SEC rules.

Detailed Summary of the Proposed Rules

The proposing release organizes the proposed rules into five main topic areas, each of which is discussed in detail below.

- Specialized Disclosure Requirements for SPAC Transactions

- Alignment of Disclosures and Liability Standards Between De-SPAC Transactions and IPOs

- Business Combinations Involving Shell Companies Generally (Including SPACs) and Related Financial Statement Requirements

- Enhanced Projections Disclosure

- Investment Company Act Safe Harbor

Depending on the circumstances, the proposed rules would be applicable to registration statements on Forms S-1, F-1, S-4 and F-4 filed under the Securities Act and Schedules 14A, 14C and TO under the Securities Exchange Act of 1934 (“Exchange Act”).

The proposed rules would add new Subpart 1600 to Regulation S-K that would prescribe extensive specialized disclosure requirements applicable to SPAC IPOs and de-SPAC transactions, including enhanced disclosures regarding sponsors, sponsor compensation, potential conflicts of interest and dilution, as well as certain disclosures on the prospectus cover page and in the prospectus summary section of registration statements. Proposed Subpart 1600 also would impose additional disclosures for de-SPAC transactions, including a fairness determination requirement.

The proposed requirements in new Subpart 1600 would, to an extent, codify and standardize some of the disclosures already commonly provided by SPACs. To the extent they overlap with existing disclosure requirements under Regulation S-K that are currently applicable to SPAC IPOs and de-SPAC transactions, the disclosure requirements of proposed Subpart 1600 would be controlling.

All information disclosed pursuant to Subpart 1600 would be required to be tagged in Inline XBRL, including detail tagging of the quantitative disclosures and block-text tagging of the qualitative disclosures.[1]

SPAC Sponsor

Proposed Item 1603 of Regulation S-K would require additional disclosure about the sponsor,[2] its affiliates and any promoters of the SPAC in registration statements and proxy/information statements filed in connection with SPAC IPOs and de-SPAC transactions. The disclosures would address:

- The experience, material roles and responsibilities of these parties, as well as any agreement, arrangement or understanding (1) between the sponsor and the SPAC, its executive officers, directors or affiliates, in determining whether to proceed with a de-SPAC transaction and (2) regarding the redemption of outstanding securities;

- The controlling persons of the sponsor and any persons who have direct and indirect material interests in the sponsor, as well as an organizational chart that shows the relationship between the SPAC, the sponsor and the sponsor’s affiliates;

- Tabular disclosure of the material terms of any lock-up agreements with the sponsor and its affiliates; and

- The nature and amounts of all compensation that has or will be awarded to, earned by or paid to the sponsor, its affiliates and any promoters for all services rendered in all capacities to the SPAC and its affiliates, as well as the nature and amounts of any reimbursements to be paid to the sponsor, its affiliates and any promoters upon the completion of a de-SPAC transaction.[3]

The SEC notes that these proposed disclosure requirements are intended to provide a SPAC’s prospective investors and existing shareholders with detailed information relating to the sponsor that could be important in understanding and analyzing a SPAC, including how the rights and interests of the sponsor, its affiliates and any promoters may differ from, and may conflict with, those of public shareholders.

The SEC further notes that although SPACs are already providing, to an extent, some of this information in their SEC filings, it believes codifying and amplifying these existing disclosure practices would help ensure that issuers provide consistent and comprehensive information across transactions, so that investors can make more-informed voting, investment and redemption decisions.

Conflicts of Interest

Item 1603, as proposed, also would require, in both SPAC IPO and de-SPAC transaction filings, disclosure of any actual or potential material conflict of interest between (1) the sponsor or its affiliates or the SPAC’s officers, directors or promoters and (2) unaffiliated security holders. This would include any conflict of interest in determining whether to proceed with a de-SPAC transaction and any conflict of interest arising from the manner in which a SPAC compensates the sponsor or the SPAC’s executive officers and directors, or the manner in which the sponsor compensates its own executive officers and directors.

The proposing release cites the following non-exhaustive examples of actual or potential conflicts of interest between the sponsor and public investors that could influence the actions of the SPAC, including:

- Conflicts stemming from the contingent nature of the sponsor’s compensation that may incentivize the sponsor and its affiliates to pursue a business combination transaction even though the transaction could result in lower returns for public shareholders than liquidation of the SPAC or an alternative transaction;

- Conflicts arising when the sponsor is a sponsor of multiple SPACs and manages several different SPACs at the same time;

- Conflicts arising when the sponsor and/or its affiliates hold financial interests in, or have contractual obligations to, other entities, including entities with which the SPAC is exploring entering into a business combination; and

- Conflicts arising when the SPAC’s officers do not work full-time at the SPAC, work for both the sponsor and the SPAC, or have responsibilities at other companies, which could impact their ability to devote adequate time and attention to managing the SPAC’s activities, or influence their decision to proceed with a particular de-SPAC transaction.

The SEC observes that these potential conflicts of interest could be particularly relevant for investors to the extent they arise when a SPAC and its sponsor are evaluating and deciding whether to recommend a business combination transaction to shareholders, especially as the SPAC nears the end of the period to complete such a transaction, and the sponsor may be under pressure to find a target and complete the de-SPAC transaction on less favorable terms or face losing the value of its securities in the SPAC.

In addition, proposed Item 1603 would require disclosure regarding the fiduciary duties each officer and director of a SPAC owes to other companies, which the SEC maintains could allow investors to assess whether and to what extent officers or directors may have to navigate a conflict of interest consistent with their obligations under the laws of the jurisdiction of incorporation or organization, may be compelled to act in the interest of another company or companies that compete with the SPAC for business combination opportunities, or may have their attention divided such that it may affect their decision-making with respect to the SPAC.

Dilution

In light of the potential for significant dilution embedded within the typical SPAC structure, proposed Items 1602 and 1604 would require more-granular information about the potential for dilution at both the SPAC IPO and de-SPAC transaction stages. Potential sources of dilution may include shareholder redemptions, sponsor compensation, underwriting fees, outstanding warrants and convertible securities, and PIPE or other financings. The SEC notes that this dilution may be particularly pronounced for the shareholders of a SPAC who do not redeem their shares prior to the consummation of the de-SPAC transaction and who may not realize or appreciate that these costs are disproportionately borne by the non-redeeming shareholders.

Specifically in connection with SPAC IPOs, proposed Item 1602 would require a description of material potential sources of future dilution following the IPO, as well as tabular disclosure of the amount of potential future dilution from the public offering price that will be absorbed by non-redeeming SPAC shareholders, to the extent known and quantifiable.

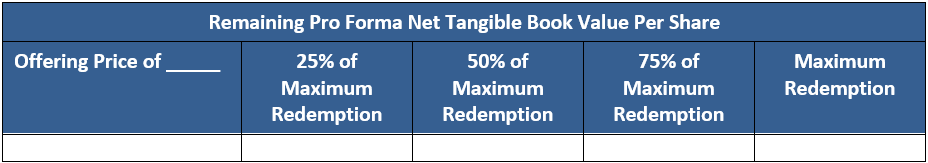

In addition, a simplified dilution table, in the following format, which would present the reader with an estimate of the remaining pro forma net tangible book value per share at quartile intervals up to the maximum redemption threshold, would be required on the prospectus cover page in SPAC IPOs on Form S-1 (or F-1):

If the IPO includes an overallotment option, the table would need to include separate rows showing remaining pro forma net tangible book value per share both with the exercise and without the exercise of the overallotment option.

For de-SPAC transactions, proposed Item 1604 would require disclosure of each material potential source of additional dilution (e.g., sponsor compensation, underwriting fees, outstanding warrants and convertible securities, and PIPE or other financings) that non-redeeming shareholders may experience at different phases of the SPAC lifecycle by electing not to redeem their shares in connection with the de-SPAC transaction.

For example, to the extent material, this disclosure would need to explain that, when a SPAC’s shareholders retain their warrants after redeeming their shares prior to the de-SPAC transaction, the non-redeeming shareholders and the post-business combination company may face potential additional dilution.

Item 1604, as proposed, also would require a sensitivity analysis in a tabular format that shows the amount of potential dilution under a range of reasonably likely redemption levels and quantifies the increasing impact of dilution on non-redeeming shareholders as redemptions increase. A description of the model, methods, assumptions, estimates and parameters necessary to understand the sensitivity analysis disclosure would also have to be provided.

Prospectus Cover Page Disclosure

On the SPAC IPO prospectus cover page, proposed Item 1602 would require that certain key disclosures be made in plain English,[4] including the time frame for the SPAC to consummate a de-SPAC transaction, redemptions, sponsor compensation, dilution (including the simplified tabular disclosure described above) and conflicts of interest.

On the de-SPAC transaction prospectus cover page, proposed Item 1604 would require information in plain English about, among other things, the fairness of the de-SPAC transaction, material financing transactions, sponsor compensation, dilution and conflicts of interest.

The SEC acknowledges that although most SPACs already provide much of the proposed information on prospectus cover pages, the proposed rules would standardize this information across all registration statements filed by SPACs for IPOs and de-SPAC transactions, allowing investors to more easily analyze and compare the disclosures across SPACs.

Prospectus Summary Disclosure

In the prospectus summary for SPAC IPOs, proposed Item 1602 would require the following disclosures in plain English, which the SEC contends are among the topics that investors are likely to find most important when considering an investment in the SPAC prior to the identification of a potential business combination candidate, based on the staff’s experience in reviewing registration statements filed in connection with SPAC IPOs:

- The process by which a potential business combination candidate will be identified and evaluated;

- Whether shareholder approval is required for the de-SPAC transaction;

- The material terms of the trust or escrow account, including the amount of gross offering proceeds that will be placed in the trust;

- The material terms of the securities being offered, including redemption rights;

- Whether the securities being offered are the same class as those held by the sponsor and its affiliates;

- The length of the time period during which the SPAC intends to consummate a de-SPAC transaction, and its plans if it does not do so, including whether and how the time period may be extended, the consequences to the sponsor of not completing an extension of this time period, and whether shareholders will have voting or redemption rights with respect to an extension of time to consummate a de-SPAC transaction;

- Any plans to seek additional financing and how such additional financing might impact shareholders;

- Tabular disclosure of sponsor compensation and the extent to which material dilution may result from such compensation; and

- Material conflicts of interest.

In the prospectus summary for de-SPAC transactions, proposed Item 1604 would require the following information in plain English, which the SEC believes is the information investors would find important when making an investment decision at the de-SPAC transaction stage (especially those topics that illuminate potential conflicts of interest and the overall fairness of the proposed transaction), based on the staff’s experience in reviewing registration statements filed in connection with de-SPAC transactions:

- The background and material terms of the de-SPAC transaction;

- The fairness of the de-SPAC transaction;

- Material conflicts of interest;

- Tabular disclosure of sponsor compensation and dilution;

- Financing transactions in connection with de-SPAC transactions; and

- Redemption rights.

Background of and Reasons for the De-SPAC Transaction; Terms and Effects

Item 1605, as proposed, would address disclosure issues more specific to de-SPAC transactions and require disclosure in any Form S-4 (or F-4), proxy/information statement or Schedule TO filed in connection with a de-SPAC transaction on the background, material terms and effects of such transaction, including:

- A summary of the background of the de-SPAC transaction, including, but not limited to, a description of any contacts, negotiations or transactions that have occurred concerning the de-SPAC transaction;[5]

- A brief description of the de-SPAC transaction;

- A brief description of any related financing transaction, including any payments from the sponsor to investors in connection with the financing transaction;

- The reasons for engaging in the particular de-SPAC transaction and for the structure and timing of the de-SPAC transaction and any related financing transaction;[6]

- An explanation of any material differences in the rights of security holders of the post-business combination company as a result of the de-SPAC transaction; and

- Disclosure regarding the accounting treatment and the federal income tax consequences of the de-SPAC transaction, if material.

These proposed disclosure requirements are modeled, in part, on certain line-item requirements found in Regulation M-A, as the SEC believes the same potential for self-interested transactions exists in de-SPAC transactions as in going-private transactions.

Proposed Item 1605 separately would require disclosure regarding:

- The effects of the de-SPAC transaction and any related financing transaction on the SPAC and its affiliates, the sponsor and its affiliates, the target company and its affiliates, and unaffiliated security holders of the SPAC. The disclosure must provide a reasonably detailed discussion of both the benefits and detriments to non-redeeming shareholders of the de-SPAC transaction and any related financing transaction, with such benefits and detriments quantified to the extent practicable;

- The SPAC’s sponsors’, officers’ and directors’ material interests in the de-SPAC transaction or any related financing transaction, including any fiduciary or contractual obligations to other entities and any interest in, or affiliation with, the target company (this would encompass material interests that are non-pecuniary in nature that may nevertheless affect the decision to proceed with a prospective de-SPAC transaction or related financing transaction); and

- Whether or not security holders are entitled to any redemption or appraisal rights and, if so, a summary of the redemption or appraisal rights. SPACs would be required to disclose, among other things, whether shareholders may redeem their shares regardless of whether they vote in favor of or against a proposed de-SPAC transaction, or abstain from voting, and whether shareholders have the right to redeem their securities at the time of any extension of the time period to complete a de-SPAC transaction. If there are no redemption or appraisal rights available for security holders who object to the de-SPAC transaction, the proposed rules would require disclosure of any other rights that may be available to security holders under the laws of the jurisdiction of incorporation or organization.

De-SPAC Fairness Determination

To enable investors to better evaluate potential conflicts of interest and misaligned incentives in connection with the decision to proceed with a de-SPAC transaction, proposed Item 1606 would require, in any Form S-4 (or F-4), proxy/information statement or Schedule TO filed in connection with a de-SPAC transaction, the SPAC to state whether it reasonably believes that the de-SPAC transaction and any related financing transaction are fair or unfair to the SPAC’s unaffiliated security holders, as well as a discussion of the bases for this statement. The SEC emphasizes that the SPAC’s statement must encompass both the de-SPAC transaction and any related financing transaction, as the fairness determination is intended to require consideration of the combined effects of both transactions (which are often dependent on each other) on unaffiliated security holders.

A statement that the SPAC has no reasonable belief as to the fairness or unfairness of the de-SPAC transaction or any related financing transaction to unaffiliated security holders would not be considered sufficiently responsive disclosure.

Disclosure also would be required about whether any director voted against, or abstained from voting on, approval of the de-SPAC transaction or any related financing transaction and, if so, identification of the director and, if known after making a reasonable inquiry, the reasons for the vote against the transaction or abstention.

Additionally, the SPAC would be required to discuss in reasonable detail the material factors upon which a reasonable belief regarding the fairness of a de-SPAC transaction and any related financing transaction is based and, to the extent practicable, the weight assigned to each factor. These factors would include, but not be limited to, the valuation of the target company; the consideration of any financial projections; any report, opinion or appraisal obtained from a third party; and the dilutive effects of the de-SPAC transaction and any related financing transaction on non-redeeming shareholders.

To provide additional context for understanding the process by which a SPAC determined to proceed with a de-SPAC transaction, proposed Item 1606 further would require disclosure of whether:

- The de-SPAC transaction or any related financing transaction is structured so that approval of at least a majority of unaffiliated security holders is required;

- A majority of directors who are not employees of the SPAC has retained an unaffiliated representative to act solely on behalf of unaffiliated security holders for purposes of negotiating the terms of the de-SPAC transaction or any related financing transaction and/or preparing a report concerning the fairness of the de-SPAC transaction or any related financing transaction; and

- The de-SPAC transaction or any related financing transaction was approved by a majority of the non-employee directors of the SPAC.

Reports, Opinions and Appraisals

While stopping short of explicitly requiring SPACs to obtain a third-party fairness opinion, proposed Item 1607 would require disclosure about whether or not the SPAC or its sponsor has received any report, opinion or appraisal obtained from an outside party relating to the consideration or the fairness of the consideration to be offered to security holders or the fairness of the de-SPAC transaction or any related financing transaction to the SPAC, the sponsor or security holders who are not affiliates.[7]

To assist investors in considering the usefulness and reliability of any such report, opinion or appraisal, disclosure would be required of:

- The identity, qualifications and method of selection of the outside party and/or unaffiliated representative;

- Any material relationship between (1) the outside party, its affiliates and/or unaffiliated representative and (2) the SPAC, its sponsor and/or their affiliates, that existed during the past two years or is mutually understood to be contemplated and any compensation received or to be received as a result of the relationship;

- Whether the SPAC or the sponsor determined the amount of consideration to be paid to the target company or its security holders, or the valuation of the target company, or whether the outside party recommended the amount of consideration to be paid or the valuation of the target company; and

- A summary concerning the negotiation, report, opinion or appraisal, which would be required to include a description of the procedures followed; the findings and recommendations; the bases for and methods of arriving at such findings and recommendations; instructions received from the SPAC or its sponsor; and any limitation imposed by the SPAC or its sponsor on the scope of the investigation.

All such reports, opinions or appraisals would need to be filed as exhibits to the Form S-4 (or F-4) or Schedule TO, or included in the proxy/information statement, for the de-SPAC transaction, as applicable.

The proposed disclosure requirements in Items 1606 and 1607, as noted previously with respect to Item 1605, are modeled on certain line-item requirements found in Regulation M-A, as the SEC believes the conflicts of interest and misaligned incentives inherent in going-private transactions are similar to those often present in de-SPAC transactions.

In light of the increasingly common reliance on de-SPAC transactions as a vehicle for private operating companies to access the public markets, the SEC is proposing to harmonize the treatment of target companies entering the public markets through de-SPAC transactions (often referred to by senior SEC officials as the “SPAC target IPO”) with that of companies conducting traditional IPOs. In the Commission’s view, a private operating company’s method of becoming a public company should not negatively impact investor protection. Accordingly, the proposed rules are intended to provide SPAC investors with disclosures and liability protections comparable to those that would be present if the target company were to undertake a traditional firm commitment underwritten IPO.

The proposals address six specific reforms in this area, as discussed below.

Co-Registrant Status of Target Company

Currently, when a SPAC offers and sells its securities in a registered de-SPAC transaction, only the SPAC, its principal executive officer, principal financial officer, controller or principal accounting officer, and the majority of its board of directors are required to sign the registration statement for the transaction. Because the SEC views the de-SPAC transaction as functionally the equivalent of the target company’s IPO, it is proposing to amend Form S-4 (and F-4) to require that the SPAC and the target company be treated as co-registrants when the registration statement is filed by the SPAC in connection with a de-SPAC transaction.

This requirement would make each of the additional signatories to the form, including the target company’s principal executive officer, principal financial officer, controller/principal accounting officer and a majority of the target’s board of directors, potentially liable under Section 11 of the Securities Act for any material misstatements or omissions in the registration statement at the time of effectiveness (subject to a due diligence defense for all parties other than the SPAC and the target company).

By treating the target company as a co-registrant (and an “issuer” under Section 6(a) of the Securities Act) in this scenario, the SEC intends to provide similar investor protections as if the target had entered the public markets through a conventional IPO. The SEC argues that the proposed heightened liability exposure associated with being a co-registrant could incentivize the target company’s directors and management to exercise greater care in the preparation and presentation of material information about the company, its financial condition and its future prospects; perform more robust due diligence with respect to materials it obtains from third-party sources in connection with the de-SPAC transaction; and more closely monitor disclosures in the registration statement. The SEC believes the proposed co-registrant requirement thereby could improve the reliability of the disclosure provided to investors about the target company, reduce the instances of misstatements and omissions, and generally improve investors’ decision-making with regard to these transactions.

Expansion of Underwriter Status and Liability

The proposing release observes that a de-SPAC transaction, which marks the introduction of the target private operating company to the public capital markets, is effectively how the target company’s securities are distributed into the hands of public investors as shareholders of the combined company. As in a traditional underwritten IPO, the SEC believes that “public investors—who were unfamiliar with the formerly private company—would benefit from the additional care and diligence exercised by SPAC underwriters in connection with the de-SPAC transaction.”

Proposed new Rule 140a under the Securities Act would clarify that a person who has acted as an underwriter in a SPAC IPO (“SPAC IPO underwriter”) and participates in the distribution by taking steps to facilitate the de-SPAC transaction, or any related financing transaction, or otherwise participates (directly or indirectly) in the de-SPAC transaction, will be deemed to be engaged in the distribution of the securities of the surviving public entity in a de-SPAC transaction within the meaning of Section 2(a)(11) of the Securities Act. Extending underwriter status to SPAC IPO underwriters in connection with de-SPAC transactions is intended to “better motivate SPAC underwriters to exercise the care necessary to ensure the accuracy of the disclosure in these transactions by affirming that they are subject to Section 11 liability for that information” (subject to a due diligence defense). The practical effect of this would be that SPAC underwriters would likely undertake a comprehensive due diligence process in connection with the de-SPAC transaction, including obtaining comfort letters from accounting firms, legal opinions and detailed representations and warranties regarding the target company, consistent with a traditional IPO.

The proposing release describes some of the activities that would be sufficient to establish that the SPAC IPO underwriter (which typically is not retained to act as a firm commitment underwriter in the de-SPAC transaction) nevertheless is participating in the distribution of the target company’s securities to the public (emphasis added; footnote omitted):

“For instance, it is common for a SPAC IPO underwriter (or its affiliates) to participate in the de-SPAC transaction as a financial advisor to the SPAC, and engage in activities necessary to the completion of the de-SPAC distribution such as assisting in identifying potential target companies, negotiating merger terms, or finding investors for and negotiating PIPE investments. Furthermore, receipt of compensation in connection with the de-SPAC transaction could constitute direct or indirect participation in the de-SPAC transaction. While SPAC IPO underwriting fees—those fees the SPAC IPO underwriters earn for their efforts in connection with the initial offering of SPAC shares to the public—generally range between 5% and 5.5% of IPO proceeds, a significant portion (typically 3.5% of IPO proceeds) is deferred until, and conditioned upon, the completion of the de-SPAC transaction. A SPAC IPO underwriter therefore typically has a strong financial interest in taking steps to ensure the consummation of the de-SPAC transaction.”

Importantly, the SEC cautions that Rule 140a, as proposed, addresses the underwriter status of only the SPAC IPO underwriter in the context of a de-SPAC transaction, and is not intended to provide an exhaustive assessment of underwriter liability in de-SPAC transactions, or in any way to limit the statutory definition of an “underwriter” under the Securities Act, which the SEC emphasizes is broad and does not include an element of intent. The proposing release suggests that underwriter status in connection with de-SPAC transactions could potentially be relevant for parties other than SPAC IPO underwriters, and thus all participants providing services in connection with, or otherwise facilitating, de-SPAC transactions should consider their potential Section 11 liability (emphasis added):

“Federal courts and the Commission may find that other parties involved in securities distributions, including other parties that perform activities necessary to the successful completion of de-SPAC transactions, are ‘statutory underwriters’ within the definition of underwriter in Section 2(a)(11). For example, financial advisors, PIPE investors or other advisors, depending on the circumstances, may be deemed statutory underwriters in connection with a de-SPAC transaction if they are purchasing from an issuer ‘with a view to’ distribution, are selling ‘for an issuer’ and/or are ‘participating’ in a distribution” [regardless of whether they also acted as an underwriter in the SPAC’s IPO].

The SEC specifically requests comment regarding whether there is adequate certainty as to which de-SPAC participants are statutory underwriters, or whether it should provide further guidance as to which additional parties may be underwriters and what activities, level of involvement or other considerations would be relevant to determining whether a party falls within the statutory definition of underwriter in a de-SPAC transaction.

Unavailability of PSLRA Safe Harbor

The PSLRA provides a safe harbor for forward-looking statements (which includes projections) under the Securities Act and the Exchange Act, under which a company is protected from liability for forward-looking statements in any private right of action under the Securities Act or Exchange Act when, among other things, the forward-looking statement is identified as such and is accompanied by meaningful cautionary statements. The safe harbor is not available, however, when a forward-looking statement is made in connection with an IPO or an offering by a blank check company that issues “penny stock.”

While projections are almost never included in registration statements for traditional IPOs, it has become standard market practice to prepare and disclose projections of the target company’s future economic performance in connection with de-SPAC transactions. Moreover, state law, such as in Delaware, may require disclosure of projections when relied on by a SPAC‘s board of directors in determining whether to approve or reject the proposed de-SPAC transaction. Market participants and courts have generally taken the view that the PSLRA safe harbor (which limits liability for forward-looking statements) is available for projections in these circumstances, which has been a distinct competitive advantage for de-SPAC transactions over traditional IPOs. To address concerns expressed by some commentators about the reliability and integrity of target company projections used in marketing de-SPAC transactions, the proposed rules seek to expand the existing definition of “blank check company” for purposes of the PSLRA to include SPACs by removing the “penny stock” condition. Amending the definition in this manner would clarify that the statutory safe harbor in the PSLRA is not available for projections and other forward-looking statements made by SPACs in connection with de-SPAC transactions.[8]

The SEC explains that, for purposes of the PSLRA, it sees no reason to treat forward-looking statements, including projections, made in connection with de-SPAC transactions differently than forward-looking statements made in traditional IPOs, in that both instances involve private companies entering the public markets for the first time, and similar informational asymmetries exist between these companies (and their insiders and early investors) and public investors.

Affirming the unavailability of the PSLRA safe harbor is intended to strengthen the incentives for SPACs to avoid potentially unreasonable or misleading financial projections, and to expend more effort and care in their preparation and review. However, the heightened litigation risks associated with the unavailability of safe harbor protection for projections combined with the expansion of potential underwriter liability to many participants in de-SPAC transactions (including financial advisors who use such projections as a basis for a fairness determination and SPAC IPO underwriters that receive deferred underwriting fees or other compensation upon completion of the de-SPAC transaction) could lead SPACs to reduce or discontinue their use (particularly where the target company is an early-stage startup with little or no revenue or profits historically whose value typically comes in the form of future financial growth) and could create a chilling effect on SPAC activity.

Re-Determination of SRC Status

In a traditional IPO, a private company determines whether it qualifies as an SRC at the time of filing its initial registration statement on Form S-1 (or F-1). Most SPACs qualify as SRCs at the time of their IPO, and a post-business combination company after a de-SPAC transaction is permitted to retain this status until the next annual determination date. The SEC observes that the absence of a re-determination of SRC status upon the completion of de-SPAC transactions permits certain post-business combination companies to avail themselves of scaled disclosure and other accommodations when they otherwise would not have qualified as an SRC had they become public companies through a traditional IPO.

Accordingly, the SEC is proposing to require a re-determination of SRC status upon the completion of a de-SPAC transaction. As proposed, this re-determination of SRC status would occur prior to the time the post-business combination company makes its first SEC filing (other than the Super 8-K), with the public float threshold measured as of a date within four business days after the completion of the de-SPAC transaction (the four-business-day window thus would end on the due date for the Super 8-K) and the revenue threshold determined by using the annual revenues of the target company as of the most recently completed fiscal year for which audited financial statements are available. The applicable thresholds in the current SRC definition would remain unchanged.[9]

The company would be required to reflect the re-determination in its first quarterly or annual report following the de-SPAC transaction. As a result, SPACs that initially qualified as SRCs could be required to provide investors with more-expansive disclosures (e.g., three years of financial statements) considerably sooner following a de-SPAC transaction than under existing rules (subject to potential disclosure accommodations available to emerging growth companies (“EGCs”)).

20-Day Minimum Dissemination Period

To ensure that SPAC shareholders have adequate time to analyze the information presented in de-SPAC transactions before making voting, investment and redemption decisions, the proposed rules would require that de-SPAC transaction prospectuses and proxy/information statements be distributed to shareholders at least 20 calendar days in advance of a shareholder meeting or the earliest date of action by consent, or the maximum period for disseminating such disclosure documents permitted under the applicable laws of the SPAC’s jurisdiction of incorporation or organization if such period is less than 20 calendar days.[10]

Non-Financial Statement Disclosures

The proposed rules would prescribe additional non-financial statement disclosures regarding the target company (comparable to what would be provided in a traditional IPO) in registration statements and proxy/information statements filed in connection with de-SPAC transactions. Specifically, disclosure would be required pursuant to the following items in Regulation S-K:

- Item 101 (description of business);

- Item 102 (description of property);

- Item 103 (legal proceedings);

- Item 304 (changes in and disagreements with accountants);

- Item 403 (security ownership of certain beneficial owners and management); and

- Item 701 (recent sales of unregistered securities).

The SEC notes that this information about the target company is already required to be included in the Super 8-K that must be filed within four business days after the completion of the de-SPAC transaction (and in many, but not all, cases is already voluntarily provided in disclosure documents for de-SPAC transactions). The proposed rules, however, would mandate that these disclosures be provided to shareholders earlier in the de-SPAC process and before they make voting, investment and redemption decisions. Inclusion of this information in a registration statement on Form S-4 (or F-4) (as opposed to a proxy/information statement) would also afford investors protections against material misstatements or omissions by subjecting issuers and other transaction participants to potential Securities Act liability. In most de-SPAC transactions in the technology and life sciences industries, it is customary to include these disclosures in the proxy statement or Form S-4 registration statement, so we believe this proposed new requirement would merely codify current practice.

Shell Company Business Combinations as Sales to Shell Company Investors

The proposing release observes that private companies have historically utilized shell companies with Exchange Act reporting obligations in various forms of transactions, such as spin-offs, reverse mergers and de-SPAC transactions, to become public companies, in many cases without filing a Securities Act registration statement. In the Commission’s view, the substantive reality of a reporting shell company business combination with a company that is not a shell company is that, even though no securities may actually be changing hands, reporting shell company investors have effectively exchanged their security representing an interest in the reporting shell company for a new security representing an interest in the combined operating company.

Due to the substantial increase in the use of reporting shell company business combination transactions as a means to enter the U.S. capital markets, including through the use of SPACs, and in an effort to provide reporting shell company shareholders with more consistent Securities Act disclosure and liability protections across the various available transaction structures, the SEC is proposing to add new Rule 145a under the Securities Act that would deem any business combination of a reporting shell company involving a non-shell company, including a de-SPAC transaction, to constitute a “sale” of securities within the meaning of the Securities Act to the reporting shell company’s shareholders, regardless of the form or structure deployed in the business combination, and regardless of whether a shareholder vote or consent is solicited.

Consequently, all de-SPAC transactions would be deemed a sale of securities to the SPAC shareholders and thus require the filing of a Securities Act registration statement (absent an applicable exemption). Registration would trigger the full panoply of federal securities law protections for SPAC investors (equivalent to what they would receive in a traditional IPO), including potential Section 11 liability for applicable parties—signatories to the registration statement (including the target company, its directors and senior officers), underwriters, auditors and other experts (e.g., valuation consultants, authors of fairness opinions)—for any material misstatements or omissions in the registration statement (subject to a due diligence defense for all parties other than the SPAC and the target company). In addition, SEC staff review of the registration statement would lengthen the de-SPAC transaction timeline.

Nothing in Rule 145a, as proposed, would prohibit the use of a valid exemption, if available, to cover the deemed sale, though the Commission’s “current view” is that the exemption under Section 3(a)(9) of the Securities Act (securities exchanged with existing shareholders where no commission or other remuneration is paid for solicitation of such exchange) generally would not be available.

Financial Statement Requirements

Consistent with its view that a company’s choice of the manner in which it goes public should not result in substantially different financial statement disclosures being provided to investors, the SEC is proposing to introduce Article 15 of Regulation S-X and related amendments to more closely align the financial statement reporting requirements in business combinations between a shell company and a private operating company, including de-SPAC transactions, with the analogous requirements in traditional IPOs.

Many of the new rules and amendments would codify existing staff guidance or financial reporting practices for shell company transactions, with which most companies’ reporting already conforms, and thus the SEC does not expect them to result in meaningful changes in disclosures, including with respect to PCAOB audit requirements, the age of financial statements, the inclusion of financial statements of significant businesses recently acquired or probable of being acquired and the exclusion of SPAC historical financial statements after the completion of a de-SPAC transaction.

One notable change would expand the circumstances in which target companies may report two years (rather than three years) of audited financial statements. In a departure from current guidance set forth in the staff’s Financial Reporting Manual, the proposed amendments would permit a SPAC or other shell company to include in its registration statement on Form S-4 (or F-4) or proxy/information statement two years of historical financial statements for the target company for all transactions involving an EGC shell company (such as a SPAC EGC) and a target company that would qualify as an EGC, irrespective of whether the shell company has filed or was already required to file its first annual report. (The proposed amendments would not affect the number of years of required financial statements for the target company when it exceeds both the SRC and EGC revenue thresholds, which would continue to be three years.)

To help address heightened investor-protection concerns around the widespread use of financial projections in de-SPAC transactions and similar circumstances, and to elevate the attention and level of care companies bring to their preparation, the SEC is proposing to amend Item 10(b) of Regulation S-K to expand and update the Commission’s views on the use of projections generally, and to add new Item 1609 to Regulation S-K that would mandate enhanced disclosures specifically relating to financial projections used in de-SPAC transactions.

Financial Projections Generally

Item 10(b) of Regulation S-K sets forth guidelines representing the Commission’s views on important factors to be considered in formulating and disclosing management’s projections of future economic performance in SEC filings. Item 10(b) states that management has the option to present in SEC filings its good-faith assessment of a registrant’s future performance, but it also states that management must have a reasonable basis for such an assessment. Item 10(b) further expresses the Commission’s views on the need for disclosure of the assumptions underlying the projections, the limitations of such projections and the format of the projections.

The proposed amendments to Item 10(b), which would apply broadly to all registrants (not just SPACs), would continue to state the Commission’s view that projected financial information included in filings subject to Item 10(b) must have a reasonable basis. To address specific concerns that some companies may present projections more prominently than actual historical results (or the fact that they have no operations at all) or use non-GAAP financial measures in the projections without a clear explanation or definition of such measures, Item 10(b) would be amended to state that:

- Any projected measures that are not based on historical financial results or operational history should be clearly distinguished from projected measures that are based on historical financial results or operational history;

- It generally would be misleading to present projections that are based on historical financial results or operational history without presenting such historical financial measure or operational history with equal or greater prominence; and

- The presentation of projections that include a non-GAAP financial measure should include a clear definition or explanation of the measure, a description of the GAAP financial measure to which it is most closely related (a reconciliation would not be required) and an explanation why the non-GAAP financial measure was selected instead of a GAAP measure.

Item 10(b) further would be revised to state that the guidelines (including as modified per the above) also apply to any projections of future economic performance of persons other than the registrant, such as the target company in a business combination transaction, that are included in the registrant’s filings.

Financial Projections in De-SPAC Transactions

Proposed new Item 1609 of Regulation S-K would complement the proposed changes to Item 10(b) described above and apply only to financial projections presented in connection with anticipated de-SPAC transactions, which the SEC believes are particularly prone to abuse.

To assist investors in assessing the bases of projections used in de-SPAC transactions and determining to what extent they should rely on such projections in making voting, investment and redemption decisions, proposed Item 1609 would require a registrant to provide the following disclosures with respect to any projections disclosed in the filing:

- The purpose of the projections and the party that prepared them;

- All material bases of the disclosed projections and all material assumptions underlying the projections, and any factors that may impact such assumptions (including a discussion of any factors that may cause the assumptions to be no longer reasonable, material growth rates or discount multiples used in preparing the projections, and the reasons for selecting such growth rates or discount multiples); and

- Whether the disclosed projections still reflect the view of the board or management of the SPAC or target company, as applicable, as of the date of the filing; if not, then discussion of the purpose of disclosing the projections and the reasons for any continued reliance by the management or board on the projections.

The growth of the SPAC industry and recent shareholder litigation have sparked debate about the status of SPACs as investment companies, which is an issue that, prior to the proposed rules, the Commission had never formally addressed. The Commission warns that SPACs may fail to recognize when their activities raise the investor-protection concerns addressed by the Investment Company Act, and that SPACs and their sponsors should sharpen their focus on evaluating when a SPAC could be an investment company.

To assist SPACs in focusing on, and appreciating, when they may be subject to investment company regulation, the SEC is proposing Rule 3a-10, which would provide a non-exclusive safe harbor from the definition of “investment company” under Section 3(a)(1)(A) of the Investment Company Act for SPACs that meet the conditions outlined below. The SEC states that, while a SPAC would not be required to rely on the safe harbor, it has designed the proposed conditions of the safe harbor to align with the structures and practices that it preliminarily believes would distinguish a SPAC that is likely to raise serious questions as to its status as an investment company from those that generally would not.

Asset Composition and Management

To rely on the proposed safe harbor, the SPAC’s assets (both the assets held in the trust or escrow account and any assets held by the SPAC directly) must consist solely of government securities, government money market funds and cash items prior to the completion of the de-SPAC transaction. In addition, these assets may not at any time be acquired or disposed of for the primary purpose of recognizing gains or decreasing losses resulting from market value changes.

Activities

The SPAC must seek to complete a single de-SPAC transaction as a result of which the surviving company (i) will be primarily engaged in the business of the target company (or companies), which business is not that of an investment company and (ii) will have at least one class of securities listed for trading on a national securities exchange. While the SPAC would be limited to only one de-SPAC transaction, such transaction may involve the combination of multiple target companies, provided that the SPAC treats them for all purposes as part of a single de-SPAC transaction.

Business Purpose

The SPAC must demonstrate its intent to complete a de-SPAC transaction by the efforts of its officers, directors and employees, its public representations of policies and its historical development. For example, the officers, directors and employees of the SPAC must be primarily focused on activities related to seeking a target company to operate and not on activities related to the management of its securities portfolio. The SPAC’s board of directors would also need to adopt an appropriate resolution evidencing that the company is primarily engaged in the business of seeking to complete a single de-SPAC transaction as described by the rule, and which is recorded contemporaneously in its minute books or comparable documents. In addition, the SPAC cannot hold itself out as being primarily engaged in the business of investing, reinvesting or trading in securities.

Duration

The SPAC must file a Form 8-K with the SEC announcing that it has entered into an agreement with at least one target company to engage in a de-SPAC transaction no later than 18 months after its IPO, and then complete the de-SPAC transaction no later than 24 months after its IPO (which is a shorter period than the 36 months allowed for completion under current stock exchange rules). The proposal does not provide any option to extend these deadlines. The SEC acknowledges that the combined effect of the two proposed duration conditions would be to force a significant proportion of SPACs that would seek to rely on the proposed safe harbor to conclude their search for a target sooner than would currently be the case.[11]

The SEC stresses that “the inability of a SPAC to identify a target and complete a de-SPAC transaction within the proposed timeframe would raise serious questions concerning the applicability of the Investment Company Act to that SPAC.”

Any assets of the SPAC that are not used in connection with the de-SPAC transaction, or in the event of the SPAC’s failure to meet the timelines required for identification or completion of a de-SPAC transaction, must be distributed in cash to investors as soon as reasonably practicable thereafter, and the SPAC would be required to cease operating as a SPAC.

Finally, existing SPACs would be well-advised, pending the potential adoption of final rules, to heed the remarks made by the director of the SEC’s Division of Investment Management at the open meeting on the proposed rules:

“For SPACs that are able to satisfy the conditions of the safe harbor with respect to their activities, the holdings of their portfolio and the duration of their project, then they would enjoy a certain amount of certainty with respect to their situations. For those SPACs that aren’t, that do not satisfy those conditions, we would expect that those SPACs should be consulting closely with their advisors and considering carefully their compliance obligations. And finally, I would just say, certainly for those SPACs that also fall outside the safe harbor, I would expect that the staff would also be taking a look at them.”

Related Materials

[1] Because issuers (including SPACs) are not required to tag any disclosures until they file their first post-IPO periodic report on Form 10-Q, 20-F or 40-F, the proposed tagging requirement for disclosures in SPAC IPO registration statements would accelerate the tagging obligations and related compliance burdens of SPACs compared to those of other filers. The SEC notes that enhancing the usability of the SPAC IPO disclosures through a tagging requirement is of particular importance given the unique nature of SPAC offerings and the potential risks they present to investors.

[2] The SEC proposes to define “SPAC sponsor” as “the entity and/or person(s) primarily responsible for organizing, directing or managing the business and affairs of a SPAC, other than in their capacities as directors or officers of the SPAC as applicable.” In regard to natural persons, the SEC explains it is proposing to exclude from the scope of the definition the activities performed by natural persons in their capacities as directors and/or officers of the SPAC to avoid overlap with existing disclosure requirements relating to directors and officers.

[3] This would include, for example, fees and reimbursements in connection with lease, consulting, support services and management agreements with entities affiliated with the sponsor, as well as reimbursements for out-of-pocket expenses incurred in performing due diligence or in identifying potential business combination candidates.

[4] Plain English principles include the use of short sentences; definite, concrete, everyday language; active voice; tabular presentation of complex information whenever possible; no legal or business jargon; and no multiple negatives.

[5] For example, this disclosure could encompass whether any portion of the underwriting fees in connection with a SPAC’s IPO is contingent upon the SPAC’s completion of a de-SPAC transaction and whether the underwriter in the SPAC’s IPO has provided additional services to the SPAC following the IPO, such as locating potential target companies, providing financial advisory services, acting as a placement agent for PIPE transactions, and/or arranging debt financing.

[6] For example, this could include a discussion of the key events and activities in identifying the target company and in negotiating the terms of the merger or acquisition, as well as the material factors considered by a SPAC’s board of directors in approving the terms of the proposed de-SPAC transaction and in recommending shareholder approval of the transaction.

[7] While fairness opinions are common in many merger transactions, they are not standard in de-SPAC transactions. The economic analysis contained in the proposing release notes that, in 2021, only 15% of de-SPAC transactions disclosed that they were supported by fairness opinions. In contrast, a study of mergers and acquisitions more broadly found that 85% of bidders obtain fairness opinions. The release further notes that the average cost for fairness opinions obtained by SPAC acquirers where such information was presented in an itemized format in SEC filings was approximately $270,000.

[8] The proposing release contends that the safe harbor is already not available to target companies in de-SPAC transactions because the target company is not then subject to Exchange Act reporting obligations.

[9] A company generally qualifies as a smaller reporting company if (i) it has a public float (the aggregate market value of the company’s outstanding voting and non-voting common equity held by non-affiliates) of less than $250 million; or (ii) it has annual revenues of less than $100 million and either (a) no public float (because it has no public equity outstanding or no public trading market for its equity exists) or (b) a public float of less than $700 million. For more information, see the SEC’s Small Entity Compliance Guide for Issuers available here.

[10] The proposing release is not clear if such 20-calendar-day period applies only to the shareholder meeting (or action by consent) of the SPAC’s shareholders, or also to the shareholder meeting (or action by consent) of the target company’s shareholders.

[11] The SEC’s economic analysis notes that approximately 41% of the SPACs in a sample of 152 SPACs with effective IPO dates between January 1, 2016 and December 31, 2019 had not announced a de-SPAC transaction agreement within 18 months after their IPO date, and approximately 35% of the sample SPACs had not completed a de-SPAC transaction within 24 months after their IPO date, and thus would not have met the proposed safe harbor duration limitations. Among all sample SPACs, approximately 43% would not have met both the 18-month and the 24-month deadlines. A SPAC’s ability to announce, and then complete, a de-SPAC transaction within these proposed time frames may become more difficult as competition for target companies increases. The proposing release notes that, as of December 31, 2021, approximately 77 of 248 SPAC IPOs in 2020 (31%) and an additional 495 of 613 SPAC IPOs in 2021 (81%) had not yet announced a target or have withdrawn an announced business combination and resumed searching.

Featured Insights

Featured Insights

Client News

Client News