SEC Approves New Nasdaq Board Diversity and Disclosure Listing Rules

On August 6, a divided U.S. Securities and Exchange Commission (SEC) voted to approve Nasdaq’s new listing rules related to board diversity and disclosure, a significant development that magnifies the rising importance of diversity in board governance.

In recent years, diverse board representation and transparency of board diversity reporting at public companies have become increasingly urgent priorities for regulators, legislators, institutional investors, asset managers, proxy advisory firms, corporate governance organizations and other key stakeholders, not least for the SEC, which has set an October deadline to propose rules requiring disclosures about the diversity of public company board members and nominees. (Proposed rulemaking on human capital management disclosure, also targeted by October, could include requirements to disclose diversity metrics more broadly, including for senior management and the general workforce.)

Nasdaq’s new rules will require most Nasdaq-listed companies, after a transition period, to have at least two diverse directors, or disclose why they do not, and to publish diversity data about their boards. Nasdaq’s stated rationale is to provide a better understanding of a listed company’s current board composition and philosophy regarding diversity, and to enhance investor confidence that all listed companies are considering diversity in the context of selecting directors.

Overview

Nasdaq’s new listing rules have two key components: required disclosure of a board diversity matrix; and numerical objectives for diverse board representation that companies must either meet or explain their reasons for not doing so. For companies currently listed on Nasdaq, the most important mandatory compliance dates under the new rules are as follows:

- By August 8, 2022, or the date the company files its proxy or information statement (or, if the company does not file a proxy or information statement, its Form 10-K or 20-F) (its Annual Meeting Filing) for its 2022 annual shareholders meeting (if later), Nasdaq-listed operating[1] companies will be required to disclose aggregated board-level diversity statistics based on each director’s voluntary self-identified gender, race or ethnicity, and LGBTQ+ status using a standardized board diversity matrix template. If a company files its 2022 proxy or information statement (or its 2022 Form 10-K or 20-F) before August 8, 2022, and does not include the matrix, the company will have until August 8, 2022 to disclose its matrix.[2] Such disclosure can either be made on the company’s website or provided in an amended annual report, such as on Form 10-K or 20-F. After such initial disclosure, the board diversity matrix is required to be disclosed going forward on an annual basis.

- By August 7, 2023, or the date the company makes its Annual Meeting Filing for its 2023 annual shareholders meeting (if later), most Nasdaq-listed operating companies will be required to have, or disclose why they do not have, at least one Diverse director, meaning such director self-identifies in one or more of the following categories: Female, Underrepresented Minority or LGBTQ+. For most calendar-year-end Nasdaq-listed companies, compliance with this rule will be required starting with proxy statements for annual shareholders meetings in 2024.[3]

- By August 6, 2025, or the date the company makes its Annual Meeting Filing for its 2025 annual shareholders meeting (if later), most operating companies listed on the Nasdaq Global Select Market and Nasdaq Global Market will be required to have, or disclose why they do not have, at least two Diverse directors, including at least one director who self-identifies as Female and at least one director who self-identifies as either an Underrepresented Minority or LGBTQ+. For most calendar-year-end Nasdaq Global Select Market and Nasdaq Global Market companies, compliance with this rule will be required starting with proxy statements for annual shareholders meetings in 2026.

- By August 6, 2026, or the date the company makes its Annual Meeting Filing for its 2026 annual shareholders meeting (if later), most operating companies listed on the Nasdaq Capital Market will be required to have, or disclose why they do not have, at least two Diverse directors, including at least one director who self-identifies as Female and at least one director who self-identifies as either an Underrepresented Minority or LGBTQ+. For most calendar-year-end Nasdaq Capital Market companies, compliance with this rule will be required starting with proxy statements for annual shareholders meetings in 2027.

Nasdaq characterizes its new requirements as a disclosure-based framework, and not a quota or numeric mandate, as companies can choose to meet the recommended minimum board diversity objectives (which it emphasizes are aspirational), or disclose why they do not and include a description of a different approach. Only companies that do not make such a disclosure could face delisting proceedings.

Nasdaq will also offer one year of complimentary access to board recruiting services through partnerships with third-party service providers to help amplify director search efforts and advance diversity at companies that do not yet meet the applicable diversity objectives.

According to a review Nasdaq conducted before submitting its rule proposal late last year, more than three-quarters of its listed companies would not have met the new board diversity objectives. While approximately 80%-90% of Nasdaq-listed companies had at least one female director, only about one-quarter had a second diverse director. The review also found that smaller companies tended to have less diverse boards and would face greater director recruitment challenges.

Diverse Board Representation — New Rule 5605(f)

Subject to the transition periods summarized above, most Nasdaq-listed companies will be required to have, or disclose why they do not have, at least two Diverse directors: at least one of whom self-identifies as Female; and at least one of whom self-identifies as either an Underrepresented Minority or LGBTQ+.

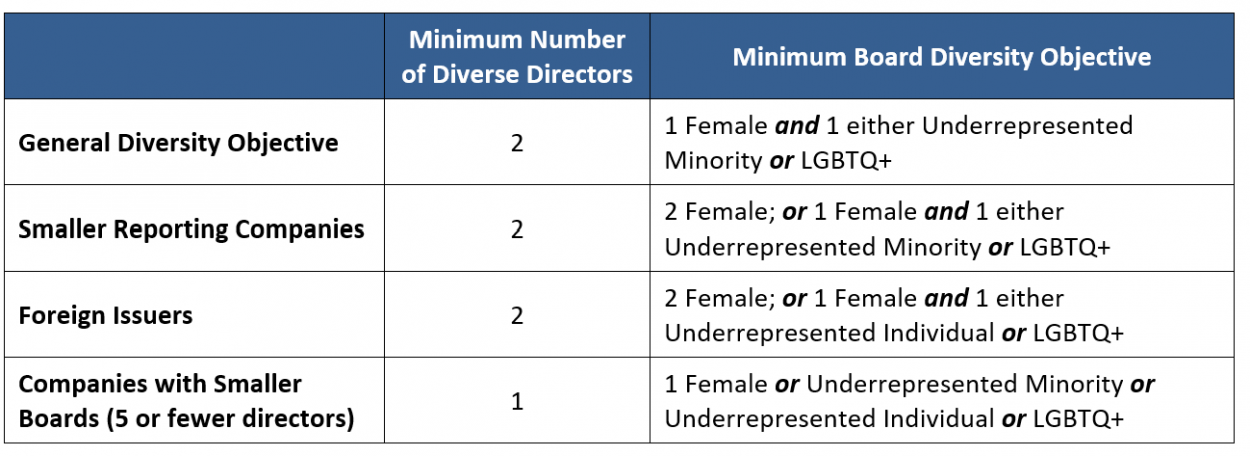

Smaller Reporting Companies,[4] Foreign Issuers[5] and companies with five or fewer directors (a Smaller Board) have additional flexibility to satisfy the diversity objective given their unique circumstances. In addition, Nasdaq exempts SPACs and other non-operating companies from the new rules. These special provisions are described below. A table comparing the diversity objectives for each category of listed company also appears below.

Smaller Reporting Companies

Smaller Reporting Companies (other than those with a Smaller Board) can meet the diversity objective with two Female directors, or with one Female director and one director who self-identifies as either an Underrepresented Minority or LGBTQ+.

Foreign Issuers

Similarly, Foreign Issuers (other than those with a Smaller Board) can meet the diversity objective with two Female directors, or with one Female director and one director who self-identifies as either an Underrepresented Individual or LGBTQ+.

Recognizing that there is no globally agreed definition as to which groups constitute racial and ethnic minorities and that the race/ethnicity categories in the U.S. may not be reflective of racial and ethnic diversity concerns in other countries, Nasdaq created the broader category of Underrepresented Individual to provide Foreign Issuers with greater flexibility to identify and disclose Diverse directors within their home countries.

Companies with Smaller Boards

Each company with a Smaller Board only will be required to have, or disclose why it does not have, at least one Diverse director.

A company that had five directors before becoming subject to the new rule may add a sixth director who is Diverse in order to meet the board diversity objective of at least one Diverse director without becoming subject to the requirement to have (or disclose why it does not have) at least two Diverse directors. However, if such company subsequently expands its board, it would be required to have at least two Diverse directors (or disclose why it does not).

SPACs and Other Exempt Companies

Special purpose acquisition companies (SPACs) are exempt from the new rule until they de-SPAC, after which the post-business combination entity will have at least two years after it completes the business combination to meet (or explain why it does not meet) the applicable diversity objectives. A limited number of other companies that do not have boards, do not list equity securities or are not operating companies also are exempt, such as asset-backed issuers and other passive issuers, limited partnerships and management investment companies, among other entities.

The table below summarizes the minimum board diversity objectives:

Defining Diversity

Nasdaq defines Diverse to mean an individual who self-identifies in one or more of the following categories:

- Female means an individual who self-identifies her gender as a woman, without regard to the individual’s designated sex at birth.

- LGBTQ+ means an individual who self-identifies as any of the following: lesbian, gay, bisexual, transgender or as a member of the queer community.

- Underrepresented Individual, a category available to Foreign Issuers, means an individual who self-identifies as such based on national, racial, ethnic, indigenous, cultural, religious or linguistic identity in the country of the Foreign Issuer’s principal executive offices (as reported on the Foreign Issuer’s Forms F-1, 10-K, 20-F or 40-F).

- Underrepresented Minority means an individual who self-identifies as one or more of the following: Black or African-American, Hispanic or Latinx, Asian, Native American or Alaska Native, Native Hawaiian or Pacific Islander, or two or more races or ethnicities.[6]

A more fulsome explanation of the various categories of diversity is available here.

Transition Period for Currently Listed Companies

As described in the overview above, Nasdaq-listed companies have a two-step transition period to meet the applicable diversity objectives (or explain why they do not)—at least one director by August 7, 2023, and full compliance at a later date—and the timeframe is based on a company’s market tier.

The table below summarizes the diversity objective transition period for currently listed companies:

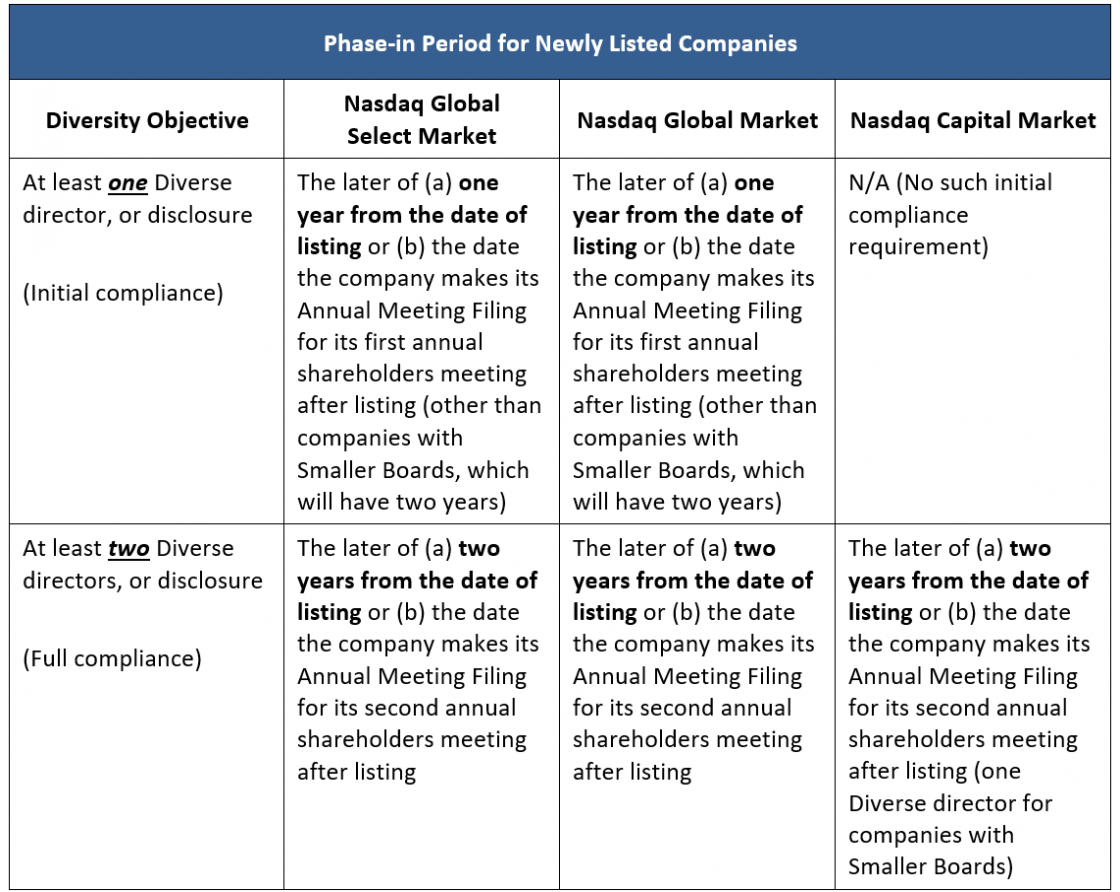

Phase-in Period for Newly Listed Companies

Nasdaq provides newly listing companies (including those listing through an initial public offering, direct listing, transfer from another exchange or the over-the-counter market, or de-SPAC merger) with additional time to meet the applicable board diversity objectives, as newly listing companies may have unique governance structures, such as staggered boards or director seats held by venture capital firms, that require additional timing considerations when adjusting the board’s composition.

The milestones for compliance depend on a company’s market tier and provide additional compliance time for companies with Smaller Boards.

The phase-in period for newly listed companies applies after the expiration of the applicable transition period described above. Companies listing before the end of the transition period have the longer of the remaining length of such transition period or two years from the date of listing, whichever is longer, to fully meet the applicable board diversity objectives (or explain why they do not).

The table below summarizes the diversity objective phase-in period for newly listed companies:

Phase-in Period for Companies Ceasing to be Smaller Reporting Companies, Foreign Issuers or Exempt Companies

Any company that ceases to be a Smaller Reporting Company, a Foreign Issuer or an exempt company will be required to satisfy the applicable board diversity objectives by the later of (a) one year from the date the company no longer qualifies as such or (b) the date the company makes its Annual Meeting Filing for its first annual shareholders meeting subsequent to such event.

Disclosure of Non-Diverse Boards

If a company satisfies the applicable board diversity objectives, no further disclosure is required. However, a company that does not meet the recommended objectives within the requisite timeframe will be subject to delisting unless it provides a public disclosure which:

- specifies the applicable requirements (e.g., the relevant diversity objective for a Smaller Reporting Company or a company with a Smaller Board and the timetable applicable to the company’s market tier); and

- explains the reasons why it does not meet such requirements, which could include describing a different approach.

Companies will have substantial flexibility in crafting the required explanation, including how much detail to provide. According to Nasdaq, the “company can choose to disclose as much, or as little, insight into the company’s circumstances or diversity philosophy as the company determines, and shareholders may request additional information directly from the company if they need additional information to make an informed voting or investment decision.”

While Nasdaq will verify that the company has provided an explanation, it will not assess the merits or substance of the explanation, and has noted there is no right or wrong reason that a company may give for not achieving the recommended diversity objective.

This disclosure must be provided in advance of the company’s next annual shareholders meeting by using either of the following methods, at the company’s option:

- in the company’s Annual Meeting Filing; or

- on its website.

If the company elects to provide the disclosure on its website, then it must publish the disclosure concurrently with the Annual Meeting Filing and also submit a URL link to the disclosure through the Nasdaq Listing Center within one business day after such posting.

Grace Period for Vacancies

A company that no longer meets the applicable board diversity objectives due to a vacancy on its board (e.g., if a Diverse director falls ill or resigns) will have until the later of (a) one year from the date of the vacancy or (b) the date the company makes its Annual Meeting Filing for its annual shareholders meeting in the calendar year following the year in which the vacancy occurs, to satisfy the applicable board diversity objectives (or explain the reasons why it does not).

During this period, the company may publicly disclose that it is relying on the grace period (instead of explaining why it does not meet the applicable board diversity objectives). Such disclosure must be provided in advance of the company’s next annual shareholders meeting in its Annual Meeting Filing or on its website.

Cure Period

If a company fails to meet, or to disclose why it does not meet, the applicable diversity objectives under the rule, it will have until the later of its next annual shareholders meeting or 180 days from the event that caused the deficiency to cure the deficiency. The company can cure the deficiency either by nominating additional directors so that it satisfies the recommended minimum diversity objectives or by providing the public disclosure explaining the reasons why it does not. A company that does not regain compliance within such time will be subject to delisting.

Board Diversity Disclosure— New Rule 5606

Nasdaq-listed companies (other than exempt companies as described above) will be required to disclose annually (to the extent permitted by applicable law) aggregated board-level diversity data based on each director’s voluntary self-identified gender, racial or ethnic characteristics, and LGBTQ+ status in a board diversity matrix, substantially in the format provided by Nasdaq here. The stated goal of the disclosure matrix is to create uniformity in reporting, which will establish a baseline for corporate board diversity data and allow stakeholders to track progress and make comparisons across companies.

The board diversity matrix disclosure will be required for all Nasdaq-listed companies subject to the new rules, including those that do not have the applicable number of Diverse directors.

In the matrix, companies (other than Foreign Issuers, which have a different template) must provide the total number of directors on their board as well as:

- the number of directors based on gender identity (female, male or non-binary) and the number of directors who did not disclose gender;

- the number of directors based on race and ethnicity (based on EEO-1 reporting categories), disaggregated by gender identity (or did not disclose gender);

- the number of directors who self-identify as LGBTQ+; and

- the number of directors who did not disclose a demographic background.

If a director chooses not to self-identify, the matrix gives companies the option of choosing the “did not disclose” demographic background or gender category.

Foreign Issuers may comply with a more flexible set of diversity objectives and elect to use the alternative board diversity matrix format provided by Nasdaq here.

To assist companies in the preparation of this disclosure, Nasdaq has provided illustrative examples of acceptable and unacceptable matrix disclosures here.

Following the first year of disclosure, companies will be required to publish the board diversity matrix for both the current and immediately preceding year.

Supplemental data may be included, and the information must be disclosed in a searchable format. In addition, if the company publishes the matrix on its website, the disclosure must remain accessible on the website.

Companies will be required to publish the board diversity matrix disclosure in advance of their next annual shareholders meeting in their Annual Meeting Filing or, alternatively, on their website. If the company elects to provide the disclosure on its website, then it must publish the disclosure concurrently with the Annual Meeting Filing and also submit a URL link to the disclosure through the Nasdaq Listing Center within one business day after such posting.

Compliance Dates

Currently listed companies will be required to publish their first board diversity matrix by the later of August 8, 2022, or the date the company makes its Annual Meeting Filing for its 2022 annual shareholders meeting. If a company makes its Annual Meeting Filing for its 2022 annual shareholders meeting before August 8, 2022, and does not include the matrix, the company will have until August 8, 2022 to disclose its matrix.[7] Such disclosure can either be made on the company’s website or provided in an amended annual report, such as on Form 10-K or 20-F.

After such initial disclosure, the board diversity matrix is required to be disclosed going forward on an annual basis. The time period to publish the board diversity matrix is aligned with the time period prescribed for a company to disclose its explanation for why it does not have the applicable number of Diverse directors (if it chooses not to comply with the board diversity objectives).

Companies newly listing on Nasdaq (including through an initial public offering, direct listing, transfer from another exchange or the over-the-counter market, or de-SPAC merger) must provide their initial board diversity matrix within one year of listing.

Cure Period

If a company fails to disclose the board diversity matrix, Nasdaq will notify the company of its noncompliance and allow the company 45 days to submit a plan to regain compliance, after which Nasdaq could permit the company up to 180 days to achieve compliance before being subject to delisting.

Free Board Recruiting Services — IM-5900-9

Nasdaq has also been approved to offer listed companies that do not yet meet the applicable diversity objectives one year of complimentary access for two users to a board recruiting service from a third-party service provider, and a tool to support board evaluation, benchmarking and refreshment. According to Nasdaq, the service will provide access to a large network of “highly qualified, diverse, board-ready candidates” to assist companies in identifying and evaluating diverse board candidates.

To facilitate this effort, Nasdaq has established partnerships with Equilar, Athena Alliance and theBoardlist, which are offering free access for a limited time to their board-search platforms: Equilar’s BoardEdge Platform and Equilar Diversity Network; Athena Alliance’s community of women leaders; and theBoardlist’s premium talent marketplace.

Until December 1, 2022, any eligible company that requests access to these services through the Nasdaq Listing Center will receive complimentary access for one year from the initiation of the service.

Additional Resources

- Board Diversity Rule: What Nasdaq-Listed Companies Should Know (3-page Nasdaq Fact Sheet)

- Board Diversity Disclosure Matrix Templates (with instructions and definitions of the various categories of diversity)

- Board Diversity Matrix Disclosure Requirements and Examples (includes examples of acceptable and unacceptable disclosures using the prescribed matrix format)

- Nasdaq Listing Center Related FAQs

- Full text of Listing Rules 5605(f) and 5606

- Summary of Key Differences between Nasdaq’s Board Diversity Rule and California’s Diversity Law

- Nasdaq plans to host several live webinars (which will be available for replay) to help companies understand key elements of the new rules, how to gain access to a variety of board recruiting services and to answer questions. The first is scheduled for August 17 (registration is available here).

- Dedicated electronic mailbox for questions: drivingdiversity@nasdaq.com

[1] SPACs and other non-operating companies are not required to comply with the new rules.

[2] See Nasdaq FAQ No. 1796.

[3] See Nasdaq FAQ No. 1797.

[4] As defined under Rule 12b-2 under the Securities Exchange Act of 1934 (the Exchange Act), a Smaller Reporting Company means an issuer that is not an investment company, an asset-backed issuer or a majority-owned subsidiary of a parent that is not a smaller reporting company and that (1) had a public float of less than $250 million; or (2) had annual revenues of less than $100 million and either: (i) no public float; or (ii) a public float of less than $700 million. A Smaller Reporting Company that does not apply the scaled disclosure requirements available to Smaller Reporting Companies is still considered a Smaller Reporting Company under Nasdaq's board diversity rule. See Nasdaq FAQ No. 1773.

[5] Foreign Issuer means (a) a Foreign Private Issuer (as defined under Exchange Act Rule 3b-4(c)) or (b) a company that (i) is a “foreign issuer” under Exchange Act Rule 3b-4(b) and (ii) has its principal executive offices located outside of the U.S.

[6] These categories are consistent with the categories reported to the U.S. Equal Employment Opportunity Commission through the EEO-1 Report, with which many companies are familiar. A U.S. company may comply with the board diversity objective rule by having two directors who self-identify in racial or ethnic categories beyond these categories, such as Middle Eastern, North African or Central Asian, and explaining that the company considers diversity more broadly than Nasdaq’s definition of diversity.

[7] See Nasdaq FAQ No. 1796.

Featured Insights

Featured Insights

Client News