PubCo Insight: SEC Augments Share Repurchase Disclosure Regime

Final rules, though less onerous than proposed, will require new and expanded quantitative and qualitative disclosures from public companies about repurchases of their equity securities, including quarterly reporting of daily share repurchase activity, and company Rule 10b5-1 trading plans

Calendar-year-end U.S. domestic issuers (including EGCs and SRCs) must comply with the new disclosure requirements starting with their next Form 10-K for any share repurchases made in the fourth quarter of 2023

In May 2023, a divided U.S. Securities and Exchange Commission (SEC) voted to approve final rules that will require additional and more detailed quantitative and qualitative disclosures from public companies about their share repurchases (commonly referred to as buybacks) and company Rule 10b5-1 trading plans (10b5-1 plans). The SEC’s stated purpose is to “enhance the transparency and integrity of the buyback process” by providing investors with “enhanced information to assess the purposes and effects of repurchases, including whether those repurchases may have been taken for reasons that may not increase an issuer’s value,” such as repurchases deliberately used to increase executive compensation or achieve certain accounting targets (such as those based on earnings per share) or to temporarily boost the share price in coordination with insider sales.

In a welcome development, the final rules were scaled back from the SEC’s original rule proposal (discussed in our previous client alert here) in response to commenters’ objections, including, most significantly, by requiring reporting of daily share repurchase information on a quarterly basis, instead of within one business day after execution, as initially proposed.

On May 12, the U.S. Chamber of Commerce, joined by two other business groups, sued the SEC in the Fifth U.S. Circuit Court of Appeals in an effort to block implementation of the new rulemaking, arguing the mandatory disclosure requirements compel speech in violation of the First Amendment and attempt to micromanage corporate decisions. The SEC has promised to “vigorously defend the challenged rule in court.”

Although the outcome of the litigation is uncertain, public companies should assume the new disclosures will be required by the compliance deadlines outlined below, which are close-at-hand, and begin preparing now for the more expansive reporting obligations, which will increase (i) compliance costs and burdens; (ii) investor, regulatory and other stakeholder scrutiny; and (iii) enforcement and litigation risks.

Key Takeaways

- No Exemptions for Certain Issuers. The final rules provide no exemptions or scaled disclosure accommodations for smaller reporting companies, emerging growth companies or foreign private issuers (FPIs) (regardless of home-country repurchase reporting requirements), though FPIs that that do not file on U.S. domestic forms will be allowed an additional six months to comply.

- Quarterly Tabular Disclosure of Daily Share Repurchases. The final rules will require quarterly (rather than the proposed daily) reporting of an issuer’s daily share repurchase activity, in tabular format, including repurchases made pursuant to a 10b5-1 plan and repurchases intended to qualify for the safe harbor in Rule 10b-18 of the Securities Exchange Act of 1934, as amended (Exchange Act).[1] The existing requirement to disclose repurchase data aggregated at the monthly level will be eliminated.

- Checkbox Disclosure of Director and Officer Trades. The final rules will require issuers to disclose quarterly via checkbox whether any of their directors or Section 16 officers[2] (and, in the case of FPIs, any of their directors or members of senior management who would be identified pursuant to Item 1 of Form 20-F) traded in the relevant securities within four business days before or after a share repurchase announcement.

- Expanded Narrative Share Repurchase Disclosures. The final rules expand the existing narrative disclosure requirements about the issuer’s repurchase programs and practices in its periodic reports to mandate disclosure regarding the issuer’s objectives or rationales for conducting share repurchases; the process or criteria for determining the repurchase amounts; and any policies and procedures relating to trading in the issuer’s securities by directors and officers[3] during a repurchase program.

- No Waiting Period for Issuer 10b5-1 Plans. The final rules confirm that issuers that use 10b5-1 plans to facilitate share repurchases will not be subject to a mandatory cooling-off period delaying the first trades after adoption or to any limitations on the use of overlapping or single-trade 10b5-1 plans—restrictions to which directors, Section 16 officers and non-executive employees became subject under the final insider trading rules that were adopted in December 2022 (discussed in our client alert here).

- Quarterly Disclosure of Issuer 10b5-1 Plans. The final rules add a new Item 408(d) to Regulation S-K that will require U.S. domestic issuers to disclose on a quarterly basis in Forms 10-Q/10-K whether, during the most recently completed fiscal quarter, the issuer adopted, materially modified[4] or terminated a 10b5-1 plan, together with a description of the plan’s material terms (other than price).

Compliance Dates

Issuers Reporting on U.S. Domestic Forms

Issuers that file on U.S. domestic forms will be required to provide the tabular disclosure of aggregated daily share repurchase data and the accompanying checkbox disclosure on a quarterly basis in a new exhibit to their Forms 10-Q and (for their fourth fiscal quarter) 10-K and to provide the related narrative disclosures in the body of those reports beginning with the first filing that covers the first full fiscal quarter that begins on or after October 1, 2023 (meaning, for calendar-year-end issuers, the fiscal 2023 Form 10-K filed in 2024 covering share repurchases made during Q4 2023).

Issuers that file on U.S. domestic forms also will be required to disclose on a quarterly basis in their Forms 10-Q and (for their fourth fiscal quarter) 10-K whether they adopted, materially modified or terminated a 10b5-1 plan and the material terms (other than price) of any such plan beginning with the first filing that covers the first full fiscal quarter that begins on or after October 1, 2023 (meaning, for calendar-year-end issuers, the fiscal 2023 Form 10-K filed in 2024 covering issuer 10b5-1 plans adopted, materially modified or terminated during Q4 2023).

FPIs Reporting on FPI Forms

FPIs that file Form 20-F annual reports and other FPI forms will be required to provide the tabular disclosure of aggregated daily share repurchase data and the accompanying checkbox disclosure on a quarterly basis in new Form F-SR (due within 45 days after the end of each fiscal quarter) beginning with the Form F-SR that covers the first full fiscal quarter that begins on or after April 1, 2024 (meaning, for calendar-year-end FPIs, the Form F-SR for the second quarter ending June 30, 2024 covering share repurchases made during Q2 2024), and to provide the related narrative disclosures on an annual basis starting in the first Form 20-F filed after their first Form F-SR has been filed (meaning, for calendar-year-end FPIs, the fiscal 2024 Form 20-F filed in 2025).

Inline XBRL

All of the new quantitative and qualitative share repurchase and issuer 10b5-1 plan disclosures mandated by the final rules are required to be tagged using Inline XBRL on the same compliance timeline outlined above.

Quarterly Tabular Disclosure of Daily Quantitative Share Repurchase Data

The proposed rules would have required issuers to disclose daily quantitative share repurchase data on a new standalone form within one business day after execution, even if the repurchase had not yet settled. After considering concerns raised in public comments, the SEC decided to drop the next-business-day reporting requirement from the final rules.

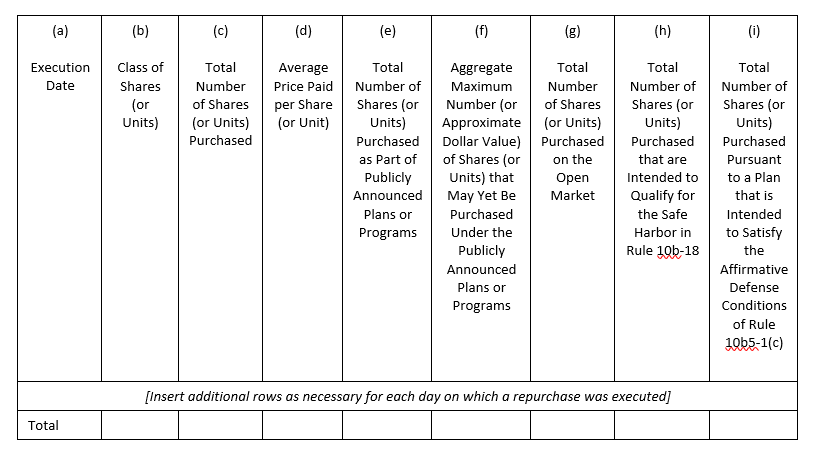

Instead, issuers[5] will be required to report quantitative share repurchase data aggregated on a daily basis (instead of on a monthly basis, as currently required), in tabular format, at the end of every fiscal quarter, including, for each day on which a repurchase was conducted during the covered fiscal quarter:

- the execution date;[6]

- the class of equity securities purchased (which should clearly identify the class, even if the issuer has only one class of equity securities outstanding);

- the total number of shares purchased (regardless of whether made pursuant to publicly announced repurchase plans or programs);

- the average price paid per share (excluding brokerage commissions and other execution costs);

- the total number of shares purchased as part of publicly announced repurchase plans or programs;

- the aggregate maximum number (or approximate dollar value) of shares that may yet be purchased under the publicly announced repurchase plans or programs;

- the total number of shares purchased on the open market (but not in tender offers or pursuant to the exercise of outstanding put options or other transactions);

- the total number of shares purchased intended to qualify for the non-exclusive safe harbor of Rule 10b-18 of the Exchange Act; and

- the total number of shares purchased pursuant to a plan intended to satisfy the affirmative defense conditions of Rule 10b5-1(c) of the Exchange Act (including, via footnote, the date such plan was adopted, materially modified or terminated).

In explaining its reasoning for requiring issuers to report more granular data on daily repurchase activity levels and repurchase prices, relative to existing disclosures, the SEC contends in the adopting release that:

“The current reporting regime, in which investors receive information only about the monthly aggregate repurchases of issuers, fails to provide enough detail for investors to draw informed conclusions about the purposes and effects of many repurchases. In contrast, the [final rules] will provide investors with data about the daily repurchase activity of an issuer and additional qualitative disclosures that investors can combine with other disclosures, such as the timing of compensatory awards or executive equity transactions, to observe whether a given repurchase was apt to affect executive compensation. Data on daily transactions and the additional qualitative disclosures would also reveal patterns in which repurchases were undertaken at times or under conditions that were likely to affect imminent accounting metrics, or prior to the release of material nonpublic information by the issuer.”

Location of Tabular Disclosure

Issuers that file on U.S. domestic forms will be required to provide the quarterly tabular disclosure in a new Exhibit 26 to their Forms 10-Q and (for their fourth fiscal quarter) 10-K (instead of in the body of those reports). FPIs that file on FPI forms will be required to provide the quarterly tabular disclosure in the body of a new Form F-SR, which must be filed with the SEC within 45 days after the end of each fiscal quarter (including the final quarter of each year). Accordingly, in a notable departure from the SEC’s historical approach to FPIs, FPIs will become subject to mandatory quarterly reporting obligations for the first time.

Due to the new and more granular daily quantitative share repurchase disclosure mandates, the final rules eliminate the existing requirements in Item 703 of Regulation S-K and Item 16E of Form 20-F for issuers to provide a monthly share repurchase table in periodic reports because they would be redundant.

Liability Considerations—Filed Instead of Furnished; Incorporation by Reference

In a significant change from the original rule proposal, the daily quantitative share repurchase data will be treated as filed with (not furnished to) the SEC, and thus issuers will be subject to Section 18 of the Exchange Act (which imposes liability for material misstatements or omissions contained in reports and other information filed with the SEC) for this disclosure. Additionally, this information will be deemed incorporated by reference into the issuer’s filings under the Securities Act of 1933, as amended (Securities Act), which will be subject to potential liability under Section 11 and Section 12 of the Securities Act.[7] This is consistent with the current treatment of monthly repurchase disclosures in periodic reports.

Checkbox Disclosure of Director and Officer Trades Close in Time to Repurchase Announcements

“[T]o assist investors in identifying transactions that warrant closer scrutiny,” issuers will be required, above their tabular disclosures of aggregated daily share repurchase information, to disclose quarterly via checkbox whether any of their directors or Section 16 officers (in the case of FPIs, any of their directors or members of senior management who would be identified pursuant to Item 1 of Form 20-F) purchased or sold shares of the same class of the issuer’s equity securities that is the subject of a publicly announced share repurchase plan or program within four business days (rather than the ten business days proposed) before or after the repurchase announcement, or the announcement of an increase in the size of an existing share repurchase plan or program. The checkbox requirement applies even if the insider transactions were made pursuant to a 10b5-1 plan.[8] Issuers are not required to identify which of their directors or officers executed any such trades.

See the Appendix to this client alert for a template for the new checkbox and tabular disclosures required in Exhibit 26 (also available here).

An analogous template for the new checkbox and tabular disclosures required in Form F-SR is available here.

To mitigate concerns expressed by commenters that the required checkbox disclosure could lead to negative inferences or give the incorrect impression that insiders were trading securities because of the repurchase announcement instead of for other reasons (such as sales pursuant to long-established 10b5-1 plans or automatic sales to fund tax withholding on share vesting), the adopting release confirms that issuers may include additional disclosure for context to avoid the potential for misinterpretations or mischaracterizations. The SEC further notes that issuers would be required to provide such additional contextual disclosure if material and necessary to prevent the required checkbox disclosure from being misleading.

In determining whether to check the box, U.S. domestic issuers may rely on a review of Section 16 filings, including Forms 3, 4 and 5 and amendments thereto filed with the SEC during the issuer’s most recent fiscal year, as well as any written representation from a reporting person that no Form 5 is required (which must be maintained in the issuer’s records for two years and made available to the SEC or its staff upon request), provided the reliance is reasonable (i.e., the issuer does not know or have reason to believe a form was filed inappropriately or should have been filed but was not). Because FPIs are exempt from Section 16 reporting, FPIs may rely on written representations from their directors and senior management (which must be maintained in their records for two years and made available to the SEC or its staff upon request) in making this determination, provided the reliance is reasonable.

Expanded Narrative Share Repurchase Disclosures in Periodic Reports

The final rules revise and expand the existing narrative repurchase disclosure requirements in Item 703 of Regulation S-K and Item 16E of Form 20-F to require additional detail regarding the purpose and structure of an issuer’s repurchase program and its share repurchases that “when combined with the daily repurchase activity disclosure, will allow investors to draw clearer and more informed conclusions about the purposes and effects of share repurchases.”

Specifically, issuers will be required to disclose quarterly in Form 10-Q and (for their fourth fiscal quarter) Form 10-K or (for FPIs that report using the FPI forms) annually in Form 20-F, with respect to any repurchases made in the period covered by the report:

- the objectives or rationales[9] for each repurchase plan or program, and the process or criteria used to determine the repurchase amounts;[10]

- any policies and procedures relating to purchases and sales of the issuer’s securities by its directors and officers (in the case of FPIs, its directors and members of senior management) during the pendency of a repurchase program, including any restrictions on such transactions;[11]

- the number of shares purchased other than through a publicly announced plan or program, and the nature of the transaction (e.g., whether the purchases were made in open-market transactions, tender offers, in satisfaction of the issuer’s obligations upon exercise of outstanding put options issued by the issuer or other transactions);[12] and

- for publicly announced repurchase plans or programs:

- the date each plan or program was announced;

- the dollar amount (or share amount) approved;

- the expiration date (if any) of each plan or program;

- each plan or program that has expired during the period covered by the repurchase table; and

- each plan or program the issuer has determined to terminate prior to expiration, or under which the issuer does not intend to make further purchases.[13]

- the date each plan or program was announced;

The adopting release emphasizes that the required narrative disclosures of the objectives or rationales for share repurchases and the process or criteria used to determine the amount of repurchases should be appropriately tailored to an issuer’s particular facts and circumstances and should not rely on generic or “boilerplate” language (footnotes omitted):

“Although not an exclusive or exhaustive list, commenters suggested that issuers could avoid boilerplate language by discussing other possible ways to use the funds allocated for the repurchase and comparing the repurchase with other investment opportunities that would ordinarily be considered by the issuer, such as capital expenditures and other uses of capital. Issuers could also discuss the expected impact of the repurchases on the value of remaining shares. Moreover, … issuers could discuss the factors driving the repurchase, including whether their stock is undervalued, prospective internal growth opportunities are economically viable or the valuation for potential targets is attractive. Issuers might additionally discuss the sources of funding for the repurchase, where material, such as, for example, in the case where the source of funding results in tax advantages that would not otherwise be available for a repurchase.”

Quarterly Disclosure Regarding U.S. Domestic Issuers’ Use and Material Terms of 10b5-1 Plans

“[T]o better allow investors, the [SEC] and other market participants to observe how issuers use Rule 10b5-1 plans,” new Item 408(d) of Regulation S-K will require U.S. domestic issuers to disclose on a quarterly basis in their Forms 10-Q and (for their fourth fiscal quarter) 10-K whether the issuer adopted, materially modified or terminated a 10b5-1 plan during the covered fiscal quarter, together with a description of the plan’s material terms, excluding pricing information but including:

- the date of adoption, material modification or termination of the plan;

- the duration of the plan; and

- the aggregate amount of issuer securities to be purchased or sold pursuant to the plan.

The plans are not required to be filed with the SEC.

This requirement substantially mirrors the new quarterly disclosure rules in Item 408(a) of Regulation S-K applicable to the use and material terms of trading plans by directors and Section 16 officers, adopted as part of the SEC’s December 2022 rulemaking (discussed in our client alert here), except that, in the case of issuers, the disclosure obligation will apply only to 10b5-1 plans and not also to other pre-planned trading plans not reliant on Rule 10b5-1 (which the SEC believes have “more limited value to investors” than information about non-10b5-1 plans used by directors and Section 16 officers).

FPIs are not required to provide the new Item 408(d) disclosures.

Practical Considerations

In anticipation of the fast-approaching compliance deadlines, public companies should begin preparing now for the more expansive disclosure requirements, which can be expected to draw increased scrutiny to their daily share repurchase activity; rationales for conducting repurchases and criteria for determining repurchase amounts; insider transactions undertaken close in time to repurchase announcements and while repurchases are ongoing; and adoption or termination of 10b5-1 share repurchase plans. To prepare for compliance, companies may wish to:

- Establish or enhance disclosure controls and procedures to accurately track, verify and report the required daily quantitative share repurchase data.

- Develop a control framework to ensure their objectives or rationales for conducting repurchases and process/criteria used to determine repurchase amounts are consistent with the required disclosures in their periodic reports and with their related public statements (such as in press releases or on earnings calls), bearing in mind there may be variation in this disclosure from one quarterly filing to the next depending on the particular circumstances surrounding the repurchase. Boards should reassess this information when approving new repurchase plans relative to previously authorized plans.

- Implement procedures for collecting and reporting the dates of director and Section 16 officer trades within four business days before or after the announcement of a share repurchase program (or an increase in the size of an existing program) for purposes of the required new checkbox disclosure.

- Consider whether to adopt new, or amend existing, insider trading policies and procedures to impose additional restrictions on transactions in the company’s securities by directors and officers within four business days before or after repurchase announcements (to ensure there are no trades that would cause the company to have to check the box) or during repurchases under a previously disclosed plan or program.

- Establish disclosure controls and procedures for monitoring the adoption, material modification and termination of company 10b5-1 plans used to execute share repurchases for quarterly reporting purposes.

For More Information

Please reach out to your Gunderson Dettmer attorney or any member of our Capital Markets/Public Companies team if you have questions or would like more information about the new disclosure requirements for issuer share repurchases and related matters discussed in this client alert.

Related Materials

Appendix

ISSUER PURCHASES OF EQUITY SECURITIES

Use the checkbox to indicate if any officer or director reporting pursuant to Section 16(a) of the Exchange Act (15 U.S.C. 78p(a)), or for foreign private issuers as defined by Rule 3b-4(c) (§ 240.3b-4(c) of this chapter), any director or member of senior management who would be identified pursuant to Item 1 of Form 20-F (§ 249.220f of this chapter), purchased or sold shares or other units of the class of the issuer’s equity securities that are registered pursuant to Section 12 of the Exchange Act and subject of a publicly announced plan or program within four (4) business days before or after the issuer’s announcement of such repurchase plan or program or the announcement of an increase of an existing share repurchase plan or program. □

[1] Rule 10b-18 provides an issuer and its affiliated purchasers with a voluntary, non-exclusive safe harbor from liability for market manipulation under Sections 9(a)(2) and 10(b) of the Exchange Act and Rule 10b-5 of the Exchange Act for share repurchases conducted in accordance with the rule’s manner, timing, price and volume conditions. The rule does not provide any exemption from the antifraud provisions of the federal securities laws.

[2] Rule 16a-1(f) of the Exchange Act defines the term “officer” to include an issuer’s president, principal financial officer, principal accounting officer (or, if there is no such accounting officer, the controller), any vice-president of the issuer in charge of a principal business unit, division or function (such as sales, administration or finance), any other officer who performs a significant policy-making function, or any other person who performs similar policy-making functions for the issuer. Officers of the issuer’s parent(s) or subsidiaries shall be deemed officers of the issuer if they perform these policy-making functions for the issuer.

[3] Unlike the required checkbox disclosure of insider transactions close in time to issuer repurchase announcements, which applies only to Section 16 officers, policies and procedures governing trading by any officer of the issuer during the pendency of repurchase programs must be disclosed.

[4] Rule 10b5-1(c)(1)(iv) of the Exchange Act provides that any modification that changes the amount, price or timing of the purchase or sale of the securities underlying a 10b5-1 plan constitutes a termination of such plan and the adoption of a new plan on the modified terms. By contrast, a plan modification that does not alter the foregoing terms (such as an adjustment for stock splits, a change in account information or other immaterial or administrative modifications) is not considered a termination of the original plan and the adoption of a new plan.

[5] For purposes of the final rules, the term “issuer” includes affiliated purchasers and any person acting on behalf of the issuer or an affiliated purchaser. An “affiliated purchaser” is defined in Rule 10b-18(a)(3) of the Exchange Act as “(i) [a] person acting, directly or indirectly, in concert with the issuer for the purpose of acquiring the issuer’s securities; or (ii) [a]n affiliate who, directly or indirectly, controls the issuer’s purchases of such securities, whose purchases are controlled by the issuer, or whose purchases are under common control with those of the issuer.” An affiliated purchaser does not include a broker or dealer solely by reason of such broker or dealer effecting share repurchases on behalf of the issuer or for its account, or an officer or director of the issuer solely by reason of such officer or director’s participation in the decision to authorize share repurchases by or on behalf of the issuer. The final rules apply only to repurchases of equity securities registered under Section 12 of the Exchange Act.

[6] “Execution” for these purposes corresponds to the “trade date”—i.e., the point at which the parties have agreed to the terms and are contractually obligated to settle the transaction—as distinct from the time of “settlement,” which is the ending point of the transaction when the actual exchange of securities and payment occurs.

[7] The adopting release notes that because the final rules require that daily repurchase data be provided on a quarterly (rather than daily) basis, the liability concerns that may have been raised by a requirement to file daily repurchase data within the proposed one-business-day timeframe are alleviated, as issuers will now have more time to obtain, verify and compile this disclosure compared to the proposal.

[8] The SEC believes that “[b]ecause repurchases often occur at relatively predictable times in the corporate calendar, executives can schedule trades in advance to potentially benefit from those repurchases that do occur at those times,” thus necessitating the checkbox requirement even in the case of 10b5-1 trades by insiders.

[9] The adopting release underscores that disclosure is not limited to one objective or rationale if an issuer has more than one.

[10] In response to commenters’ concerns about potential exposure of confidential information, the adopting release clarifies that “[a]lthough the disclosures required by the final amendments should convey a thorough understanding of the issuer’s objectives or rationales for the repurchases, and the process or criteria it used in determining the amount of the repurchase, the final amendments do not require issuers to provide disclosure at a level of granularity that would reveal any competitive or sensitive information beyond what may already be gleaned from other disclosures regarding the business and financial condition of the issuer.”

[11] The adopting release notes this is a disclosure obligation that may assist investors in determining the extent to which executives’ interests may have helped motivate repurchases, but is “not a requirement for an issuer to have, adopt or change any such policies and procedures.” The SEC acknowledges that issuers may increasingly impose restrictions on director and officer trading during share repurchases in anticipation of greater market scrutiny of the new disclosures, which could decrease the liquidity of insiders’ holdings of an issuer’s securities. Note that this disclosure obligation is separate from, and in addition to, the requirement, adopted in December 2022 (discussed in our client alert here), for issuers to disclose whether they have adopted policies and procedures governing purchases, sales and other dispositions (such as through gifts) of their securities by insiders or the issuer itself, and to file a copy of any such policies and procedures as an exhibit to their annual report, which will first be required for calendar-year-end U.S. domestic issuers in their fiscal 2024 Form 10-K filed in 2025.

[12] Under existing rules, this information is already required to be disclosed in a footnote to the monthly quantitative share repurchase table. Because the final rules eliminate the monthly table, this disclosure will now be required in the main text of the narrative discussion instead.

[13] See footnote 12 above.

Featured Insights

Featured Insights

Client News