PubCo and Funds Insight: SEC Accelerates Beneficial Ownership Reporting on Schedules 13D and 13G

Compliance with shortened filing deadlines will be required for Schedule 13D beginning in February 2024 and for Schedule 13G in September 2024

On October 10, 2023, the U.S. Securities and Exchange Commission (SEC or Commission) adopted final rules accelerating the filing deadlines for both initial and amended beneficial ownership reports on Schedules 13D and 13G and amending certain other provisions of the beneficial ownership reporting requirements under Sections 13(d) and 13(g) of the Securities Exchange Act of 1934 (Exchange Act). The SEC also issued new interpretive guidance clarifying the application of the existing beneficial ownership rules to the use of cash-settled derivative securities and group formations.

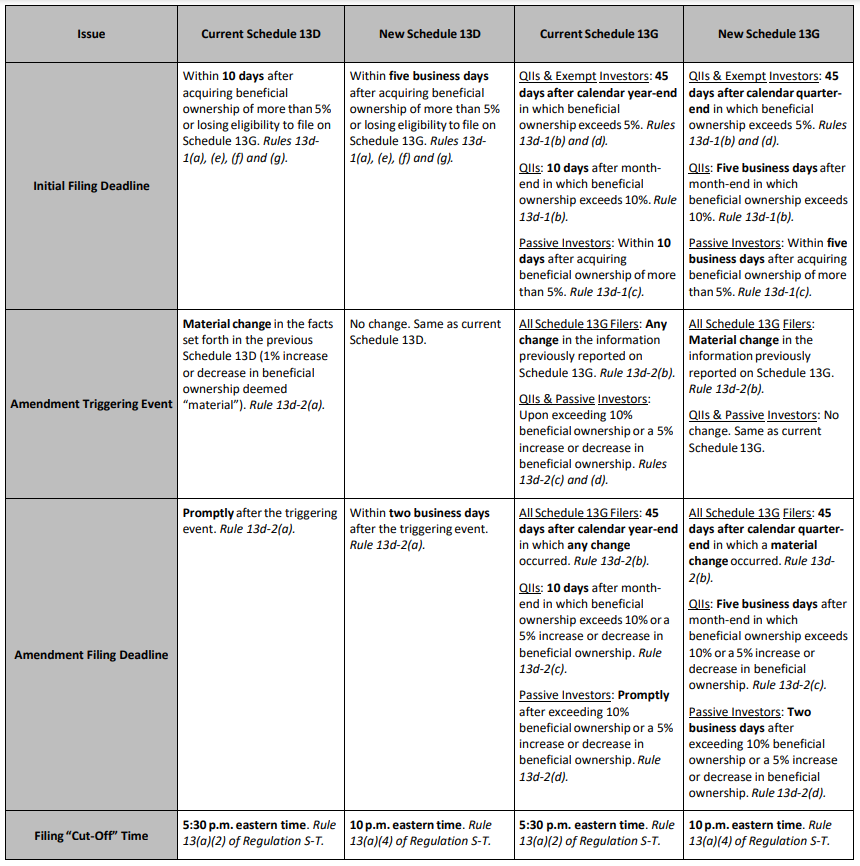

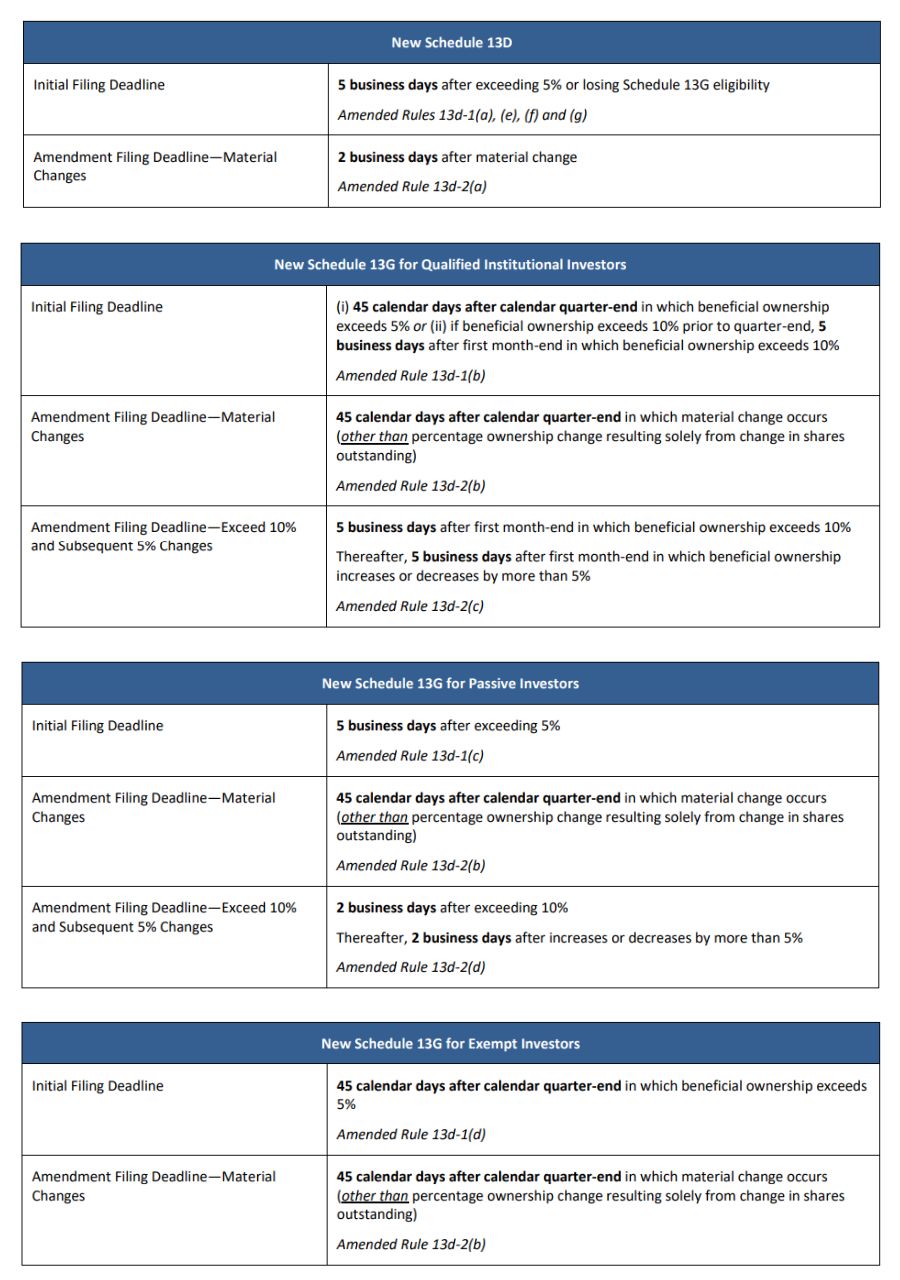

A table summarizing the revised reporting timetables—which, in response to concerns raised by public commenters, are less onerous for investors than those originally proposed by the SEC last year—appears on pages 10-11 of the adopting release, available here and also reproduced (with light editing for clarity) in Appendix A at the end of this client alert. A set of summary tables broken out by type of Schedule 13G filer is included in Appendix B.

Exchange Act Sections 13(d) and 13(g), together with the related rules of Regulation 13D-G, require an investor (including any group) that beneficially owns more than 5% of a covered class[1] of a public company’s equity securities to disclose their ownership position by filing with the SEC either a Schedule 13D or a Schedule 13G. Generally, investors with control intent must file the long form Schedule 13D, while investors without control intent and certain other investors are eligible to file the more abbreviated Schedule 13G. This regulatory framework is intended to serve as a comprehensive disclosure system of corporate ownership that can alert issuers and the market to rapid accumulations of equity securities by persons who would then have the potential to change or influence control of the issuer.

According to SEC Chair Gary Gensler, the purpose of the amendments is to update “antiquated” disclosure deadlines—first enacted in 1968 and 1977—and other aspects of the beneficial ownership rules that have not kept pace with modern advances in the financial markets and technology, with the goal of “reducing overall information asymmetries in the market, promoting transparency, allowing better-informed decision-making by investors and improving liquidity.”

Relative to the current beneficial ownership reporting system, the expedited filing timelines will enable public companies to be informed about changes in beneficial ownership positions of their major shareholders, and to identify potential activists, sooner.

Overview

As adopted, the amendments:

- Accelerate the filing deadlines for both initial and amended beneficial ownership reports on Schedules 13D and 13G (see Appendix A and Appendix B for tables summarizing the changes), including:

- Shorten the filing deadline for an initial Schedule 13D from 10 calendar days to 5 business days, and specify that Schedule 13D amendments must be filed within 2 business days after a material change;

- Shorten the filing deadlines for many initial Schedule 13Gs and certain Schedule 13G amendments from 45 calendar days after the end of the applicable calendar year to 45 calendar days after the end of the applicable calendar quarter, and require that Schedule 13G amendments be filed only after a material change (rather than any change);

- Extend the EDGAR filing cut-off time from 5:30 p.m. ET to 10:00 p.m. ET (the same deadline as for Section 16 beneficial ownership reports filed on Forms 3, 4 and 5);

- Require that Schedule 13D and 13G filings be made using a structured, machine-readable data language;

- Specify that Schedule 13D filers must disclose interests in all derivative securities that use the issuer’s equity security as a reference security, including cash-settled derivatives; and

- Expressly impute acquisitions of additional equity securities of a covered class by group members to the group at any time after the group’s formation (excluding intragroup transfers of securities).

The related new interpretive guidance:

- Clarifies the limited circumstances under which holders of cash-settled derivative securities (excluding security-based swaps (SBS))[2] may be deemed beneficial owners of the underlying reference equity securities; and

- Clarifies the scenarios in which two or more persons may be treated as a “group” subject to beneficial ownership disclosure obligations, including that an express agreement is not required and certain concerted actions may suffice (see Appendix C for the full text of this guidance).

Ongoing SEC Enforcement Initiative Targets Untimely Beneficial Ownership Reporting

The amendments were adopted against the backdrop of the Commission’s heightened scrutiny of untimely insider filings under Exchange Act Sections 13 and 16, particularly by repeated late filers. In late September, the SEC announced—as part of an “ongoing investigation of potential beneficial ownership violations” deploying advanced data analytics—a new sweep of enforcement actions against multiple officers, directors and greater than 5% shareholders of public companies for alleged serial failures to file timely beneficial ownership reports on Form 4 and Schedules 13D and 13G regarding their holdings and transactions in company securities. The SEC also charged the companies “for contributing to the filing failures by insiders or failing to report their insiders’ filing delinquencies.”

The adopting release reiterates that the Commission has the authority to investigate and enforce beneficial ownership reporting violations and to impose various remedies for late filings, such as injunctive relief, cease-and-desist orders or civil monetary penalties. The adopting release further emphasizes that no state of mind requirement exists for these violations and thus even inadvertent failures to file still constitute violations.

Takeaways

The compressed filing timeframes, significant increase in required frequency of Schedule 13G reporting, structured data requirements and clarifications regarding group status will increase compliance costs for investors and likely elicit enhanced SEC scrutiny of filer compliance with the beneficial ownership reporting amendments and related guidance.

Schedule 13D and 13G filers should confirm they have effective compliance systems and processes in place to monitor beneficial ownership levels to determine whether filing obligations have been triggered. To ensure timely compliance with the tighter disclosure deadlines, filers should update their policies and procedures to monitor ownership positions on a more frequent basis, particularly for initial and amended Schedule 13G filings, which will shift to a quarterly cadence from an annual cadence. In light of the new interpretive guidance, filers should also be mindful of the potential beneficial ownership implications of holding any non-SBS cash-settled derivative securities as well as potential group status arising from their communications or activities with other shareholders and with issuers.

If you have any questions or would like more information about the amended beneficial ownership reporting requirements and related guidance discussed in this client alert, please contact your regular Gunderson Dettmer attorney or any member of our Public Companies or Venture Capital and Growth Equity Funds practice teams.

|

Key Compliance Dates

The new SEC guidance included in the adopting release related to cash-settled derivatives and group formation should be considered effective immediately. |

Accelerated Filing Deadlines

The amendments generally accelerate the filing deadlines for both initial and amended beneficial ownership reports on Schedules 13D and 13G as described below.

Schedule 13D Filings

Initial Filings—Exceed 5% Ownership; Loss of 13G Eligibility

The filing deadline for the initial Schedule 13D is shortened to 5 business days[4] (down from 10 calendar days) after the date[5] on which a person (including any group) acquires beneficial ownership of more than 5% of a covered class or loses eligibility to report on the short form Schedule 13G in lieu of Schedule 13D.

Amendments—Material Changes

The filing deadline for Schedule 13D amendments is revised to 2 business days (from the undefined “promptly”) after the date on which a material change in the facts previously reported occurs.

Schedule 13G Filings

The Schedule 13G filing deadlines vary by investor category.

Initial Filings—Exceed 5% Ownership

For Qualified Institutional Investors (QIIs)[6] and Exempt Investors,[7] the filing deadline for the initial Schedule 13G is shortened to 45 calendar days[8] after the end of the calendar quarter (from 45 calendar days after the end of the calendar year) in which beneficial ownership exceeds 5% of a covered class. Thus, these filers will no longer have the ability to beneficially own greater than 5% throughout a calendar year without triggering a Schedule 13G filing obligation.

For Passive Investors,[9] the filing deadline for the initial Schedule 13G is shortened to 5 business days (down from 10 calendar days) after the date[10] on which they acquire beneficial ownership of more than 5% of a covered class.

Initial Filings—Exceed 10% Ownership Prior to Quarter-End (QIIs only)

For QIIs, the filing deadline for the initial Schedule 13G is shortened to 5 business days (down from 10 calendar days) after the end of the first month in which beneficial ownership exceeds 10% of a covered class.

Amendments—Material Changes

For all Schedule 13G filers, the filing deadline for Schedule 13G amendments is shortened to 45 calendar days after the end of the calendar quarter in which a material change in the facts previously reported occurs (from 45 calendar days after the end of the calendar year in which any change (regardless of materiality) occurs). As under the existing rules, an amendment need not be filed with respect to a change in the beneficial ownership percentage previously reported resulting solely from a change in the aggregate number of securities outstanding.

The SEC declined to explicitly define the term “material” for purposes of triggering a Schedule 13G amendment obligation or to provide an express safe harbor for certain specified de minimis changes in beneficial ownership. Rather, the adopting release explains that materiality is already defined in the Exchange Act and is a familiar, established concept in the federal securities laws.[11]

The SEC notes, however, that the language in Rule 13d-2(a) that provides guidance for beneficial owners to determine when a Schedule 13D amendment obligation arises under that rule—including the statement that “acquisition or disposition of beneficial ownership of securities in an amount equal to one percent or more of the class of securities shall be deemed ‘material’”—is “equally instructive” for purposes of determining when a Schedule 13G amendment is due. But it cautions that “these are non-exclusive circumstances in which an amendment obligation has been triggered,” pointing to additional language in the rule text stating that a material change includes, “but [is] not limited to,” a “material increase or decrease in the percentage of the class beneficially owned” and that “acquisitions or dispositions of less than [1% of the class of covered securities] may be material, depending upon the facts and circumstances.”

Amendments—Exceed 10% Ownership and Subsequent 5% Changes

For QIIs, the filing deadline for Schedule 13G amendments is shortened to 5 business days (down from 10 calendar days) after the end of the first month in which beneficial ownership exceeds 10% of a covered class, with additional amendments due 5 business days (down from 10 calendar days) after the end of the first month in which beneficial ownership subsequently increases or decreases by more than 5% of the covered class.

For Passive Investors, the filing deadline for Schedule 13G amendments is revised to 2 business days (from “promptly”) after the date on which beneficial ownership exceeds 10% of a covered class, with additional amendments due 2 business days (rather than “promptly”) after any subsequent increase or decrease in beneficial ownership by more than 5% of the covered class.

Extension of Filing Cut-Off Time

To help ease filers’ administrative burdens associated with the accelerated filing deadlines, the amendments extend the EDGAR filing cut-off time for initial and amended Schedules 13D and 13G from 5:30 p.m. ET to 10:00 p.m. ET (the same deadline as for Section 16 filings on Forms 3, 4 and 5).

In light of this additional time, the amendments remove the opportunity for a Schedule 13D or 13G filer to pursue a temporary hardship exemption under Rule 201(a) of Regulation S-T (available to filers who experience unanticipated technical difficulties preventing the timely submission of an electronic filing). However, filers will remain eligible to request a filing date adjustment under Rule 13(b) of Regulation S-T if they attempt in good faith to timely file, but the filing is delayed due to technical difficulties beyond their control (e.g., in the event of an EDGAR outage).

Structured Data Requirement

The amendments require that Schedules 13D and 13G be filed using an XML-based structured, machine-readable data language. This requirement applies to all information disclosed on Schedules 13D and 13G (other than exhibits), including quantitative disclosures, textual narratives and identification checkboxes.

As is the case with other EDGAR XML filings, reporting persons will be able to, at their option, submit filings directly to EDGAR in 13D/G-specific XML or use a web-based reporting application developed by the SEC that will generate the Schedule in 13D/G-specific XML in connection with the submission of the filing to EDGAR.

This requirement is intended to improve the accessibility and usability of the disclosures reported on Schedules 13D and 13G, “allowing investors to access, aggregate and analyze the reported information in a much more timely and efficient manner.”

Clarification of Derivatives Disclosure in Schedule 13D

To eliminate any ambiguity as to the scope of Schedule 13D’s disclosure requirements with respect to derivative securities, the amendments revise Item 6 of Schedule 13D—which currently requires disclosure of any contracts, arrangements, understandings or relationships with respect to the issuer’s securities—to expressly state that a Schedule 13D filer must disclose interests in all derivative securities that use the issuer’s equity security as a reference security, including cash-settled SBS and other derivatives settled exclusively in cash.

Previously, cash-settled derivative securities were not expressly included in the list of examples of such contracts, arrangements, understandings or relationships provided in the instructions to Item 6, and practice among Schedule 13D filers has been mixed as to whether such securities were included or excluded in the narrative disclosure in response to Item 6.

Commission Guidance

After considering significant pushback during the public comment period, the SEC elected not to adopt previously proposed changes to certain existing rules and instead published interpretive guidance in the adopting release clarifying:

- The application of the existing legal standards for determining beneficial ownership under Rule 13d-3 to an investor’s use of non-SBS cash-settled derivative securities; and

- The application of the existing legal standard governing the formation of a “group” found in Sections 13(d)(3) and 13(g)(3) to certain common types of shareholder engagement activities for beneficial ownership reporting purposes.

Treatment of Non-SBS Cash-Settled Derivatives

Currently, holders of cash-settled derivative securities are not explicitly included in the definition of “beneficial owner” in Rule 13d-3. The new Commission guidance, which appears on pages 113-15 of the adopting release (available here), states that “[a]lthough non-SBS derivative securities settled exclusively in cash generally are designed to represent only an economic interest, discrete facts and circumstances could arise where the holder of these securities may have voting or investment power as described in Rule 13d-3(a) or otherwise could be deemed to be a beneficial owner [of the underlying reference equity security] as determined under Rule 13d-3(b) or 13d-3(d).” Under this guidance, the reporting of beneficial ownership may be required to the extent the non-SBS cash-settled derivative security:

- Provides its holder, directly or indirectly, with exclusive or shared voting or investment power over the reference equity security through a contractual term of the derivative security or otherwise;

- Is acquired with the purpose or effect of divesting its holder of beneficial ownership of the reference equity security or preventing the vesting of that beneficial ownership as part of a plan or scheme to evade the reporting requirements of Section 13(d) or 13(g); or

- Grants its holder a right to acquire beneficial ownership of the reference equity security within 60 days or with the purpose or effect of changing or influencing control of the issuer.

Notwithstanding the above instances, however, the guidance emphasizes that the final determination as to whether the holder of any non-SBS cash-settled derivative security is the beneficial owner of the reference equity security ultimately will depend on the relevant facts and circumstances.[12]

Group Formation Does Not Require Express Agreement

The term “group” is not defined in the statutory text or any SEC rule. The appropriate legal standard for determining whether a group is formed—and thus whether the group members’ beneficial ownership must be aggregated for purposes of determining whether the reporting threshold has been crossed—is expressly stated in Sections 13(d)(3) and 13(g)(3), which provide that “[w]hen two or more persons act as a…group for the purpose of acquiring, holding or disposing of securities of an issuer, such…group shall be deemed a ‘person.’”

The new Commission guidance, which appears on pages 131-39 of the adopting release (available here), is intended to clarify the SEC’s view that the determination as to whether two or more persons are acting as a group depends on an analysis of all the relevant facts and circumstances and not solely on the presence or absence of an express agreement, and that in certain circumstances concerted actions by two or more persons for the purpose of acquiring, holding (which includes voting) or disposing of securities of an issuer are sufficient to constitute the formation of a group: “the evidence must show, at a minimum, indicia, such as an informal arrangement or coordination in furtherance, of a common purpose to acquire, hold or dispose of securities of an issuer.”

By contrast, “inadvertent or coincidental contact would not be sufficient to satisfy the standard given the absence of volitional acts made in concert or in coordination with others.”

Shareholder Engagement and Communication Activities

To address commenter concerns that this legal standard for group formation might be read too broadly and have an unintended chilling effect on communications among shareholders and shareholder engagement with issuers, the guidance also includes a set of seven Q&As with fact patterns describing a variety of common shareholder engagement and communication activities that, without further action, either would not or could be deemed to result in the formation of a group. These interpretations are largely consistent with prior SEC guidance and views previously expressed by courts.

For example, according to the guidance, a group would NOT be formed when two or more shareholders:

- Communicate with each other regarding an issuer or its securities without taking any other actions, including discussions related to improvement of the issuer’s long-term performance or changes in issuer practices, or coordination of “vote no” campaigns against individual directors in uncontested elections;

- Jointly make recommendations to an issuer regarding the structure and composition of its board of directors without attempting to convince the board to take specific actions through a change in the existing board membership or bind the board to take action; or

- Jointly submit a non-binding shareholder proposal to an issuer, provided there is no agreement to vote against director candidates nominated by the issuer’s management or other management proposals if the non-binding proposal is not included in the issuer’s proxy statement or, if passed, is not acted upon favorably by the issuer’s board.

The SEC emphasizes that “an exchange of views and any other type of dialogue in oral or written form not involving an intent to engage in concerted actions or other agreement with respect to the acquisition, holding or disposition of securities, standing alone, would not constitute an ‘act’ undertaken for the purpose of ‘holding’ securities of the issuer under Section 13(d)(3) or 13(g)(3).”

Furthermore, meetings, emails, and phone or other conversations between a shareholder and an activist investor seeking support for the activist’s proposals to an issuer’s board or management would not, without more (such as consenting or committing to a course of action), constitute coordination sufficient to find that the shareholder and the activist formed a group (though joint or coordinated publication of soliciting materials with an activist investor might be indicative of group formation). Similarly, a shareholder’s announcement of its independently determined intention to vote in favor of an unaffiliated activist investor’s director nominees would not, without more, give rise to group status.

On the other hand, if, in advance of filing a Schedule 13D, a beneficial owner of a substantial block of a covered class intentionally communicates to other market participants that such a filing will be made (to the extent this information is not yet public) with the purpose of causing such persons to make purchases in the same covered class, the blockholder and any market participants who made purchases as a direct result of that communication would potentially become subject to regulation as a group.[13]

The Q&A guidance on group formation is set forth in its entirety (excluding footnotes) in Appendix C at the end of this client alert.

Post-Formation Acquisitions of Beneficial Ownership by Group Members

The final rules amend Rule 13d-5 to expressly provide that a group subject to reporting obligations under Section 13(d) or 13(g) will be deemed to acquire any additional equity securities in the same class beneficially owned by the group that are acquired by a member of the group at any time after the group’s formation (including on the same day the group was formed), excluding any intra-group transfers of equity securities.[14]

[1] A “covered class” generally includes a voting class of equity securities registered under Section 12 of the Exchange Act.

[2] SBS are excluded from the scope of the final rules because the SEC is limited in its authority to alone deem beneficial ownership due to an SBS position and because SBS meeting certain thresholds will be required to be disclosed under a separately proposed reporting regime that is the subject of a different SEC rulemaking initiative.

[3] The adopting release provides the following example: “a Schedule 13G filer will be required to file an amendment within 45 days after September 30, 2024 if, as of end of the day on that date, there were any material changes in the information the filer previously reported on Schedule 13G.”

[4] “Business day” for purposes of Regulation 13D-G (which is currently undefined) will be defined, consistent with the customary definition of the term, to mean any day other than a Saturday, Sunday or U.S. federal holiday.

[5] The adopting release clarifies that, for purposes of determining the filing deadline, the first day in the five-business day count toward reaching the deadline is the day after the date on which beneficial ownership of more than 5% is acquired or on which a person loses its Schedule 13G eligibility (rather than the date of such acquisition or loss).

[6] The term “Qualified Institutional Investors” refers to the institutional investors qualified to report on Schedule 13G, in lieu of Schedule 13D and in reliance on Rule 13d-1(b), including registered broker-dealers, registered investment companies, registered investment advisers, insurance companies and other investors enumerated in Rule 13d-1(b)(1)(ii).

[7] The term “Exempt Investors” refers to persons holding beneficial ownership of more than 5% of a covered class but who have not made an acquisition of beneficial ownership subject to Section 13(d), such as founders and other pre-IPO investors or those who have not acquired more than 2% of a covered class within a 12-month period. These investors, however, are subject to Section 13(g) and required to report their beneficial ownership pursuant to Rule 13d-1(d).

[8] If the deadline falls on a Saturday, Sunday or U.S. federal holiday, then the filing may be made on the following business day.

[9] The term “Passive Investors” refers to beneficial owners of more than 5% but less than 20% of a covered class who can certify under Item 10 of Schedule 13G that the subject securities were not acquired or held with the purpose or effect of changing or influencing the control of the issuer of such securities, or in connection with or as a participant in any transaction having that purpose or effect. These investors are eligible to report beneficial ownership on Schedule 13G in reliance on Rule 13d-1(c).

[10] The adopting release clarifies that, for purposes of determining the filing deadline, the first day in the five-business day count toward reaching the deadline is the day after the date on which beneficial ownership of more than 5% is acquired (rather than the date of such acquisition).

[11] Exchange Act Rule 12b-2 provides that “[t]he term ‘material,’ when used to qualify a requirement for the furnishing of information as to any subject, limits the information required to those matters to which there is a substantial likelihood that a reasonable investor would attach importance in determining whether to buy or sell the securities registered.” The U.S. Supreme Court has held that information is material if “there is a substantial likelihood that a reasonable shareholder would consider it important” in making an investment decision, or if it would have “significantly altered the ‘total mix’ of information made available.” See TSC Indus. v. Northway, Inc., 426 U.S. 438, 449 (1976); Basic, Inc. v. Levinson, 485 U.S. 224, 232 (1988); and Matrixx Initiatives v. Siracusano, 563 U.S. 27 (2011).

[12] The adopting release notes that this guidance is consistent with guidance the Commission issued in 2011 regarding the application of Rule 13d-3 to SBS, and that the SBS guidance provides “an instructive analytical framework” with respect to non-SBS cash settled derivatives.

[13] The SEC notes, however, that a tippee under such circumstances would not become a member of a group, and thus would not incur a reporting obligation, until it actually makes a purchase of securities of the same covered class in response to having been tipped (even if the tippee already is a beneficial owner of that class)—i.e., the communication about the upcoming filing, by itself, does not create a group.

[14] The SEC notes that absent an express provision that would treat post-formation acquisitions of beneficial ownership by group members as acquisitions by the group, the SEC (or other affected parties) must prove the acquisition is attributable to the group.

SEC SUMMARY OF REVISED SCHEDULES 13D AND 13G FILING DEADLINES

(PDF VERSION AVAILABLE HERE)

SUMMARY OF NEW SCHEDULES 13D AND 13G FILING DEADLINES BY INVESTOR CATEGORY

(PDF VERSION AVAILABLE HERE)

GUIDANCE ON THE APPLICATION OF THE CURRENT LEGAL STANDARD FOR GROUP FORMATION UNDER EXCHANGE ACT SECTIONS 13(d)(3) AND 13(g)(3) TO CERTAIN COMMON TYPES OF SHAREHOLDER ENGAGEMENT ACTIVITIES

Question: Is a group formed when two or more shareholders communicate with each other regarding an issuer or its securities (including discussions that relate to improvement of the long-term performance of the issuer, changes in issuer practices, submissions or solicitations in support of a non-binding shareholder proposal, a joint engagement strategy (that is not control-related), or a “vote no” campaign against individual directors in uncontested elections) without taking any other actions?

Response: No. In our view, a discussion whether held in private, such as a meeting between two parties, or in a public forum, such as a conference that involves an independent and free exchange of ideas and views among shareholders, alone and without more, would not be sufficient to satisfy the “act as a . . . group” standard in Sections 13(d)(3) and 13(g)(3). Sections 13(d)(3) and 13(g)(3) were intended to prevent circumvention of the disclosures required by Schedules 13D and 13G, not to complicate shareholders’ ability to independently and freely express their views and ideas to one another. The policy objectives ordinarily served by Schedule 13D or Schedule 13G filings would not be advanced by requiring disclosure that reports this or similar types of shareholder communications. Thus, an exchange of views and any other type of dialogue in oral or written form not involving an intent to engage in concerted actions or other agreement with respect to the acquisition, holding, or disposition of securities, standing alone, would not constitute an “act” undertaken for the purpose of “holding” securities of the issuer under Section 13(d)(3) or 13(g)(3).

Question: Is a group formed when two or more shareholders engage in discussions with an issuer’s management, without taking any other actions?

Response: No. For the same reasons described above, we do not believe that two or more shareholders “act as a . . . group” for the purpose of “holding” a covered class within the meaning of those terms as they appear in Section 13(d)(3) or 13(g)(3) if they simply engage in a similar exchange of ideas and views, alone and without more, with an issuer’s management.

Question: Is a group formed when shareholders jointly make recommendations to an issuer regarding the structure and composition of the issuer’s board of directors where (1) no discussion of individual directors or board expansion occurs and (2) no commitments are made, or agreements or understandings are reached, among the shareholders regarding the potential withholding of their votes to approve, or voting against, management’s director candidates if the issuer does not take steps to implement the shareholders’ recommended actions?

Response: No. Where recommendations are made in the context of a discussion that does not involve an attempt to convince the board to take specific actions through a change in the existing board membership or bind the board to take action, we do not believe that the shareholders “act as a . . . group” for the purpose of “holding” securities of the covered class within the meaning of those terms as they appear in Sections 13(d)(3) or 13(g)(3). Rather, we view this engagement as the type of independent and free exchange of ideas between shareholders and issuers’ management that does not implicate the policy concerns addressed by Section 13(d) or Section 13(g).

Question: Is a group formed if shareholders jointly submit a non-binding shareholder proposal to an issuer pursuant to Exchange Act Rule 14a-8 for presentation at a meeting of shareholders?

Response: No. The Rule 14a-8 shareholder proposal submission process is simply another means through which shareholders can express their views to an issuer’s management and board and other shareholders. For purposes of group formation, we do not believe shareholders engaging in a free and independent exchange of thoughts about a potential shareholder proposal, jointly submitting, or jointly presenting, a non-binding proposal to an issuer in accordance with Rule 14a-8 (or other means) should be treated differently from, for example, shareholders jointly meeting with an issuer’s management without other indicia of group formation. Accordingly, where the proposal is non-binding, we do not believe that the shareholders “act as a . . . group” for the purpose of “holding” securities of the covered class within the meaning of those terms as they appear in Section 13(d)(3) or 13(g)(3). Assuming that the joint conduct has been limited to the creation, submission, and/or presentation of a non-binding proposal, those statutory provisions would not result in the shareholders being treated as a group, and the shareholders’ beneficial ownership would not be aggregated for purposes of determining whether the five percent threshold under Section 13(d)(1) or 13(g)(1) had been crossed.

Question: Would a conversation, email, phone contact, or meetings between a shareholder and an activist investor that is seeking support for its proposals to an issuer’s board or management, without more, such as consenting or committing to a course of action, constitute such coordination as would result in the shareholder and activist being deemed to form a group?

Response: No. Communications such as the types described, alone and without more, would not be sufficient to satisfy the “act as a . . . group” standard in Sections 13(d)(3) and 13(g)(3) as they are merely the exchange of views among shareholders about the issuer. This view is consistent with the Commission’s previous statement that a shareholder who is a passive recipient of proxy soliciting activities, without more, would not be deemed a member of a group with persons conducting the solicitation. Activities that extend beyond these types of communications, which include joint or coordinated publication of soliciting materials with an activist investor might, however, be indicative of group formation, depending upon the facts and circumstances.

Question: Would an announcement or a communication by a shareholder of the shareholder’s intention to vote in favor of an unaffiliated activist investor’s director nominees, without more, constitute coordination sufficient to find that the shareholder and the activist investor formed a group?

Response: No. We do not view a shareholder’s independently-determined act of exercising its voting rights, and any announcements or communications regarding its voting decision, without more, as indicia of group formation. This view is consistent with our general approach towards the exercise of the right of suffrage by a shareholder in other areas of the Federal securities laws. Shareholders, whether institutional or otherwise, are thus not engaging in conduct at risk of being deemed to give rise to group formation as a result of simply independently announcing or advising others—including the issuer—how they intend to vote and the reasons why.

Question: If a beneficial owner of a substantial block of a covered class that is or will be required to file a Schedule 13D intentionally communicates to other market participants (including investors) that such a filing will be made (to the extent this information is not yet public) with the purpose of causing such persons to make purchases in the same covered class, and one or more of the other market participants make purchases in the same covered class as a direct result of that communication, would the blockholder and any of those market participants that made purchases potentially become subject to regulation as a group?

Response: Yes. To the extent the information was shared by the blockholder with the purpose of causing others to make purchases in the same covered class and the purchases were made as a direct result of the blockholder’s information, these activities raise the possibility that all of these beneficial owners are “act[ing] as” a “group for the purpose of acquiring” securities of the covered class within the meaning of Section 13(d)(3). Such purchases may implicate the need for public disclosure underlying Section 13(d)(3) and these purchases could potentially be deemed as having been undertaken by a “group” for the purpose of “acquiring” securities as specified under Section 13(d)(3). Given that a Schedule 13D filing may affect the market for and the price of an issuer’s securities, non-public information that a person will make a Schedule 13D filing in the near future can be material. By privately sharing this material information in advance of the public filing deadline, the blockholder may incentivize the market participants who received the information to acquire shares before the filing is made. Such arrangements also raise investor protection concerns regarding perceived unfairness and trust in markets. The final determination as to whether a group is formed between the blockholder and the other market participants will ultimately depend upon the facts and circumstances, including (1) whether the purpose of the blockholder’s communication with the other market participants was to cause them to purchase the securities and (2) whether the market participants’ purchases were made as a direct result of the information shared by the blockholder.

Featured Insights

Featured Insights

Client News