Preparing for the SEC’s New ‘Pay-Versus-Performance’ Proxy Disclosure Rules

- Effective for the Upcoming 2023 Proxy Season

- New Rules Mandate Disclosure of the Relationship Between Executive Compensation ‘Actually Paid’ and Company and Peer-Group TSR, Net Income and a Company-Selected Financial Performance Measure

- Rules Exempt EGCs and FPIs, and Provide Scaled Disclosure Relief to SRCs

INTRODUCTION

The U.S. Securities and Exchange Commission (SEC) recently adopted final rules that require public companies to disclose, in both tabular and narrative format, information about the relationship between the compensation they pay executives and their financial performance for up to five fiscal years in proxy or information statements in which executive compensation disclosures are required. More than a decade in the making, the new rules implement the so-called pay-versus-performance disclosure requirements mandated by the Dodd-Frank Act in the aftermath of the 2008 financial crisis.

The final pay-versus-performance rules are highly prescriptive, impose significant new disclosure obligations beginning with the 2023 proxy season, and will require substantial advance planning and preparation. The rules exempt emerging growth companies (EGCs) and foreign private issuers (FPIs) and provide some scaled disclosure relief to smaller reporting companies (SRCs). For companies subject to the rules, though, implementation will take a meaningful investment of time. In particular, the adopted approach for valuing equity awards to be included in calculating the new metric of executive compensation “actually paid” will require input from advisors including outside accounting and valuation firms to prepare calculations that were not previously required, that many companies historically have not performed and that may be complex, burdensome and involve significant effort.

In light of the short lead-time for compliance, public companies and their compensation committees should start preparing now for the expansive new disclosure requirements, which will increase the length and complexity of existing compensation disclosures and propel heightened levels of stakeholder scrutiny. To assist our public-company clients in complying with these new disclosure requirements, we provide below a brief overview of the final rules (including the phased reporting timelines), followed by a set of detailed Q&As addressing all key aspects of the rules. We conclude with practical commentary highlighting specific steps companies can take now to ensure they have adequate time to implement the new disclosures, and invite you to engage with Gunderson Dettmer’s public companies and executive compensation teams to discuss how we can help.

OVERVIEW

SEC reporting companies (other than EGCs and FPIs) must begin to comply with the new pay-versus-performance disclosure requirements in proxy and information statements that are required to include executive compensation information for fiscal years ending on or after December 16, 2022, meaning, for calendar-year-end companies, in their proxy statements for 2023 annual meetings filed next spring. Pay-versus-performance disclosure is not required in other SEC filings where executive compensation information is required, including Form S-1 registration statements and Form 10-K annual reports.

Only three fiscal years of pay-versus-performance disclosure must be provided in the initial filing year, with an additional fiscal year of disclosure added in each of the two following years, so that the disclosure will cover five fiscal years when fully phased-in. Scaled disclosure accommodations are available to companies that qualify as SRCs,[1] including the ability to provide only two fiscal years of disclosure in the initial filing year, with a third fiscal year of disclosure added in the following year, so that the disclosure will cover three fiscal years when fully phased-in.

The final pay-versus-performance rules add new Item 402(v) to Regulation S-K, which, at a high level, requires:

- a new pay-versus-performance table that presents, for each of the five most recently completed fiscal years (subject to a phase-in period):

- total compensation paid to the principal executive officer (PEO) as reported in the Summary Compensation Table (SCT) in the proxy statement, and the average total compensation reported for the remaining named executive officers (NEOs)[2] collectively;

- compensation “actually paid” to the PEO and the average compensation “actually paid” to the other NEOs collectively, in both cases calculated by adjusting the SCT total compensation amounts for equity awards and pension benefits using a prescribed formula;

- cumulative total shareholder return (TSR) for both the company and its selected peer group, calculated based on an initial fixed $100 investment;

- the company’s net income, determined in accordance with U.S. generally accepted accounting principles (GAAP); and

- the single “most important” financial performance measure (not already included in the table and which may be a non-GAAP financial metric) used by the company to link NEO compensation “actually paid” to company performance for the most recently completed fiscal year (Company-Selected Measure);

- accompanying narrative and/or graphical disclosures providing a “clear description” of (1) the relationships between each of the financial performance measures included in the table and the compensation “actually paid” to the PEO and, on average, to the other NEOs; and (2) the relationship between the company’s cumulative TSR and its peer-group cumulative TSR, in each case over the five most recently completed fiscal years (or any shorter period reported in the table); and

- a separate, unranked tabular list of the three to seven “most important” financial performance measures (which may include non-financial performance measures) used by the company to link NEO compensation “actually paid” to company performance for the most recently completed fiscal year (Tabular List).

Q&As

General

Which companies are subject to the new pay-versus-performance rules?

The rules apply to all SEC reporting companies other than EGCs, FPIs, registered investment companies and companies with reporting obligations only under Section 15(d) of the Securities Exchange Act of 1934 (Exchange Act). SRCs are subject to scaled reporting requirements, as discussed in more detail below. Companies are not required to provide disclosure for any fiscal years in which they were not SEC reporting companies.

Which SEC filings are affected?

Pay-versus-performance disclosures are required in proxy statements for annual and special shareholder meetings filed on Schedule 14A and information statements filed on Schedule 14C in which executive compensation disclosures under Item 402 of Regulation S-K are required in conjunction with a shareholder vote. The disclosures will be required by a new Item 402(v) of Regulation S-K, and be subject to the say-on-pay advisory vote.

The disclosures are not required in other filings where Item 402 executive compensation disclosures are required, including Form S-1 and other registration statements under the Securities Act of 1933 (Securities Act) and Form 10-K annual reports, as the pay-versus-performance information was intended to be presented in circumstances in which shareholder action is to be taken with regard to executive compensation or an election of directors.

While the disclosures will be considered “filed” for purposes of Exchange Act liability, they will not be deemed to be incorporated by reference into filings under the Securities Act or the Exchange Act, except to the extent a company specifically incorporates them by reference.

Is there a prescribed location for the pay-versus-performance disclosures?

The rules do not prescribe the location of the required disclosures in the proxy or information statement, and allow companies flexibility in determining where in the filing to provide them. In the adopting release, the SEC specifically states that it decided against mandatory inclusion of these disclosures in the Compensation Discussion and Analysis (CD&A) section of the proxy statement because such placement “may cause confusion by suggesting that the [company] considered the pay-versus-performance relationship in its compensation decisions, which may or may not be the case.”

If the company did not consider the information included in the pay-versus-performance disclosures when making decisions about executive compensation, or if the company is not required to present a CD&A, the pay-versus-performance disclosures could be included with the other executive compensation disclosures called for by Item 402 of Regulation S-K, such as at the end of the executive compensation tables or after the CEO pay ratio disclosure (if applicable).

When will the first pay-versus-performance disclosures be required?

Public companies must begin to comply with the new disclosure requirements in proxy and information statements that include executive compensation information for fiscal years ending on or after December 16, 2022. This means that, for calendar-year-end companies, the first pay-versus-performance disclosures will be required in their proxy statements for the 2023 annual meeting of shareholders filed next spring.

Pay-Versus-Performance Table

Is there a prescribed format for the new pay-versus-performance table?

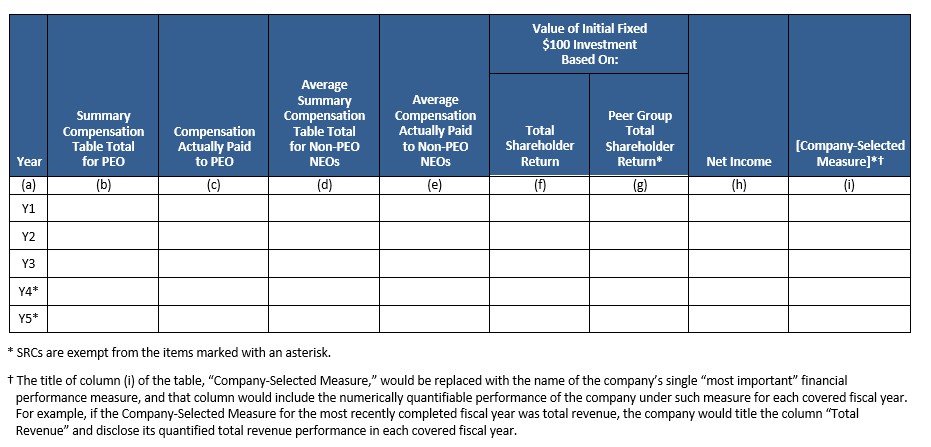

Companies are required to present the annual values of the prescribed measures of executive compensation and financial performance in a new standardized table as follows:

Companies are permitted to voluntarily supplement the mandatory tabular disclosure (e.g., by adding columns for additional company performance measures or rows for additional fiscal years), so long as any additional disclosure is clearly identified as supplemental, not misleading and not presented with greater prominence than, or does not otherwise obscure, the required disclosure, as discussed in more detail below.

How many fiscal years of information must be provided in the pay-versus-performance table (and accompanying narrative and/or graphical relationship disclosures)?

After a phase-in period, companies other than SRCs must provide the pay-versus performance disclosure for the five most recently completed fiscal years, and SRCs must provide the disclosure for the three most recently completed fiscal years. By contrast, the SCT under Item 402(c) of Regulation S-K requires reporting compensation for only three fiscal years (two fiscal years for SRCs).

In their first applicable proxy filing, however, all companies that are not SRCs are required to provide the pay-versus-performance disclosure for only three fiscal years. In each of their next two proxy filings, they must include disclosure for an additional fiscal year (i.e., four fiscal years in the second filing, and five fiscal years in subsequent filings).[3]

SRCs. SRCs are required to provide only two (rather than three) fiscal years of pay-versus-performance disclosure in their first applicable proxy filing, and only three (rather than five) fiscal years of disclosure in subsequent filings.[4]

Newly public companies. Newly public companies that are not EGCs or FPIs (which are exempted from the rules) are required to provide the pay-versus-performance disclosure only for fiscal years in which they were SEC reporting companies. Because the disclosure is not required in registration statements, it does not have to be provided in the initial public offering (IPO) process.[5]

What compensation information is required in the pay-versus-performance table for the PEO?

Compensation for the PEO is required to be disclosed on an individual basis, consisting of the following information for each covered fiscal year: (i) the total PEO compensation reported in the SCT and (ii) the compensation “actually paid” to the PEO.

Where more than one person served as the company’s PEO in a covered fiscal year, the table must include separate SCT total compensation and compensation “actually paid” columns for each PEO during that fiscal year. The adopting release shows how additional columns can be added to the table to reflect multiple PEOs in a single fiscal year. Companies must provide footnote disclosure identifying the name of each PEO included in the table and the fiscal year(s) in which they are included.

What compensation information is required in the pay-versus-performance table for the NEOs who are not the PEO?

Compensation for the NEOs other than the PEO is required to be disclosed as an average, which the SEC believes will make it easier for investors to compare a company’s pay-versus-performance disclosure over time given there can be frequent turnover in a company’s NEOs from year to year. Companies are required to disclose the following compensation information for the non-PEO NEOs collectively for each covered fiscal year: (i) the average total compensation reported in the SCT for this group and (ii) the average compensation “actually paid” to this group.

Different NEOs may be included in the average throughout the five-year reporting period (i.e., new calculations of the five-year compensation history based on the NEO composition as of the most recently completed fiscal year are not required). Companies must identify in footnotes to the table the names of the individual NEOs whose compensation amounts are included in the average for each fiscal year, so that investors can consider whether changes in the average compensation reported from year to year were due to compositional changes in the included NEOs.

How is the amount of executive compensation “actually paid” calculated?

The amount of executive compensation “actually paid” for a covered fiscal year equals total compensation as reported in the SCT for that fiscal year, with adjustments to the treatment of equity awards and (for non-SRCs) pension benefits, as described below.

Companies must disclose in footnotes to the table the required individual adjustments (deductions and additions) to the total compensation amounts reported in the SCT to arrive at executive compensation “actually paid.” For NEOs other than the PEO, these adjustments must be disclosed as averages.

What equity award adjustments are required to be made to calculate executive compensation “actually paid”?

The approach adopted in the final rules is a significant departure from common practices for reporting the value attributable to equity awards in the SCT and essentially “marks to market” outstanding and unvested equity awards on a fair-value basis from the grant date to the vesting date, as follows:

- Subtract the grant-date fair values of the equity awards reported in the “Stock Awards” and “Option Awards” columns of the SCT for the covered fiscal year;

- For any equity awards granted in the covered fiscal year that are outstanding and unvested as of the end of the covered fiscal year, add the fair value at fiscal-year-end;

- For any equity awards granted in prior fiscal years that are outstanding and unvested as of the end of the covered fiscal year, add the increase (or subtract the decrease) in fair value by comparing the fair value at the end of the covered fiscal year with the fair value at the end of the prior fiscal year;

- For any equity awards that are granted and vest in the same covered fiscal year, add the fair value as of the vesting date;

- For any equity awards granted in prior fiscal years that vest in the covered fiscal year, add the increase (or subtract the decrease) in fair value by comparing the fair value as of the vesting date with the fair value at the end of the prior fiscal year;

- For any equity awards granted in prior fiscal years that are deemed to fail to meet the applicable vesting conditions during the covered fiscal year, subtract the fair value at the end of the prior fiscal year; and

- For any dividends or other earnings paid on equity awards in the covered fiscal year prior to the vesting date, add such amount if it is not otherwise reflected in the fair value of such awards or included in any other component of total compensation for the covered fiscal year.

The general principle underlying this new approach is that equity awards will first be reported as executive compensation “actually paid” in the fiscal year during which the award is granted based on the fair value as of fiscal-year-end (unless the award vests earlier) and then, in each subsequent fiscal year, changes in the fair value of the award as of fiscal-year-end will be reported until a final fair value is reported for the fiscal year in which vesting occurs, determined as of the vesting date (i.e., the date when “all applicable vesting conditions were satisfied”).[6] The adopting release notes that this approach is intended to exclude post-vesting changes in value that generally reflect investment decisions made by the executive rather than compensation decisions made by the company.

According to the SEC, the resulting value of equity compensation “actually paid” is conceptually similar to realizable pay as it reflects “an attempt to measure the change in value of an executive’s pay package—including outstanding awards that have not yet been realized—after the grant date, as performance outcomes are experienced.”

For purposes of these adjustments, “fair value” must be computed in a manner consistent with FASB ASC Topic 718. The fair value determinations are required to take into account the excess fair value (if any) as a result of any adjustments (whether through amendment, cancellation, replacement or other means) or other material modifications to equity awards made during the covered fiscal year. For equity awards subject to performance conditions, the changes in fair value at the end of the covered fiscal year should be calculated based on the probable outcome of such conditions as of the last day of the fiscal year.

In addition to the deductions and additions used to determine executive compensation “actually paid,” companies must provide footnote disclosure of any equity award valuation assumptions that differ materially from those disclosed in their financial statements as of the grant date of such equity awards.

What pension benefit adjustments are required to be made to calculate executive compensation “actually paid”?

- Subtract the aggregate change (if positive)[7] in the actuarial present value of the NEO’s accumulated benefit under all defined benefit and actuarial pension plans reported in the “Change in Pension Value and Nonqualified Deferred Compensation Earnings” column of the SCT for the covered fiscal year; and

- Add the “service cost,” calculated as the actuarial present value of the NEO’s benefit under all such plans attributable to services rendered during the covered fiscal year; plus the “prior service cost,” calculated as the entire cost of benefits granted (or credit for benefits reduced) in a plan amendment or initial plan adoption during the covered fiscal year that are attributed by the benefit formula to services rendered in periods prior to the plan amendment or adoption, in each case determined in accordance with GAAP (FASB ASC Topic 715). The adjustment does not distinguish between vested and unvested benefits.

The adopting release notes that the resulting value of pension compensation “actually paid” will, in many cases, approximate the value that would be set aside currently by the company to fund the pension benefits payable upon retirement to each NEO for the services provided, and any plan amendments made, during the covered fiscal year. The SEC further notes that while service costs associated with defined benefit plans are reported in audited financial statement footnotes at the plan level, they are not currently required to be disaggregated by individual, and thus companies would incur an additional expense to obtain the service cost and prior service cost information with respect to each individual NEO.

The pension benefit adjustments described above will not apply to SRCs because they are not otherwise required to disclose executive compensation related to pension plans.

Must one-time payments, such as a signing or severance bonus, be included in executive compensation “actually paid”?

The adopting release states that companies will not be permitted to exclude signing and severance bonuses and other one-time payments from the amount of executive compensation “actually paid” because, although those figures may not represent the NEO’s compensation in a “typical” year where no such payment is made, they do reflect amounts that are “actually paid” to the NEOs. The SEC observes that, even if such payments are not ordinarily recurring with respect to a particular NEO, shareholders voting on executive compensation or directors may wish to take into account the company resources devoted to such payments in light of the company’s performance.

What financial performance measures must be included in the pay-versus-performance table for each covered fiscal year?

The pay-versus-performance table mandates disclosure of the following four financial performance measures for each fiscal year reported in the table:

- cumulative TSR of the company;

- cumulative TSR of the company’s selected peer group (non-SRCs only);

- the company’s GAAP net income; and

- the Company-Selected Measure (non-SRCs only).

Companies have the flexibility to include, as new columns in the table, additional measures of performance that may be relevant to investors in evaluating the alignment between pay and performance, so long as the additional performance measures are clearly identified as supplemental, not misleading and not presented with greater prominence than, or do not otherwise obscure, the required disclosure, as discussed in more detail below.

What if a company does not currently use financial performance measures as part of its executive compensation program design or awards?

While companies that do not currently use financial performance measures in their executive compensation plans would not have to present a Company-Selected Measure or the Tabular List, they would still be required to disclose company TSR, peer-group TSR (non-SRCs only) and net income in the pay-versus-performance table and provide a clear description, in narrative and/or graphical format, of the relationships between those financial performance measures and NEO compensation “actually paid” over their five most recently completed fiscal years (or any shorter period reported in the table). A company could, however, add contextual or clarifying disclosure explaining that it does not take those financial performance measures into account in setting executive compensation, and why.

Companies are not required to adopt new, or modify existing, compensation policies or practices as a result of the new rules, and may continue to make executive compensation decisions based on preferred metrics of company performance (or no company performance metrics at all).

How is cumulative TSR calculated?

Cumulative TSR for both the company and its selected peer group is calculated in substantially the same manner as is required for stock performance graphs by Item 201(e) of Regulation S-K,[8] measured over the period beginning at the “measurement point” established by the market close on the last trading day before the company’s earliest fiscal year in the pay-versus-performance table, through and including the end of the fiscal year for which cumulative TSR is being calculated. That is, the TSR for the first fiscal year in the table will represent the TSR over that first fiscal year, the TSR for the second fiscal year in the table will represent the cumulative TSR over the first and the second fiscal years, etc., such that the TSR for the most recent fiscal year in the table will represent the cumulative TSR over all fiscal years reported in the table.

The closing price at the measurement point must be converted into a fixed investment of $100, stated in dollars, in the company’s stock (or the stocks represented by the peer group). For each covered fiscal year, the amount included in the table must be the value of such fixed investment based on the cumulative TSR as of the end of that fiscal year. The same methodology must be used in calculating both the company’s TSR and that of its peer group.

|

How is the company’s peer group determined?

Companies have the option of choosing the same peer group (i) used for their Item 201(e) stock performance graph (a published industry or line-of-business index, peer companies selected in good faith or companies with similar market capitalization, if certain criteria are met) or (ii) if applicable, reported in their CD&A for purposes of disclosing their compensation benchmarking practices. If the peer group is not a published industry or line-of-business index, the constituent companies of the peer group must be disclosed in a footnote or incorporated by reference to prior filings if previously disclosed.

Peer-group TSR must be weighted according to the respective peer companies’ stock market capitalization at the beginning of the earliest fiscal year included in the table, consistent with the calculation of peer-group TSR under Item 201(e) of Regulation S-K.

SRCs are not required to present a peer-group TSR because they are not required to disclose an Item 201(e) stock performance graph or a CD&A.

What happens if the peer group changes between fiscal years?

If a company changes the peer group used in its pay-versus-performance disclosure from the one used in the immediately preceding fiscal year, it will be required to include tabular disclosure of peer-group TSR only for the new peer group for each of the fiscal years reported in the table (including prior years), and must explain in a footnote to the table the reason(s) for the change and compare the company’s cumulative TSR with that of both the old and the new peer group.

What is the “Company-Selected Measure” and how is it determined?

Companies that are not SRCs are required to disclose in the pay-versus-performance table a Company-Selected Measure that, in the company’s assessment, represents the single “most important” financial performance measure[9] that is not otherwise required to be disclosed in the table (i.e., other than net income or company or peer-group TSR) used by the company to link NEO compensation “actually paid” to company performance for the most recently completed fiscal year. The Company-Selected Measure must be a financial performance measure. (Non-financial performance measures (including environmental, social and governance (ESG) metrics) may (but are not required to) be included in the Tabular List, as discussed below.)

The SEC does not define “most important,” and companies are not required to explain how or why they made their choice.

If the company’s single “most important” financial performance measure is already included in the table (e.g., net income), the company would designate its next-“most important” financial performance measure as its Company-Selected Measure.

The determination of “most important” is made with reference only to the most recently completed fiscal year (as opposed to the prior five fiscal years). As a result, the Company-Selected Measure could change from one filing to the next, in which case the new Company-Selected Measure would need to be recalculated for each of the fiscal years reported in the table (including prior years).

Disclosure of the Company-Selected Measure in the table must be accompanied by narrative and/or graphical disclosures providing a clear description of the relationship between the Company-Selected Measure and NEO compensation “actually paid” over the five most recently completed fiscal years (or any shorter period reported in the table), as discussed in more detail below.

Companies that do not use any financial performance measures to link NEO compensation “actually paid” to company performance, or that only use measures already required to be disclosed in the table (i.e., net income and company and peer-group TSR), would not be required to disclose a Company-Selected Measure or its relationship to NEO compensation “actually paid.”

Must the methodology for calculating the Company-Selected Measure be disclosed?

Companies are not required to disclose the methodology used to calculate the Company-Selected Measure, although the SEC advises companies to “consider if such disclosure would be helpful to investors to understand the Company-Selected Measure, or necessary to prevent the Company-Selected Measure disclosure from being confusing or misleading.” In addition, companies may cross-reference to other disclosures, if any, elsewhere in the proxy statement (such as in the CD&A) that describe their processes and calculations that go into determining NEO compensation as it relates to the Company-Selected Measure.

Companies may choose to provide a non-GAAP financial metric such as EBITDA or adjusted net income as their Company-Selected Measure (any supplemental performance measures they elect to present may be non-GAAP financial metrics, as well). Any such non-GAAP financial metrics will not be subject to Regulation G and Item 10(e) of Regulation S-K, consistent with how non-GAAP financial metrics are treated in the CD&A (and thus requirements such as reconciliation to the most directly comparable GAAP measure and presentation of the most directly comparable GAAP measure with equal or greater prominence will not apply). However, companies must disclose how the metric is derived from their audited financial statements.

Are companies permitted to include additional performance measures in the pay-versus-performance table?

Companies may elect to include additional columns in the table to present “important” measures of company performance other than the Company-Selected Measure, so long as the additional performance measures are clearly identified as supplemental, not misleading and not presented with greater prominence than, or do not otherwise obscure, the required disclosure.[10]

Any additional performance measure voluntarily included in the table must also be accompanied by a clear description, in narrative and/or graphical format, of the relationship between such performance measure and NEO compensation “actually paid” over the five most recently completed fiscal years (or any shorter period reported in the table), as discussed in more detail below.

Narrative and/or Graphical Relationship Disclosure

What additional disclosures must accompany the information reported in the pay-versus-performance table?

Companies are required to use the information presented in the pay-versus-performance table to provide “clear descriptions” of the following relationships, in each case over their five most recently completed fiscal years (or any shorter period reported in the table):

- the relationships between (i) (A) the compensation “actually paid” to the PEO and (B) the compensation “actually paid,” on average, to the other NEOs and (ii) the company’s cumulative TSR;

- the relationships between (i) (A) the compensation “actually paid” to the PEO and (B) the compensation “actually paid,” on average, to the other NEOs and (ii) the company’s net income;

- the relationships between (i) (A) the compensation “actually paid” to the PEO and (B) the compensation “actually paid,” on average, to the other NEOs and (ii) the Company-Selected Measure (non-SRCs only);

- if the company elects to voluntarily include any additional performance measure(s) in the table, the relationships between (i) (A) the compensation “actually paid” to the PEO and (B) the compensation “actually paid,” on average, to the other NEOs and (ii) such additional performance measure(s); and

- the relationship between (i) cumulative TSR of the company and (ii) cumulative TSR of the company’s peer group (non-SRCs only).

SRCs are only required to present such clear descriptions with respect to the measures they are required to include in the table (i.e., net income and company TSR) and for their three, rather than five, most recently completed fiscal years.

Is there a prescribed format for the required relationship disclosures?

Companies may apply a wide range of formats when describing these relationships, whether a narrative discussion, a graphical presentation or a combination of the two.[11] Companies also have the flexibility to decide whether to group any of these relationship disclosures together, provided any combined description of multiple relationships is “clear.”

Tabular List of “Most Important” Performance Measures

What is the “Tabular List” and how is it determined?

Companies that are not SRCs are required to provide a separate tabular list of at least three, but not more than seven, of their “most important” financial performance measures used to link NEO compensation “actually paid” to company performance for the most recently completed fiscal year. The Tabular List is not required to be ranked in order of importance. If the company uses fewer than three financial performance measures, this disclosure would be limited to the lesser number of financial performance measures actually used.

As in the case of the Company-Selected Measure, the determination of “most important” is made with reference only to the most recently completed fiscal year (as opposed to the prior five fiscal years). As a result, the performance measures included in the Tabular List could change from one filing to the next.

The Tabular List may include net income and company and peer-group TSR (if applicable), and must include the Company-Selected Measure reported in the pay-versus-performance table. (Note, however, that although the Tabular List may include non-financial performance measures, as discussed below, the Company-Selected Measure must be a financial performance measure chosen from this list).

As with the Company-Selected Measure, a financial performance measure need not be presented within the company’s financial statements or otherwise included in the company’s SEC filings to be included in the Tabular List.

Companies that do not use any financial performance measures to link NEO compensation “actually paid” to company performance would not be required to present a Tabular List.

May non-financial performance measures be included in the Tabular List?

Non-financial performance measures[12] (including ESG metrics) may (but are not required to) be included in the Tabular List if such measures are among the company’s three to seven “most important” performance measures, provided at least three financial performance measures (or fewer, if the company only uses fewer) are also disclosed in the Tabular List.

The Tabular List must not exceed seven performance measures, regardless of whether the company elects to include non-financial performance measures.

Must the methodology for calculating the performance measures included in the Tabular List be disclosed?

As with the Company-Selected Measure, companies are not required to disclose the methodology used to calculate the performance measures included in the Tabular List, although the SEC advises companies to “consider if such disclosure would be helpful to investors to understand the measures included in the Tabular List, or necessary to prevent the Tabular List disclosure from being confusing or misleading.” Companies must describe how they derive any non-GAAP financial metrics included in the Tabular List from their audited financial statements (but need not provide a full GAAP reconciliation). In addition, companies may cross-reference to other disclosures, if any, elsewhere in the proxy statement (such as in the CD&A) that describe their processes and calculations that go into determining NEO compensation as it relates to the performance measures included in the Tabular List.

Is there a prescribed format for the Tabular List?

Companies may present the Tabular List disclosure in one of three different formats: (i) as a single list covering all NEOs; (ii) as two separate lists, one for the PEO and one for all NEOs other than the PEO; or (iii) as separate lists for the PEO and each non-PEO NEO. Companies electing to provide multiple tabular lists must disclose at least three (or fewer, if the company only uses fewer), but not more than seven, financial performance measures in each list, and may include non-financial performance measures in such lists if such measures are among their “most important” performance measures.

Voluntary Supplemental Disclosure

Are companies permitted to provide supplemental pay-versus-performance disclosure?

Companies may voluntarily supplement their mandatory pay-versus-performance disclosure with additional or alternative measures of compensation (e.g., realized or realizable pay) or performance (financial or non-financial) and additional fiscal years of data (in the table or elsewhere), or other supplemental disclosures, if they deem them to be helpful to explaining the correlation of their pay with performance, so long as any additional disclosures are clearly identified as supplemental, not misleading and not presented with greater prominence than, or do not otherwise obscure, the required disclosure.[13]

In addition, the SEC notes that companies will continue to have significant latitude in presenting additional compensation explanations and analyses (such as in their CD&A), in order to add context or clarify their unique circumstances and considerations in designing compensation.

Inline XBRL

What are the Inline XBRL tagging requirements for the new pay-versus-performance disclosure?

Companies are required to use Inline XBRL to separately tag each value disclosed in the pay-versus-performance table, block-text tag the footnote and relationship disclosures and the Tabular List, and tag specific data points (such as quantitative amounts) within the footnote disclosures. The tagging requirement will be phased-in for SRCs as discussed below.

SRC Scaled Disclosure Accommodations

What relief is available to smaller reporting companies?

Companies that qualify as SRCs are subject to scaled pay-versus-performance reporting requirements, consistent with the scaled-disclosure approach generally applicable to SRCs under the SEC’s executive compensation rules. Specifically, relative to non-SRCs:

- They are required to provide only two (rather than three) fiscal years of pay-versus-performance disclosure in their first applicable proxy filing, and only three (rather than five) fiscal years of disclosure in subsequent proxy filings.

- They are required to provide disclosure about fewer NEOs.

- They are not required to present a peer-group TSR or a Company-Selected Measure in the pay-versus-performance table (or provide any narrative and/or graphical relationship disclosures with respect to those performance measures), or a Tabular List.

- They are not required to adjust for pension amounts in the calculation of executive compensation “actually paid.”

- They are not required to comply with the XBRL data-tagging requirements until the third filing in which they provide pay-versus-performance disclosure, instead of the first.

WHAT COMPANIES CAN DO NOW TO PREPARE

In light of the short lead-time to comply with the expansive new disclosure requirements, companies may want to consider taking the following actions now to avoid any delay in filing their 2023 proxy statements:

- Review the new requirements and their potential implications with the company’s compensation committee, full board, senior management team, compensation consultant, outside counsel and other relevant advisors such as auditors and equity valuation specialists. Implementing the new disclosures will be a time- and labor-intensive process, requiring a coordinated effort by numerous parties.

- Establish a process and timeline for collecting, reviewing and approving the necessary data; reassess the company’s disclosure controls and procedures and consider whether any enhancements are needed in light of the new disclosure requirements.

- Prepare a mock-up of the disclosures required by the final rules, including the new pay-versus-performance table and accompanying relationship disclosures; determine the most effective format for the required relationship disclosures (a narrative discussion, graphical presentation or combination of both), viewing them through an investor lens.

- Calculate compensation “actually paid” for applicable prior years (including year-end and vesting-date fair values and pension service cost), bearing in mind that the equity award adjustments deviate significantly from common practices for reporting equity awards in the SCT and will require new calculations that were not previously required, that many companies historically have not performed and that may be complex, burdensome and involve significant effort.

- Determine the company peer group to be used in calculating peer-group cumulative TSR that must be disclosed in the table (either the peer group used for the stock performance graph or the peer group identified in the CD&A).

- Start thinking about which performance measures (both financial and non-financial) the company considers to be “most important” for inclusion in the Tabular List and the identification of the single “most important” financial performance metric from this list to designate as the Company-Selected Measure for inclusion in the table, remembering these measures should be focused on the most recently completed fiscal year.

- Consider whether to supplement the mandatory pay-versus performance disclosure with additional or alternative measures of compensation or performance, additional fiscal years of data or other supplemental disclosures if helpful to explaining how pay relates to performance.

- Pay special attention to the location of the new disclosures within the proxy statement; ensure the new disclosures are consistent with any existing pay-versus-performance disclosures and other information disclosed in the CD&A, and evaluate whether any changes may be necessary to the CD&A.

- Evaluate the potential impact of the new disclosures on how proxy advisory firms, institutional investors, shareholder activists and financial analysts view the company. Proxy advisors and investors are likely to use these disclosures to inform their say-on-pay recommendations and voting and engagement strategies, and activists may use this information against companies in proxy fights and “vote no” campaigns.

RELATED MATERIALS

[1] A company generally qualifies as a smaller reporting company if (i) it has a public float (the aggregate market value of the company’s outstanding voting and non-voting common equity held by non-affiliates) of less than $250 million; or (ii) it has annual revenues of less than $100 million and either (a) no public float (because it has no public equity outstanding or no public trading market for its equity exists) or (b) a public float of less than $700 million. For more information, see the SEC’s Small Entity Compliance Guide for Issuers available here.

[2] Pay-versus-performance disclosures are required about the NEOs for whom executive compensation disclosure is required under Item 402(a)(3) of Regulation S-K for companies other than SRCs, and under Item 402(m)(2) for SRCs.

[3] For example, the 2023 proxy statement for a calendar-year-end non-SRC will include disclosure for 2022, 2021 and 2020; the 2024 proxy statement will include disclosure for 2023, 2022, 2021 and 2020; and the 2025 proxy statement will include disclosure for 2024, 2023, 2022, 2021 and 2020.

[4] For example, the 2023 proxy statement for a calendar-year-end SRC will include disclosure for 2022 and 2021; the 2024 proxy statement will include disclosure for 2023, 2022 and 2021; and the 2025 proxy statement will include disclosure for 2024, 2023 and 2022.

[5] For example, a company that completed an IPO and became a reporting company in 2022 would be required to provide disclosure only for 2022 (for the period following the IPO date) in its first proxy statement filed in 2023. In its 2024 proxy statement, the company would be required to provide the disclosure only for 2023 and 2022, with an additional fiscal year of disclosure included in each subsequent proxy filing until five fiscal years of disclosure (three fiscal years for SRCs) are provided. This is consistent with the phase-in period for new reporting companies in their SCT disclosure.

[6] The final rules do not provide further guidance on when an equity award would be considered “vested” for purposes of this disclosure.

[7] If the change in actuarial value of pension plans is not positive, it is not currently reflected in the SCT total compensation amount and therefore need not be deducted for purposes of this adjustment.

[8] Cumulative TSR is calculated as the sum of (1) the cumulative amount of dividends for the measurement period (assuming dividend reinvestment) and (2) the difference between the company’s stock price at the end and the beginning of the measurement period; divided by the stock price at the beginning of the measurement period.

[9] For purposes of the pay-versus-performance disclosure, “financial performance measures” means measures that are determined and presented in accordance with the accounting principles used in preparing the company’s financial statements, any measures that are derived wholly or in part from such measures, and stock price and TSR. A financial performance measure need not be presented within the company’s financial statements or otherwise included in the company’s SEC filings to be the Company-Selected Measure, or to be included in the Tabular List (as described below).

[10] The adopting release notes that, in situations where companies elect to describe multiple measures because they believe multiple measures are equally the “most important,” they would still be required to select one Company-Selected Measure, but could provide explanatory disclosure, for example, about why they included the additional measures and the reason they chose the Company-Selected Measure.

[11] The SEC encourages companies to present the required relationship disclosures “in the format that most clearly provides information to investors about the relationships, based on the nature of each measure and how it is associated with executive compensation actually paid.” The adopting release provides the following two non-exclusive examples: (i) “a graph providing executive compensation actually paid and change in the financial performance measure(s) (TSR, net income or Company-Selected Measure) on parallel axes and plotting compensation and such measure(s) over the required time period” and (ii) “narrative or tabular disclosure showing the percentage change over each year of the required time period in both executive compensation actually paid and the financial performance measure(s) together with a brief discussion of how those changes are related.”

[12] “Non-financial performance measures” are performance measures other than those that fall within the definition of “financial performance measures,” which, for purposes of the pay-versus-performance disclosure, are measures that are determined and presented in accordance with the accounting principles used in preparing the company’s financial statements, any measures that are derived wholly or in part from such measures, and stock price and TSR.

[13] The adopting release advises companies that are already providing voluntary pay-versus-performance disclosure in their proxy statements to consider whether retaining their existing disclosure would be duplicative of the information required by the final rules and, if so, how they might mitigate any such duplication (e.g. by removing, revising or relocating the existing disclosure). In addition, the SEC cautions that the placement and presentation of any legacy disclosures should not obscure the required disclosure, place the required disclosure in a less prominent position, or otherwise mislead or confuse investors.

Featured Insights

Featured Insights

Client News