‘Are Shareholders Getting Their Money’s Worth?’ SEC Revives Proposal to Require ‘Pay-Versus-Performance’ Proxy Disclosures

Significant Expansion of Original 2015 Proposal Would Mandate Disclosure of Additional Financial Performance Measures Beyond Total Shareholder Return

KEY TAKEAWAYS

- The Securities and Exchange Commission (“SEC” or “Commission”) has reopened a 30-day public comment period, until March 4, on a 2015 proposal to require companies to disclose in their proxy statements the relationship between the compensation they pay executives and their financial performance for up to five years.

- Questions the Commission posed in reviving the pay-versus-performance proposal suggest that any final rule may be more expansive than originally proposed, potentially requiring companies to disclose additional financial performance measures beyond total shareholder return (“TSR”) and peer group TSR, including pre-tax net income, net income, a company-specific measure that represents their most important performance measure as well as a list of their five most important performance measures, ranked in order of importance.

- A final SEC rule may be adopted later this year and could become effective in time for the 2023 proxy season.

- Companies and their compensation committees can begin preparing now for the potential new disclosure requirements, which will increase the length and complexity of existing compensation disclosures, along with investor and regulatory scrutiny. Please engage with Gunderson Dettmer’s public companies team to discuss how we can help.

OVERVIEW

Late last month, the SEC kicked off its ambitious rulemaking agenda for 2022 by reopening the public comment period on its long-dormant rule proposal that would require public companies (excluding emerging growth companies and foreign private issuers) to disclose, in both tabular and narrative format, the relationship between the compensation they pay executives and their financial performance for up to five years in proxy or information statements in which executive compensation disclosures are required. Scaled disclosure accommodations would be available to smaller reporting companies (“SRCs”).[1]

The so-called pay-versus-performance disclosure requirements, mandated by Section 953(a) of the Dodd-Frank Act in the aftermath of the 2008 financial crisis, were first proposed and opened to public comment in 2015 but never adopted. Early in his tenure, SEC Chair Gary Gensler publicly committed to finalizing the Commission’s unfinished Dodd-Frank rulemaking responsibilities, including the pay-versus-performance rule and another executive compensation-related initiative on “clawbacks,” which requires the Commission to direct the U.S. stock exchanges to establish listing standards requiring listed companies to adopt, comply with and provide disclosure about a compensation recovery policy applicable to incentive-based compensation received by current and former executive officers in the event of certain financial restatements. The comment period for the clawback rule proposal, also stalled since 2015, was similarly reopened last October, when the SEC signaled it was considering broadening the rule. Comments were due by late November, and the SEC is now actively reviewing the feedback received; adoption of a final clawback rule is expected later this year (see our previous client memo here). Additionally, the SEC last fall advanced another long-delayed Dodd-Frank mandate that would require institutional investment managers to disclose, for the first time, their proxy votes related to executive compensation matters.

The original pay-versus-performance proposal relied on cumulative TSR as the sole measure of company financial performance against which to assess compensation. The SEC said it chose the TSR metric for its comparability across companies, noting that it is consistently calculated, objectively determinable and already required to be determined and disclosed by companies elsewhere in their SEC filings and thus familiar to shareholders. Some commenters expressed concerns, however, that using only TSR could mislead investors or provide an incomplete picture of performance. Chair Gensler said that reopening the comment period would allow the Commission to consider if disclosure of “additional performance metrics would better reflect Congress’s intention in the Dodd-Frank Act and would provide shareholders with information they need to evaluate a company’s executive compensation policies.”

Specifically, the SEC is now weighing whether to significantly expand the original rule proposal to require tabular disclosure of the following three financial performance measures, in addition to TSR and peer group TSR:

- pre-tax net income;

- net income; and

- a measure chosen by the company that it believes represents the “most important” performance measure (that is not already included in the table) it uses to link executive compensation actually paid to company performance, over the time horizon of the disclosure (“Company-Selected Measure”) (if the company did not use any measures other than those already included in the table, it would indicate that fact in its disclosure).

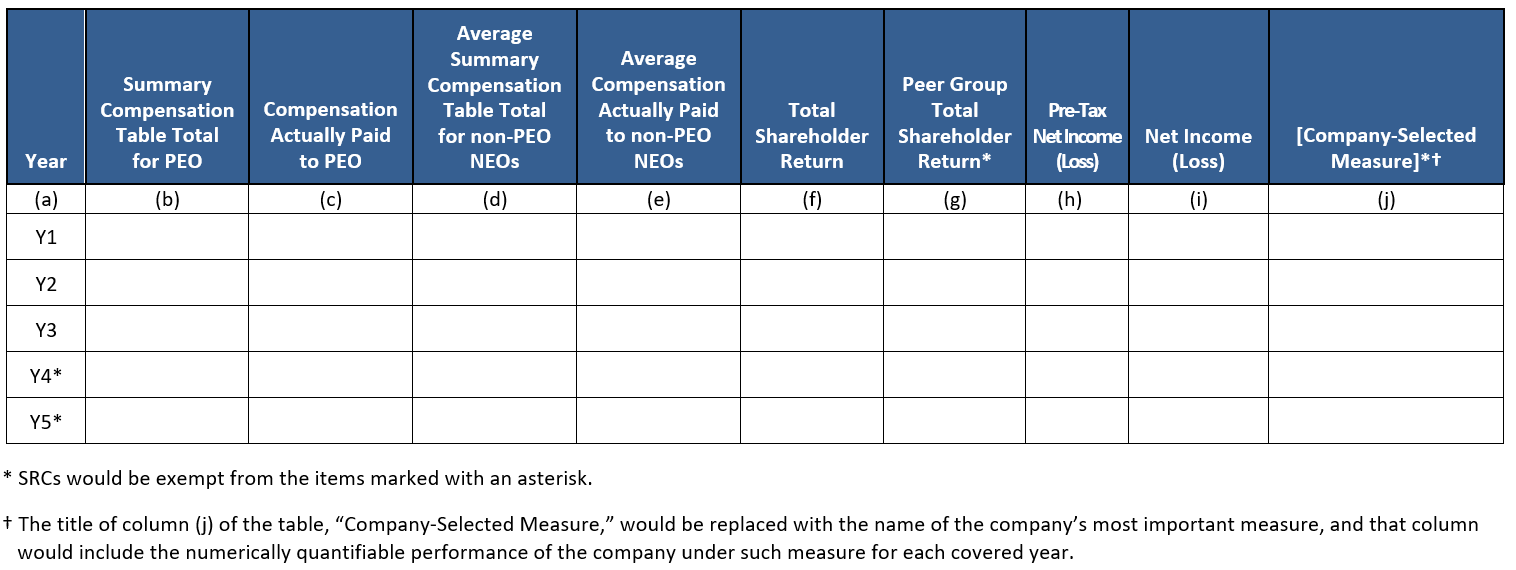

The three new measures would be disclosed in additional columns to the table described in the original rule proposal and shown below:

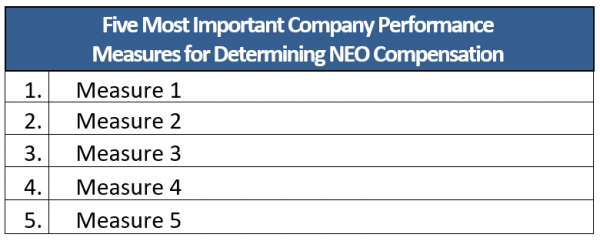

In addition to the Company-Selected Measure, the SEC is deliberating whether to separately require, for companies other than SRCs, a tabular list of the company’s five most important performance measures it uses to link executive compensation actually paid to company performance, over the time horizon of the disclosure, in order of importance (if the company considers fewer than five performance measures, this disclosure would be limited to the lesser number of measures actually considered).

Companies could cross-reference to existing disclosures elsewhere in the disclosure document (such as in the Compensation Discussion and Analysis (“CD&A”)) that describe the various processes and calculations that go into determining executive compensation as it relates to these additional company-specific performance measures.

The proposed format for the tabular list is shown below:

The Commission is also reconsidering whether the scaled disclosure accommodations for SRCs included in the original rule proposal and the additional measures under consideration, such as reduced reporting periods and omission of peer group TSR, the Company-Selected Measure and the list of the five most important performance measures, should be retained or recalibrated in the final rule.

The continued evolution of executive compensation practices since the pay-versus-performance rule was initially proposed over six years ago provided an impetus for the SEC to reopen the comment file, including the rise of environmental, social and governance (“ESG”)-linked executive pay and changes to executive pay practices spurred by the pandemic. One of the SEC commissioners pointed to the widening gap between pay for executives and the broader workforce. The reopening release also cites the growing prevalence of performance-contingent share plans and declining use of stock options to compensate CEOs among S&P 500 and Russell 3000 companies, as well as a decrease over the last several years in the use of TSR as the sole performance metric in long-term incentive plans, and the recent use by some companies of TSR as a modifier to results initially determined by one or more other financial metrics.

Chair Gensler said he believes the rule proposal, if adopted, “would strengthen the transparency and quality of executive compensation disclosure” and “make it easier for shareholders to assess the company’s decision-making with respect to its executive compensation policies.” In the words of Commissioner Allison Herren Lee, the proposed disclosures seek to address a question central to good corporate governance: “[A]re shareholders getting their money’s worth?” Dissenting Commissioner Hester Peirce, on the other hand, stated that mandatory disclosure of additional performance measures beyond TSR “would increase the burdens of public company reporting, but seem likely to be of dubious use to investors.”

The SEC is seeking comment from the public on all aspects of the original 2015 proposal, as well as on the potential expanded disclosures discussed in the reopening release, by March 4. A final rule could be adopted in the coming months and become effective in time for the 2023 proxy season.

In anticipation of final SEC rulemaking, companies and their compensation committees may wish to carefully review the performance metrics used in their incentive compensation programs and discuss internally and with counsel what their disclosures might look like if the proposed rule, including the more expansive disclosure mandates contemplated in the reopened proposal, is adopted. The potential new disclosure requirements outlined in both the original rule proposal and the reopening release will increase the length and complexity of existing compensation disclosures, along with investor and regulatory scrutiny. If you have questions or would like assistance, please contact the Gunderson Dettmer attorney with whom you regularly work or a member of the firm’s public companies team.

RULE SUMMARY

A summary of key aspects of the original rule proposal follows, including a discussion of the additional disclosures the SEC is contemplating during the reopened comment period and selected related requests for comment.

Which companies are subject to the proposed rule?

Reporting companies other than emerging growth companies and foreign private issuers are subject to the proposed rule, including SRCs, though only on a scaled basis. The proposal limits the time period of the required disclosures and provides certain other relief to SRCs as discussed below.

Which SEC filings are affected?

The proposed rule requires companies to include pay-versus-performance disclosures in proxy statements for annual or special shareholder meetings on Schedule 14A and information statements on Schedule 14C in which executive compensation disclosures under Item 402 of Regulation S-K are required. The disclosures will be required by a new Item 402(v) of Regulation S-K, and be subject to the say-on-pay advisory vote. While the disclosures will be considered “filed” for purposes of liability under the Securities Exchange Act of 1934 (“Exchange Act”), they will not be deemed to be incorporated by reference into filings under the Securities Act of 1933 (e.g., Form S-1) or other Exchange Act filings (e.g., Form 10-K), except to the extent a company specifically incorporates them by reference.

What information are companies required to disclose?

Companies are required to disclose the following information in tabular format for up to five years:

- compensation “actually paid” to the principal executive officer (“PEO”) and an average of the compensation “actually paid” to the other named executive officers (“NEOs”).[2] Compensation “actually paid” is based on total compensation already reported in the Summary Compensation Table in the proxy statement, with certain adjustments to the amounts disclosed for equity awards and pension benefits discussed below;

- total executive compensation reported in the Summary Compensation Table for the PEO and an average for the remaining NEOs; and

- cumulative TSR of the company and (for companies other than SRCs) its selected peer group.

In addition, following the table, companies are required to provide a clear description of (1) the relationship between executive compensation actually paid and the company’s TSR and (2) for companies other than SRCs, the relationship between the company’s TSR and the TSR of its selected peer group, which relationships may be described narratively, graphically or a combination of the two.[3]

The SEC explained that it proposed to require companies to provide the pay-versus-performance disclosure for NEOs other than the PEO as an average, rather than in the aggregate (i.e., the sum of all other NEOs’ compensation) or on an individual basis for each NEO, in order to enhance comparability from year to year given the potential for significant variability in the composition and number of non-PEO NEOs over the time horizon of the disclosure.

In instances where a company had more than one PEO in a given year, the amounts for each PEO are required to be added together.

Proposed Disclosure of Additional Financial Performance Measures As noted above, the SEC is now weighing whether to significantly expand the original rule proposal to require tabular disclosure of the following financial performance measures, in addition to TSR and peer group TSR:

Companies would also be required to provide a clear description of the relationship between executive compensation actually paid and each of pre-tax net income, net income, and the Company-Selected Measure in narrative and/or graphic form. The SEC believes the additional detail and context provided by each of the suggested new measures may broaden the picture of financial performance presented in the disclosure and enhance its usefulness. Pre-Tax Net Income and Net Income Pre-tax net income and net income are GAAP measures generally reported on the financial statements that the SEC believes “are additional important measures of company financial performance that may be relevant to investors in evaluating executive compensation.” The SEC notes their inclusion could complement presentation of market-based TSR by also providing accounting-based measures of financial performance and may lower the burden of analysis for investors. The SEC specifically requests comment on:

Company-Selected Measure The SEC suggests the Company-Selected Measure could elicit “additional useful disclosure” while reducing the risk, previously raised by commenters, of misrepresentation that could result from application of a “one-size-fits-all” benchmark across all companies. The SEC specifically seeks feedback on:

Five Most Important Performance Measures The SEC notes that tabular disclosure of the five most important performance measures “may enable investors to more easily assess which performance metrics actually have the most impact on compensation actually paid and make their own judgments as to whether compensation appropriately incentivizes management.” This disclosure is also intended to “provide investors with context that could be useful in interpreting the remainder of the pay-versus-performance disclosure,” and may help address concerns that exclusive reliance on TSR could mislead investors or provide an incomplete picture of performance. Specific comment requests include:

|

What if a company does not currently use performance measures as part of its executive compensation program design or awards?

The proposed pay-versus-performance disclosure is intended to enhance comparability and usefulness by requiring standardized measures of compensation and performance that are consistent across companies, thereby facilitating shareholders’ evaluation of the optimality of companies’ pay-versus-performance alignment, and of directors’ oversight of this area, relative to their peers when making related voting decisions. (The SEC, notes, for example, that CD&A disclosures that may provide more direct measures of the historical pay-versus-performance relationship are subject to considerable variation and lack standardization and comparability.) Accordingly, while companies that do not currently use performance measures in their executive compensation packages would not have to disclose a Company-Selected Measure or a tabular list of their five most important performance measures, they would still be required to disclose TSR, peer group TSR (for non-SRCs), pre-tax net income and net income in the table shown above and to present a narrative and/or graphic description of the relationship between the prescribed pay and performance measures.

The SEC believes that the need for uniform and comparable disclosure across companies in order to increase its usefulness to shareholders is balanced by the flexibility it affords companies to describe their pay-versus-performance relationship in a format that is best suited to their particular facts and circumstances and to present additional, alternative measures of compensation and performance and additional years of data at their discretion, as discussed below. The SEC further notes that companies will continue to have significant latitude in presenting additional compensation analyses such as in their CD&A.

How is compensation “actually paid” calculated?

In order to encourage consistency and comparability across companies, the proposed rule introduces a new definition of compensation “actually paid,” which equals total compensation as reported in the Summary Compensation Table with the following adjustments:

- Equity awards. Companies must include the fair value of equity awards on the date of vesting rather than on the date of grant (as is required in the Summary Compensation Table);[4] and

- Pension benefits. Companies must adjust pension amounts by deducting the change in actuarial present value of pension benefits reflected in the Summary Compensation Table and adding back the actuarially determined service cost for services rendered by the executive during a given year.[5]

Companies must disclose in the footnotes to the table the individual adjustments to the amounts reported in the Summary Compensation Table to arrive at executive compensation actually paid. For NEOs other than the PEO, those adjustments must be disclosed as averages. Companies must also disclose in the footnotes the vesting date valuation assumptions if they are materially different from those disclosed in their financial statements as of the grant date.

How are a company’s TSR and peer group determined?

A company’s TSR is determined in the same manner and over the same time period as is required for stock performance graphs by Item 201(e) of Regulation S-K. That is, TSR is calculated as the sum of (1) cumulative dividends (assuming dividend reinvestment) and (2) the increase or decrease in the company’s stock price for the year; divided by the share price at the beginning of the year.

Companies have the option of choosing the same peer group (i) used for their Item 201(e) stock performance graph (a published industry or line-of-business index, peer companies selected in good faith or companies with similar market capitalization, if certain criteria are met) or (ii) if applicable, reported in their CD&A for purposes of disclosing the company’s compensation benchmarking practices. If the peer group is not a published industry or line-of-business index, the composition of the peer group must be disclosed or incorporated by reference from prior filings.

SRCs are not required to present a peer group TSR because they are not required to disclose an Item 201(e) stock performance graph or a CD&A.

Is there a prescribed format for the proposed disclosures?

The amount of compensation actually paid, the total compensation and the TSR of the company and its peers, as well as the proposed additional performance measures discussed in the reopened proposal, are required to be presented in a new standardized table, the proposed template for which appears above.

The description of the relationships between (1) executive compensation actually paid and company TSR (and the proposed new performance measures) and (2) for companies other than SRCs, company TSR and peer group TSR must follow the table and may be presented narratively and/or graphically. Companies may apply a wide range of formats when discussing the relationship; the proposed rule does not prescribe a uniform format or any minimum presentation requirements.

Companies are permitted to voluntarily supplement the required disclosure with alternative pay measures (e.g., realized pay, realizable pay) that provide useful information about the relationship between compensation and performance, as well as supplemental measures of financial performance and additional years of data, or other supplemental disclosures, provided that any supplementary disclosures are clearly identified, not misleading and not presented with greater prominence than the required disclosure.

As originally proposed, companies are required to use XBRL to tag separately the numerical data disclosed in the required table, and to separately block-text tag, as three blocks, the disclosure of the relationship among the measures, the footnote disclosure of deductions and additions used to determine executive compensation actually paid and the footnote disclosure regarding vesting date valuation assumptions. The tagging requirement will be phased-in for SRCs as discussed below. The SEC is now reviewing whether to require companies to also tag specific data points (such as quantitative amounts) within the footnote disclosures that would be block-text tagged, as well as to use Inline XBRL (rather than XBRL) to tag these disclosures (which would align the rule with the Inline XBRL tagging requirements for company financial statements).

Is there a prescribed location for the proposed disclosures?

The proposed rule does not specify the location of the pay-versus-performance disclosures in the proxy or information statement. The disclosures may be included in the CD&A when the performance measures being disclosed were considered in compensation decisions. If the disclosed measures were not considered in compensation decisions, or if the company is not required to present a CD&A, the SEC expects the pay-versus-performance disclosures to be included with the other executive compensation disclosures called for by Item 402.

What relief is available to smaller reporting companies?

The proposed rule provides the following scaled disclosure accommodations for SRCs:

- Consistent with the transition period outlined below, they are required to provide only two (instead of three) years of disclosures in their first filings and only three (instead of five) years of disclosures in subsequent filings.

- They are not required to present a peer group TSR, Company-Selected Measure or list of the five most important performance measures.

- They are not required to adjust for amounts related to pension plans for purposes of determining and disclosing executive compensation actually paid.

- They are not required to comply with the XBRL data-tagging requirements until the third filing in which they provide pay-versus-performance disclosures.

Reconsideration of Relief for SRCs and Selected Related Requests for Comment The reopening release explains that as a result of the 2018 expansion of the definition of smaller reporting company, SRCs today would account for about 45% of all companies subject to the proposed rule (up from approximately 40% when the original 2015 proposal was published), and thus nearly half of all reporting companies would be exempt from certain of the proposed disclosure requirements. In light of this increase, the Commission is reconsidering whether the scaled disclosure accommodations for SRCs included in the original rule proposal and the additional measures under consideration, such as reduced reporting periods and omission of peer group TSR, the Company-Selected Measure and the list of the five most important performance measures, should be retained or recalibrated in the final rule. The SEC invites input on:

|

Is there a transition period for compliance with the proposed rule?

The proposed rule provides a phase-in for all companies.

The pay-versus-performance disclosures are required for the five most recently completed years (three years for SRCs) even though the Summary Compensation Table under Item 402(c) of Regulation S-K requires compensation information for only three years (two years for SRCs). The SEC noted in the proposing release that requiring a longer period of time would allow investors to observe trends in the relationship between executive compensation actually paid and financial performance.

In their first filings, however, all companies except for SRCs are required to provide the disclosures for only three years. They could add information for each additional year in their second and third filings. As noted above, SRCs are required to provide only two years of disclosures in their first filings and three years of disclosures in subsequent filings.

Newly public companies that are not emerging growth companies (which are exempted from the proposed rule) are required to provide the pay-versus-performance disclosures only for the most recently completed year in their first year as a reporting company and only for the two most recently completed years in their second year as a reporting company, which is consistent with the phase-in period for new reporting companies in their Summary Compensation Table disclosure.

Other Topics for Public Comment Notable additional matters the SEC could address in the final rule, as reflected in its requests for comment in the reopening release, include:

|

RELATED MATERIALS

[1] A company generally qualifies as a smaller reporting company if (i) it has a public float (the aggregate market value of the company’s outstanding voting and non-voting common equity held by non-affiliates) of less than $250 million; or (ii) it has annual revenues of less than $100 million and either (a) no public float (because it has no public equity outstanding or no public trading market for its equity exists) or (b) a public float of less than $700 million. For more information, see the SEC’s Small Entity Compliance Guide for Issuers available here.

[2] The proposed rule requires pay-versus-performance disclosure about the NEOs for whom disclosure is required under Item 402(a)(3) of Regulation S-K for companies other than SRCs, and under Item 402(m)(2) for SRCs.

[3] The proposing release provides the following two non-exclusive examples of disclosure about the relationship: “a graph providing executive compensation actually paid and change in TSR on parallel axes and plotting compensation and TSR over the required time period” and “showing the percentage change over each year of the required time period in both executive compensation actually paid and TSR together with a brief discussion of that relationship.”

[4] The proposing release notes that “[u]sing vesting-date valuations would result in a compensation measure that includes, upon the vesting date, the grant date value of equity awards plus or minus any change in the value of equity awards between the grant and vesting date…[S]uch changes in the value of equity awards after the grant date represent a direct channel, and one of the primary means, through which pay is linked to registrant performance. We therefore believe that it is important that such changes in the value of equity awards be reflected in the pay-versus-performance disclosure.”

[5] The proposing release explains that executive compensation actually paid is intended to “include only the actuarial present value of benefits attributable to services rendered during the applicable fiscal year. That is, the measure would exclude that part of the change in actuarial pension value that results from any change in the actuarial value of benefits accrued in previous years, and should thus increase the comparability between compensation provided through defined benefit and defined contribution plans. This adjustment is also expected to reduce the volatility in measured pension compensation caused by changes in interest rates and other actuarial assumptions, and should thus make it easier to evaluate the relationship of pay-versus-performance.” SRCs are not required to make this adjustment because they are subject to scaled compensation disclosure that does not include pension plans.

Featured Insights

Featured Insights

Client News