Latin America

Since 2006, Gunderson Dettmer has supported entrepreneurship and venture capital investment in Latin America and is proud to have played an important role with many of the region’s most impactful companies and transactions. Our Latin America team has a thriving practice representing hundreds of the region’s most innovative high-growth companies and dozens of the leading investors in Latin America. We have handled more than 650 transactions for clients in the region since 2017.

Learn More

Latin America

Since 2006, Gunderson Dettmer has supported entrepreneurship and venture capital investment in Latin America and is proud to have played an important role with many of the region’s most impactful companies and transactions. Our Latin America team has a thriving practice representing hundreds of the region’s most innovative high-growth companies and dozens of the leading investors in Latin America. We have handled more than 650 transactions for clients in the region since 2017.

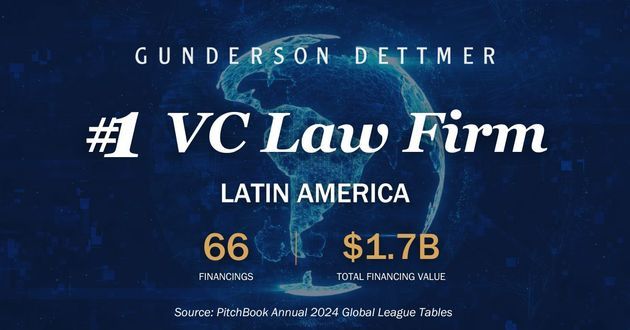

Gunderson Dettmer is known for its extensive experience negotiating financing transactions for emerging companies and their investors. Our Latin America practice is no different, and we handle more venture financings in the region than any other law firm in the world. According to Pitchbook, we routinely represent companies or investors in more financings in Latin America than any other law firm. We have represented companies in more than $3.8 billion in mergers and acquisitions transactions in Latin America since 2014, including the acquisition of 99 Taxis by Didi in 2018, the acquisition of Vivareal by OLX Brasil in 2020, the acquisition of Cornershop by Uber in 2020, the acquisition Elo7 by Etsy in 2021, and the acquisition of Neoway by B3 in 2021, and the acquisition of Technisys by SoFi in 2022.

Highlights

Gunderson Dettmer "holds a major market share of venture financings in Latin America and has an impressive record in M&A."

- Advised Brazil-based fintech isaac on its acquisition by Arco.

- Advised Brazil-based client Solfácil on its $100m Series C financing, led by QED and with participation by the Softbank Group, VEF and Valor Capital.

- Advised Brazil-based online accounting platform, Contabilizei, on its $63.2m Series C financing led by SoftBank.

Webinar

What Latin American Venture-Backed Companies Need to Know about U.S. Tax

Gunderson Dettmer hosted the What Latin American Venture-Backed Companies Need to Know about U.S. Tax webinar. Partners Jace Clegg, Christel Moreno and Adan Muller presented the common U.S. tax provisions in venture financing agreements, how they are negotiated with investors, and how they impact companies after the financing.

Webinar

How the SEC’s Private Fund Adviser Rules and Other Recent Developments Will Affect VCs in LatAm

Partners Brian Hutchings and Ben Buckwalter discuss new rules that govern how funds use and disclose side letters, handle potential conflicts of interest, report to their investors, as well as other activities that are most directly relevant to fund managers focused on the Latin America region.