David He

David is a partner focused on start-ups and venture capital.

David works closely with venture funds, startups and technology companies on a variety of matters, including cross-border equity and debt financings, mergers and acquisitions, corporate restructurings, and corporate governance. He has advised on hundreds of venture-backed deals and has led negotiations involving parties based in the U.S., India, China, Middle East, Africa, Australia and all across Southeast Asia.

David has been recognized by The Legal 500 as a “Next Generation Partner” in the Start-Up and Venture Capital - Foreign Firms in Singapore category. He is recognized by Chambers and Partners and named by the India Business Law Journal’s A-List as one of the top 100 India-focused lawyers at international law firms. David was also listed as one of Asia’s 40 Under 40 Lawyers for 2022 by Asian Legal Business, a Thomson Reuters publication, which recognizes the top young lawyers from international and domestic firms across Greater China, South Korea, Japan, Southeast Asia and India. Most recently, David was featured as a guest on the BRAVE Southeast Asia Tech Podcast.

David serves as outside counsel and has represented a number of startups based in APAC, India, MENA and the UK in their venture financings, M&A and general corporate matters, including: abillion (Singapore), Alerzo (Nigeria), Appsmith (India), AyoConnect (Indonesia), Believe Beauty (Saudi Arabia), Brik.id (Indonesia), Dachin (Indonesia), ErudiFi (Singapore), Fastcargo Logistics (Philippines), Gallabox (India), Globaleur (South Korea), Jago (Indonesia), Khatabook (India), Koppiku (Malaysia), Loop Health (India), Love Bonito (Singapore), MobiusCarbon (UK), PayMongo (Philippines), PickUp Coffee (Philippines), RevSure.ai (India), SaaS Labs (India), Salmon (UAE), SirionLabs (India), Terminal Africa (Nigeria), Terrascope (Singapore), TurtleTree Labs (Singapore), Travtus (UK) and Yellow.ai (India).

David also regularly acts as counsel to venture capital and growth equity investors based all over the world, including: Addition, AI Fund, Asia Partners, Goodwater Capital, Greenoaks Capital, Lightspeed India and Lightspeed US, Lone Pine Capital, Matrix Partners, Monk’s Hill Ventures, Peak XV, Prosus Ventures, Rocketship, Softbank Ventures Asia, Spark Capital, SIG, Tanglin Venture Partners, Tiger Global, TNB Aura, Valar Ventures, Vertex Ventures and Wavemaker.

Previously, David practiced in the Silicon Valley office of Fenwick & West and the New York office of Davis Polk & Wardwell. David received his J.D. from Columbia Law School, where he served as the Chief Articles Editor of the Columbia Business Law Review. He received his B.S. in Applied Economics and Management from Cornell University.

David has passed the Level I examination of the Chartered Financial Analyst (CFA) program. He is a fluent Mandarin speaker and is a member of the State Bars of California and New York.

Podcast

Choose Your Startup Lawyer

Jeremy Au, venture capitalist and serial founder, speaks with Singapore Partner David He about his startup law partnership journey, the importance of selecting a good startup lawyer, how crucial the initial months of the lawyer-founder relationship are, as well as the significance of establishing strong legal foundations for startups.

Publication

Chambers and Partners Global Practice Guide 2024: Venture Capital (Singapore Chapter)

Gunderson Dettmer was invited to contribute to the inaugural Venture Capital Chambers and Partners Global Practice Guide. Singapore partner, David He, together with associates Benjamin Teo, Kinnari Sahita and Cheryl Lau, co-authored the Singapore chapter, providing a comprehensive overview and insights into the Singapore venture market.

Topics include: Trends and Developments, VC Fund Structures, Economics and Regulation, Investments in VC Portfolio Companies (due diligence, documentation, investor safeguards, corporate governance), Government Subsidies and Tax, Employee Incentivization and Exits.

Presentation

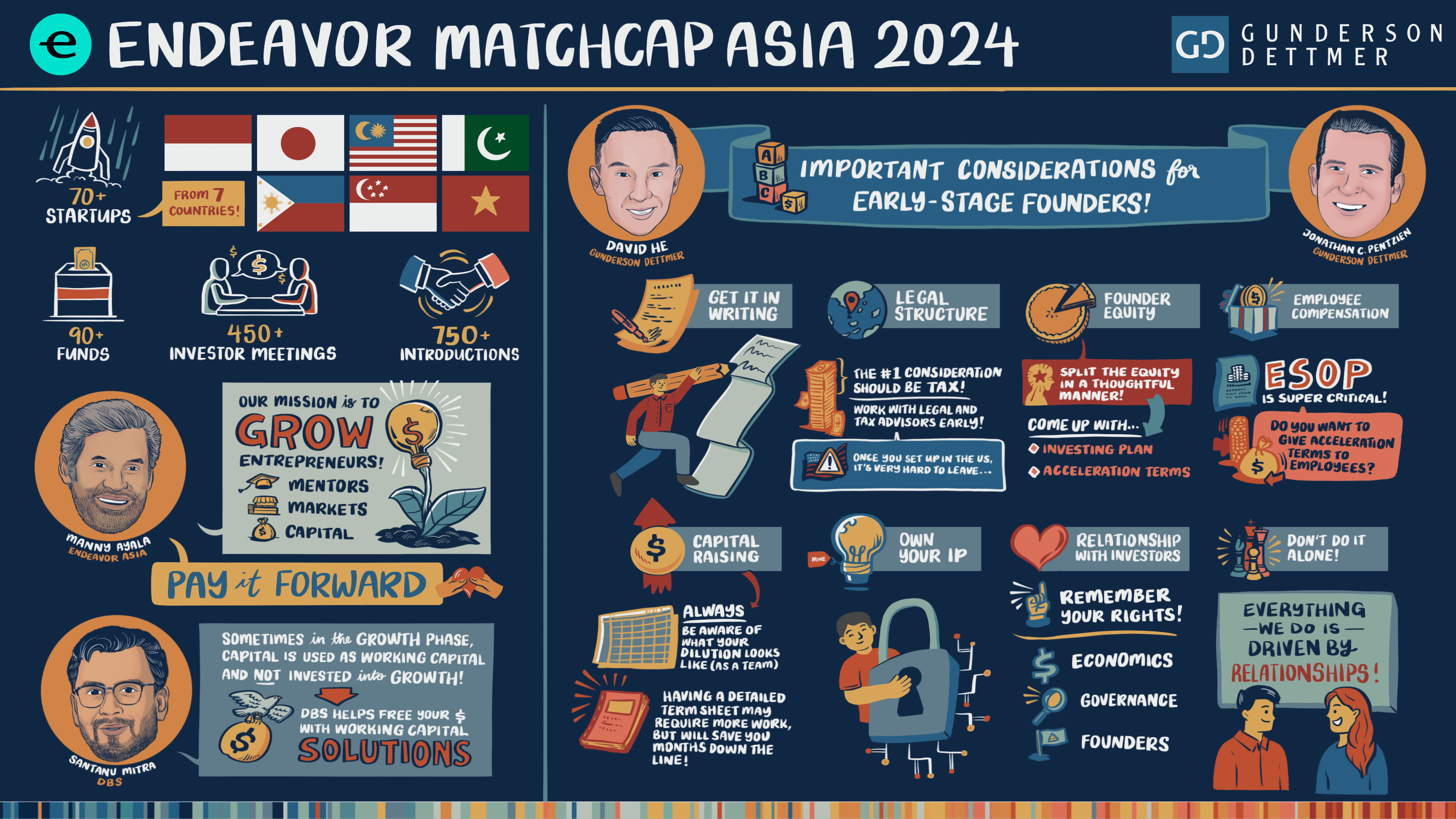

Important Considerations for Early-Stage Founders

Singapore managing partner Jonathan C. Pentzien and partner David He presented to over 70 early-stage founders from 7 Asian countries at the 2024 Endeavor MatchCap Asia opening event in Singapore. Here are the key takeaways.